简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BOE Gets Negative Rates Advantage by Watching Others Go First

Abstract:SHARE THIS ARTICLE ShareTweetPostEmail Photographer: Simon Dawson/Bloomberg Photographer: Simon Da

The Bank of England has one big advantage when it comes to the contentious topic of negative interest rates: its no pioneer.

All that makes BOE Governor Andrew Bailey reluctant to cut the key rate -- now at 0.1% -- below zero, and he‘s got other policy options that he can pursue first. But he also won’t rule it out. Given the U.K. is facing the worst slump in centuries, plus a potentially hard Brexit hitting the recovery in 2021, Morgan Stanley and Barclays say he may ultimately have to go there.

“You can understand the temptation to look at other tools like negative rates,” said James Smith, an economist at ING in London. “Bank rate at its current level is getting decreasingly stimulative as time goes on.”

Investors recently pared bets the BOE will cut further -- reckoning instead that alternatives such as more bond-buying will be the preferred route. Thats likely to be the case on Thursday, when the bank is expected to add another 100 billion pounds ($125 billion) to its target, taking it to 745 billion pounds in total.

In a television interview on Friday, Bailey said officials stand ready to take more action.

If more drastic moves are required, policy makers have signaled that they won‘t be rushing headlong into negative rates. They’re already reviewing a host of complications including the prospect that it‘ll damage profits at lenders -- as it has in the euro zone -- because they’ll struggle to pass the cost onto savers.

In any case, policy makers have time to lay the groundwork and give clear signals so markets and banks are prepared.

| BOEs Likely Order of Action |

|---|

| 1. More QE2. More Term Funding Scheme, possibly favoring certain types of loans3. More macroprudential easing4. Yield curve control and forward guidance5. Negative ratesSource: Barclays |

Years of subzero borrowing costs in Europe and Japan have already shown that while fears such as cash hoarding are unfounded, the benefits for the economy depend on implementation.

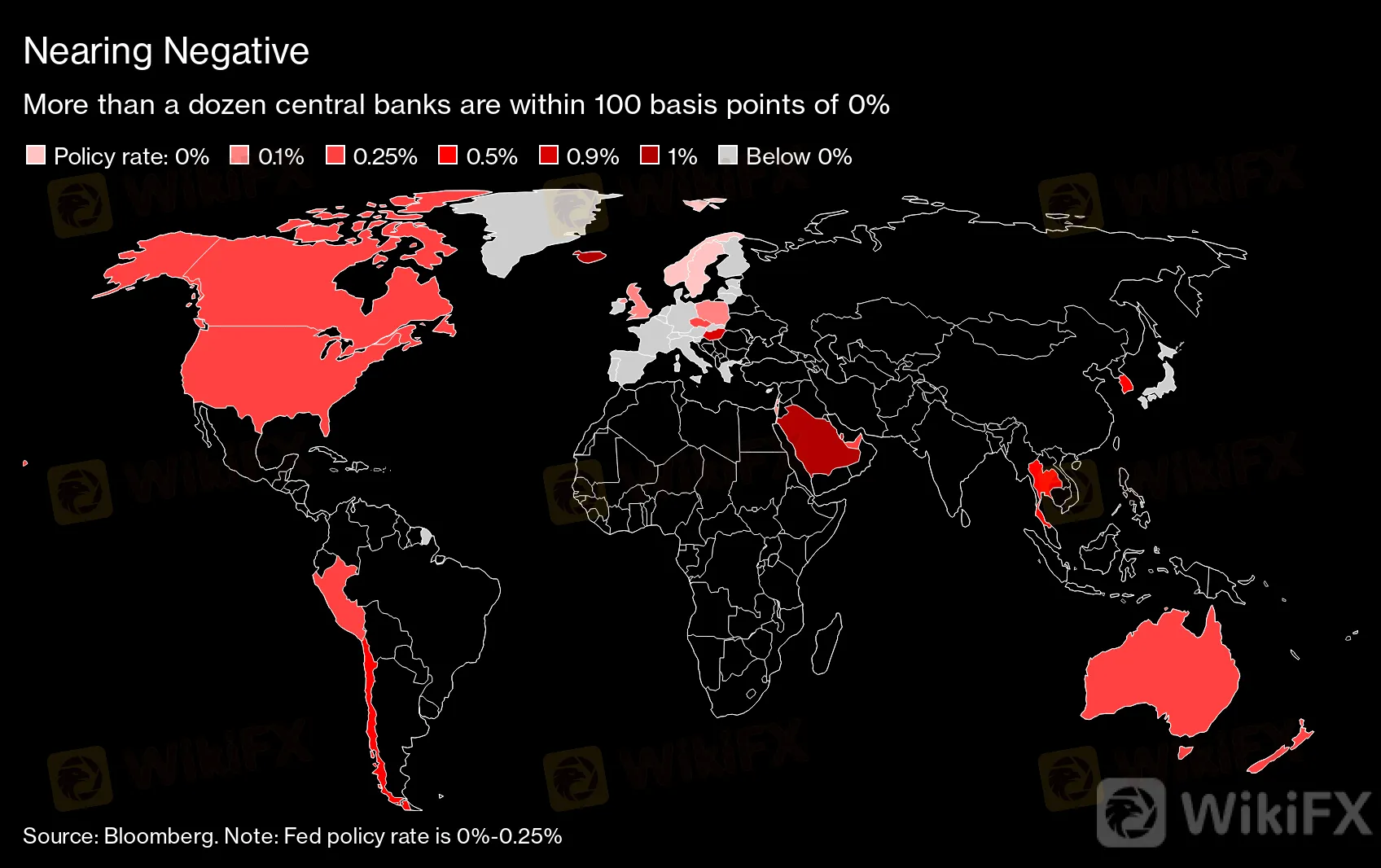

Nearing Negative

More than a dozen central banks are within 100 basis points of 0%

Source: Bloomberg. Note: Fed policy rate is 0%-0.25%

The key lesson is to make sure banks pass on the cheap financing costs to companies and households.

The ECBs six years of negative rates provide a real-life case study. Although officials claim the policy helped revive the economy and create millions of jobs, they also acknowledge that the adverse impact on banks and financial stability worsens over time. Their most recent stimulus programs have included an enormous new bond-buying program but no further cuts in the deposit rate of minus 0.5%.

They did opt for stealth rate cuts though, reducing the borrowing cost on long-term loans to banks that are expressly used for financing credit to companies and households.

The BOE could follow that model by cutting the rate on its Term Funding Scheme for bank lending.

Its a “better alternative to negative rates,” according to Deutsche Bank economists including Sanjay Raja. “One, it would have less of an impact on bank profitability; and two, the BOE would avoid any further depreciation to sterling, which would ultimately hurt consumers through import inflation.”

The U.K. central bank will probably exhaust other measures first. In addition to stepping up asset purchases this week, it could include buying riskier securities. The BOE may even try form of yield-curve control, or targeting interest rates on bonds.

“We are skeptical that another rate cut is high in the MPCs pecking order,” Goldman Sachs analysts including Sven Jari Stehn wrote in a report, saying increased bond-buying would come first. “We view a reduction in the rate on the Term Funding Scheme as more likely.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator