简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

India Inflation Could Surge to 12% on Second Stimulus, Rabobank Says

Abstract:India can expect inflation to surge to more than double the central bank‘s target and the currency could lose a quarter of its value if the Reserve Bank of India begins printing money to fund the government’s spending.

Supply Lines is a daily newsletter that tracks Covid-19s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.

India can expect inflation to surge to more than double the central bank‘s target and the currency could lose a quarter of its value if the Reserve Bank of India begins printing money to fund the government’s spending.

That‘s according to Rabobank, which said in a report this week that India should avoid repeating the mistakes of the 1980s, when the central bank’s monetization of government debt led to a spike in money supply and inflation.

Rabobank estimates that inflation could surge to an average of 12% in 2021 if the RBI was to finance a second stimulus package of $270 billion, a similar amount to what was announced in the first spending plan earlier this year. The rupee could plunge 16% against the dollar from 2020 levels and almost 25% from 2019 under that scenario.

The RBIs mandate is to keep inflation within a band of 2%-6%.

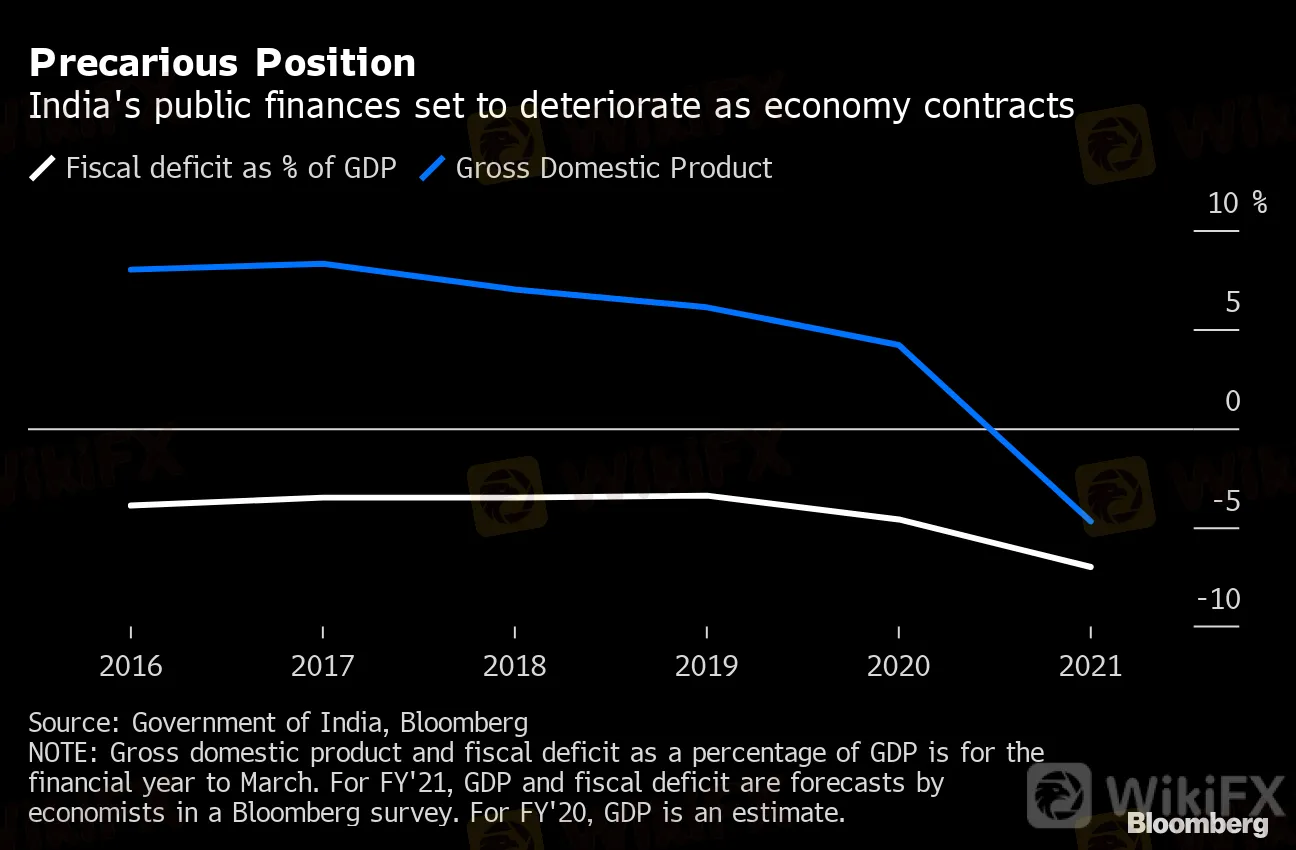

Public finances are under strain as tax collection slumps, with pressure growing on the RBI to directly fund the spending needed by the government to prop up the economy during the coronavirus pandemic. The fiscal deficit is set to widen this year to 7% of gross domestic product -- double the governments target -- a Bloomberg survey of economists shows.

Precarious Position

India's public finances set to deteriorate as economy contracts

Source: Government of India, Bloomberg

NOTE: Gross domestic product and fiscal deficit as a percentage of GDP is for the financial year to March. For FY'21, GDP and fiscal deficit are forecasts by economists in a Bloomberg survey. For FY'20, GDP is an estimate.

“Fast-rising inflation in combination with a freefall of the currency does not bode well for economic performance of countries,” the Rabobank analysts, led by Michael Every, wrote in the report. Modern Monetary Theory -- which proposes governments spend their way out of a crisis and print money to pay for it -- would be “more damaging to the Indian economy than any short-term prosperity it brings,” they wrote.

Read: What You Need to Know About Modern Monetary Theory—and Why

Indias Fiscal Responsibility and and Budget Management Act prevents the RBI from buying bonds directly from the government in the primary market, but the law provides an escape clause in the event of the country facing a national calamity or a severe slowdown.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator