简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.K. Budget Deficit Swells to Record on Coronavirus Stimulus

Abstract:U.K. government borrowing soared to almost 130 billion pounds ($165 billion) in the first three months of the fiscal year amid the towering cost of supporting the economy through the coronavirus crisis.The Office for National Statistics said Tuesday that the budget deficit stood at 35.5 billion pounds in June alone, leaving debt at 99.6% of GDP -- the highest since 1961.

Supply Lines is a daily newsletter that tracks COVID-19s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.

U.K. government borrowing soared to almost 130 billion pounds ($165 billion) in the first three months of the fiscal year amid the towering cost of supporting the economy through the coronavirus crisis.

The Office for National Statistics said Tuesday that the budget deficit stood at 35.5 billion pounds in June alone, leaving debt at 99.6% of GDP -- the highest since 1961.

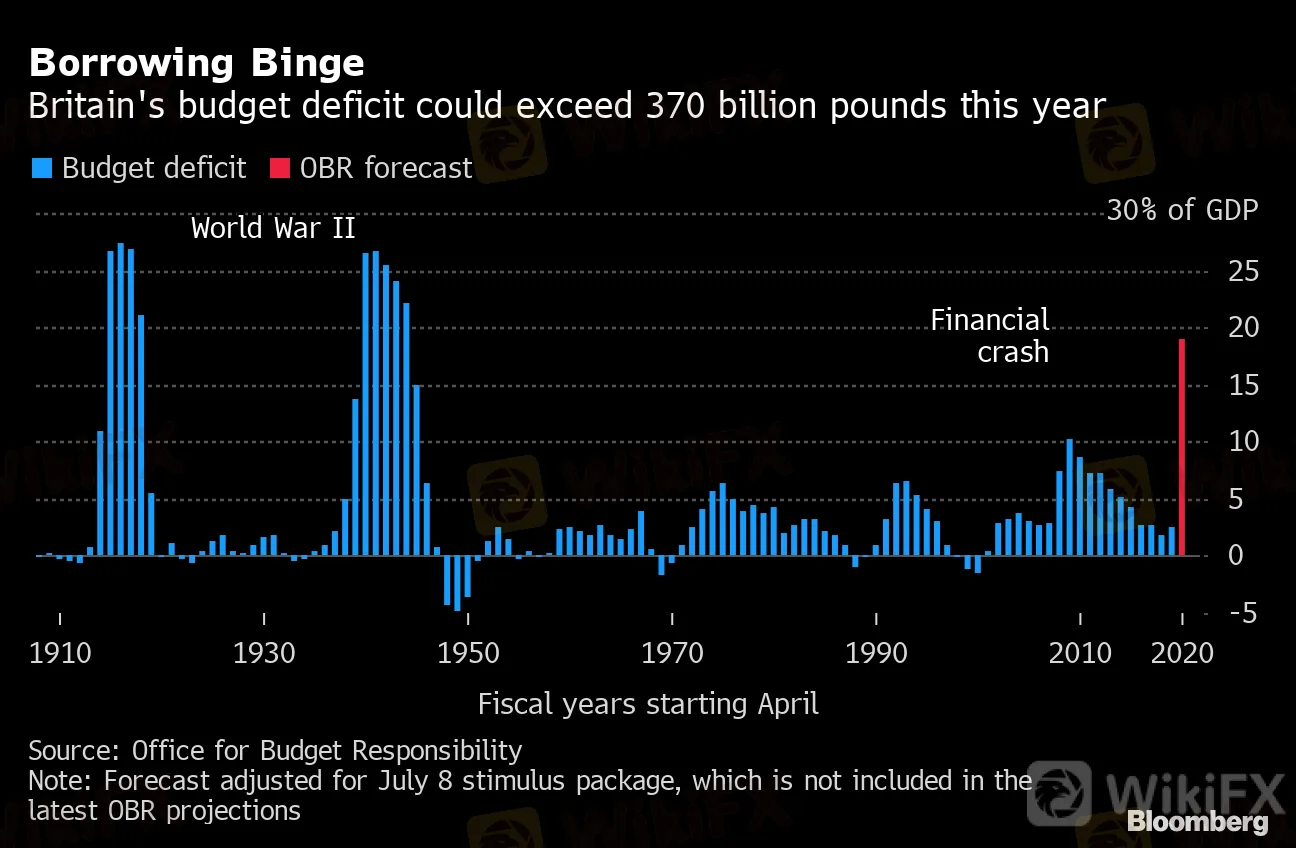

Chancellor of the Exchequer Rishi Sunak has committed more than 190 billion pounds of government spending and tax cuts in an effort to save jobs and keep businesses afloat. Combined with the damage inflicted by the worst recession for at least a century, that means a deficit that was forecast to be just 55 billion pounds this year is now on course to exceed 370 billion pounds, according to the Office for Budget Responsibility.

Borrowing Binge

Britain's budget deficit could exceed 370 billion pounds this year

Source: Office for Budget Responsibility

Note: Forecast adjusted for July 8 stimulus package, which is not included in the latest OBR projections

The pound was at $1.2689 following the report, up 0.2% on the day. Ten-year gilt yields were at 0.15%, close to a record low.

At around 19% of GDP, the deficit projected for 2020-21 would be the highest since World War II and almost double the levels reached after the financial crisis a decade ago. And its not the most pessimistic scenario outlined by the fiscal watchdog last week.

Government debt could take decades to bring down to more sustainable levels, economists say. But while the stock of debt is high, the cost of servicing it is more affordable than ever, thanks in part to massive Bank of England bond buying in the secondary market which has pushed down gilt yields. Tax rises nonetheless appear inevitable once the crisis has passed.

The latest snapshot of the public finances showed government revenue fell 13% between April and June compared with a year earlier, with receipts down across the board. Spending meanwhile jumped over 40%, driven by a 70% increase in departmental outlays.

A cash measure that determines government bond issuance stood at 47.1 billion pounds in June, taking the total for the fiscal first quarter to 174 billion pounds. The Debt Management Office is on course to sell around half a trillion pounds of gilts for the year as a whole.

(Adds detail from report)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator