简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Frozen Treasury Yields Belie Hedging Bets on Stronger Fed Action

Abstract:Dwindling volumes in interest-rates markets suggest that the normal summer doldrums are arriving on time, yet underneath the surface there are signs that traders are bracing for more drama ahead.

Dwindling volumes in interest-rates markets suggest that the normal summer doldrums are arriving on time, yet underneath the surface there are signs that traders are bracing for more drama ahead.

From trades anticipating yield-curve control measures by the Federal Reserve, to lingering bets on negative interest rates and even positions that would benefit from an eventual rate increase by the Fed, traders are searching for the next edge based on what they expect the central bank will do.

The positioning highlights the array of options that remain on the table for Fed policy this summer and beyond, depending on how the economic outlook evolves with the spread of the coronavirus.

The latest read on growth briefly buoyed bond bears on Thursday: Ten-year Treasury yields touched a roughly one-week high of 0.71% after June employment data came in stronger than forecast. Yet in a sign of how uncertain the outlook remains as the virus spreads, that move quickly faded. The rate ended the day at 0.67%, right in-line with its average for the past three months.

Here are some of the possible scenarios that investors and strategists are considering in the months ahead:

Yield-Curve Control

The base-case scenario for many economists is that the Fed will set target yields for certain maturities of Treasury securities by the end of the year, though policy makers appeared unconvinced of the need for that when they met at their June meeting, according to minutes released Wednesday.

Strategies targeting curve control are starting to emerge in rates volatility, such as receiver spreads that bet that the fixed rates paid in interest-rate swaps will remain above the floating rate they‘re swapped for. Barclays late last month recommended similar trades “to express the view that short to intermediate rates can grind lower,” a bet on curve control after the Fed’s policy review in September.

Should the Fed adopt a type of curve control favored by former Chair Ben Bernanke, expect the central bank to rule out targeting rates on securities of more than two to three years maturity. This may trigger more intermediate curve plays in the futures market, such as 5- and 7-year spreads, a popular recent theme. Open interest in 5- and 10-year futures -- a tally of outstanding positions -- has surged, a likely indication that traders are positioning for the prospect of curve control.

Negative Rates

Fed funds futures continue to price in a chance of a negative policy rate from around mid-2021 and positioning for that scenario has been a popular theme in eurodollar options.

While options hedging activity has slowed, there remains a significant amount of risk in calls targeting an equivalent yield of 0% or lower, despite continued push-back from Fed officials. More recently, demand has shifted into mid-curve eurodollar plays which target a negative policy rate for 2022 but with quicker payouts.

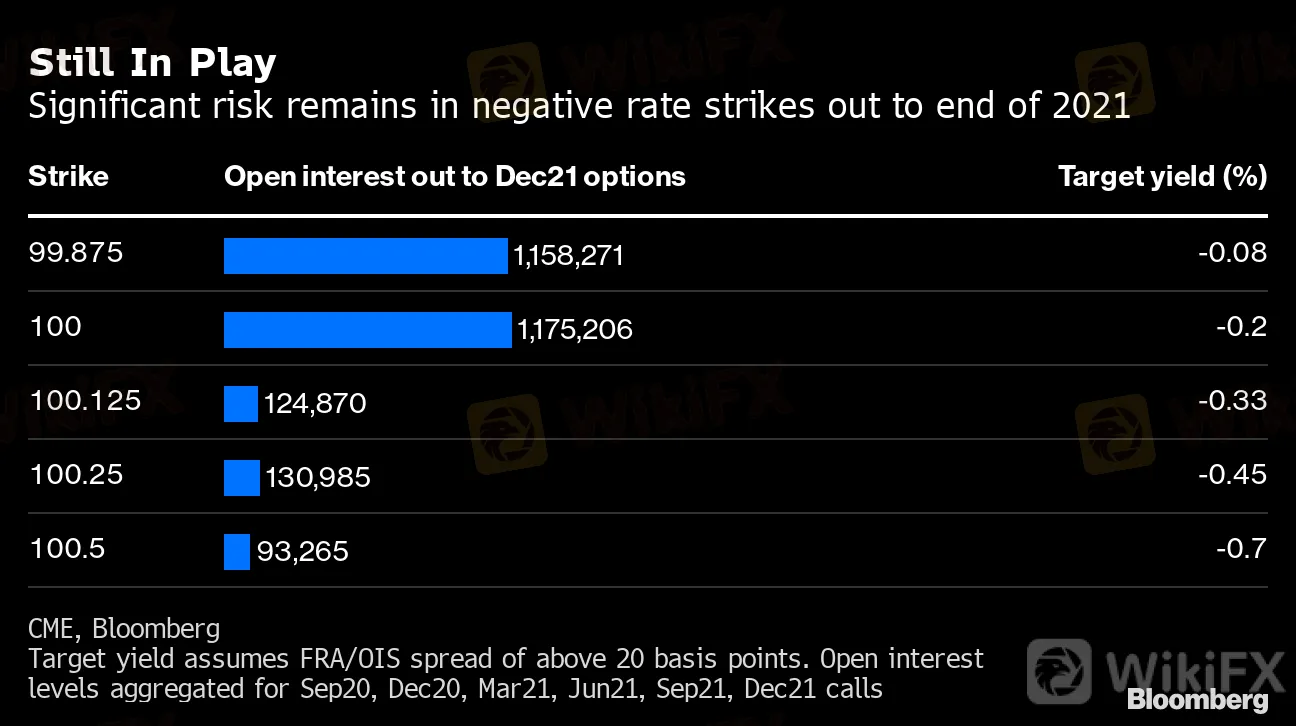

Still In Play

Significant risk remains in negative rate strikes out to end of 2021

CME, Bloomberg

Target yield assumes FRA/OIS spread of above 20 basis points. Open interest levels aggregated for Sep20, Dec20, Mar21, Jun21, Sep21, Dec21 calls

Short Volatility

The Feds most-recent summary of economic projections shows expectations that the policy rate will be on hold at the current level through 2022. Treasury volatility has subsequently remained at depressed levels over the past two months.

A popular play to benefit from continued subdued volatility has been via Treasury options: selling volatility structures known as straddles and strangles that will be profitable if interest rates remain in tight ranges. A recent trade included a sizable $21 million short-volatility position in 10-year Treasury options.

Low-volatility plays have also emerged in the eurodollar options market. This past week a $6 million wager targeted a potential $25 million payout that benefits from a continued low-volatility environment.

Rate Hikes

The eurodollar strip remains at historically flat levels as rate-hike premium is scarce. The spread between December 2021 and December 2022 eurodollar futures is just six basis points, which reflects only a 25% chance of a rate increase by end-2022.

Should the outlook for the economic recovery from the pandemic improve, traders will look for that premium to edge back into the eurodollar strip. A large position has recently been amassed for such a scenario targeting a steeper June 2021/June 2022 eurodollar spread.

Expect these types of plays to become more popular if the narrative surrounding the economic outlook improves.

What to Watch

The economic calendar:

July 6: Markit U.S. services PMI; ISM non-manufacturing index

July 7: JOLTS job openings

July 8: MBA mortgage applications; consumer credit

July 9: Jobless claims; Bloomberg consumer comfort; wholesale trade/inventories

July 10: Producer price index

The Fed calendar:

July 7: Atlanta Fed‘s Raphael Bostic; San Francisco Fed’s Mary Daly and Richmond Feds Thomas Barkin in virtual discussion

July 8: Bostic

July 9: Bostic

The auction schedule:

July 6: 13-, 26-week bills

July 7: 42-, 119-day cash-management bill; 3-year notes

July 8: 10-year notes

July 9: 4-, 8-week bills; 30-year bonds

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator