简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S. Africa Inflation Drop Unlikely to Prompt Aggresive Rate Cuts

Abstract:South African inflation at the lowest level in almost 16 years may not be enough to push the central bank to cut interests by a big margin next week.

South African inflation at the lowest level in almost 16 years may not be enough to push the central bank to cut interests by a big margin next week.

At 2.1% in May, inflation dropped below the central banks target band for the first time since 2005. The monetary policy committee had projected such a breach for the second and third quarters, and Governor Lesetja Kganyago said last month that the panel would only step in if it became a protracted event.

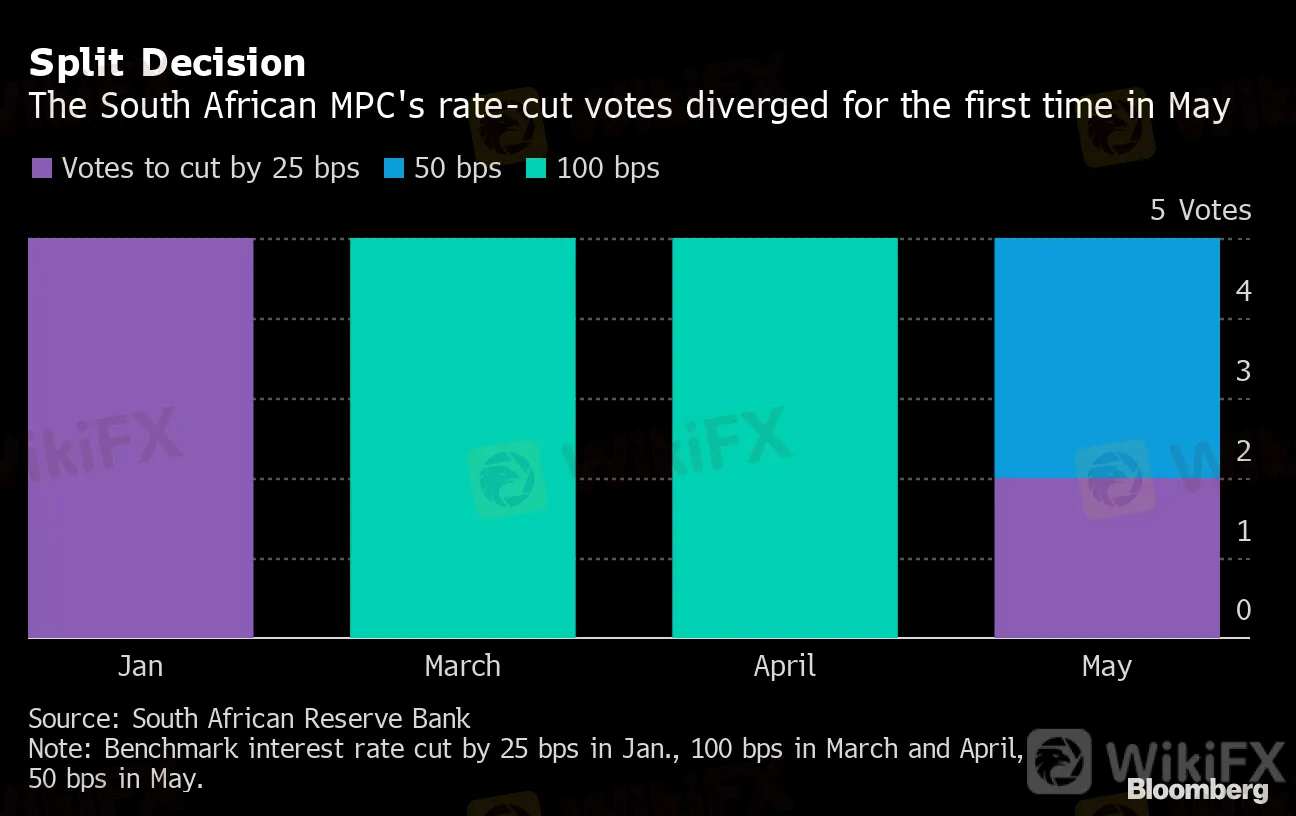

As the impact of the coronavirus and economic fallout of lockdown to curb its spread became clear, the MPC reduced the benchmark repurchase rate to the lowest since it was introduced in 1998. That included a move at an unscheduled meeting in April, where the vote was unanimous for a 100 basis-point cut. However, by May, two members favored a reduction of only 25 basis points and the result was half a percentage point of easing.

Split Decision

The South African MPC's rate-cut votes diverged for the first time in May

Source: South African Reserve Bank

Note: Benchmark interest rate cut by 25 bps in Jan., 100 bps in March and April, 50 bps in May.

“We pencil in a 50 basis-point cut for now, but acknowledge that until more evidence of structural core price disinflation comes to the fore, the South African Reserve Bank may well go back to its usual incremental 25 basis points cuts from now on,” said Jeffrey Schultz, a senior economist at BNP Paribas South Africa.

The central bank sees the economy contracting by 7% in 2020 and forecasts an annualized drop in gross domestic product of 32.6% for the three months through June, which would be the deepest quarterly decline since at least 1990. The Reserve Bank expects inflation to peak at 5% in the second quarter of 2021. It will probably then drop back to below 4.5%, where the MPC prefers to anchor it, for most of 2022.

The May inflation data that‘s in line with the central bank’s expectations is unlikely to change its assessment of interest rates, said Elize Kruger, an independent economist. The central banks quarterly projection model now forecasts a repurchase rate of 3.63% by the end of this year and 4.1% by the end of 2021. Still, its economic-growth outlook would have more bearing on the interest rate trajectory, Kruger said.

What Bloombergs Economist Says...

“They will likely hold next week and continue to monitor inflation outcomes. I still expect the SARB to cut by 50bps but only later in the year. Cuts bigger than that will be reflective of the SARBs view of the extent of weakness in the economy driven by demand rather than supply.”

-- Boingotlo Gasealahwe, Africa Economist

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator