简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

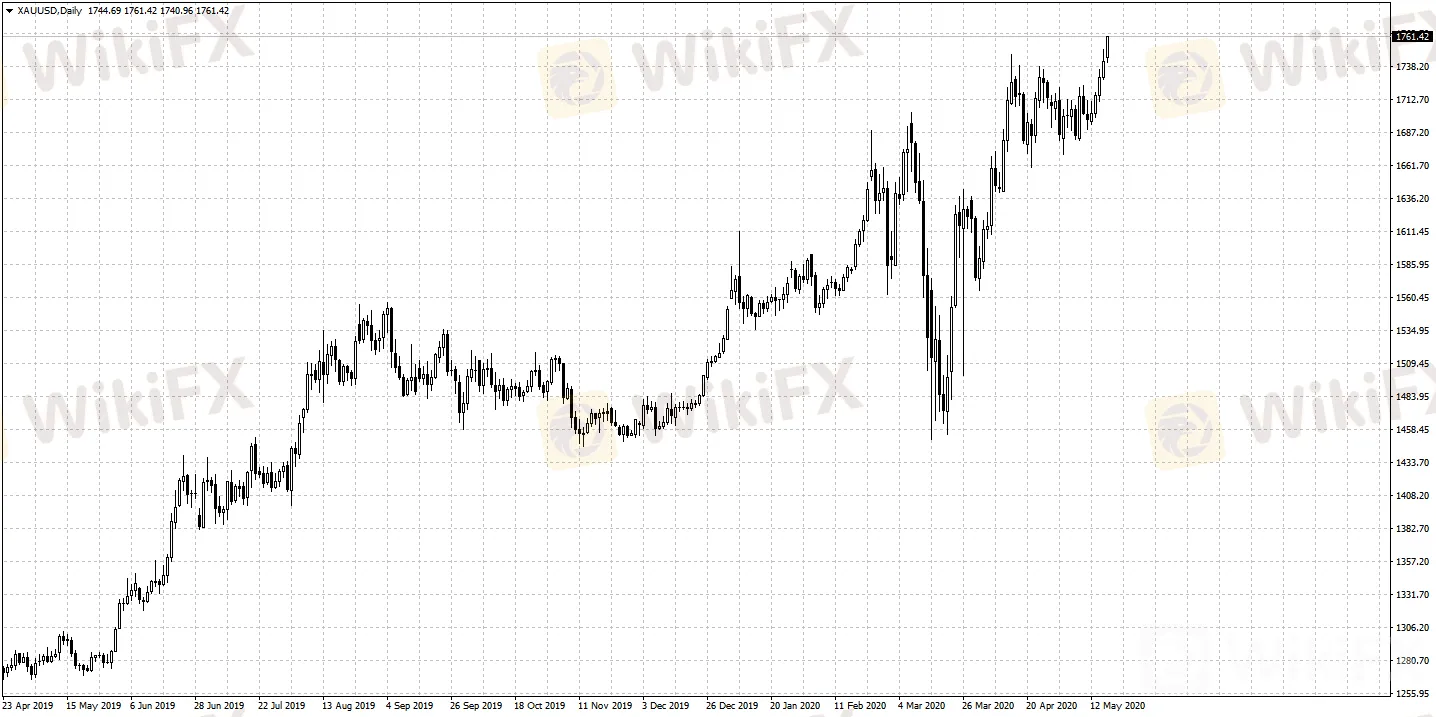

HSBC Lost US$200 Million in Gold Trading

Abstract:May 18th from WikiFX news.According to US media, HSBC lost around US$200 million within one day in March, much exceeding the maximum loss estimated by HSBC’s risk value model and costing a whole year’s total gain in gold trading.

May 18th from WikiFX news. According to US media, HSBC lost around US$200 million within one day in March, much exceeding the maximum loss estimated by HSBC‘s risk value model and costing a whole year’s total gain in gold trading.

In other words, HSBC lost a whole years gold-trading profit within just one day.

The loss has largely been due to the extremity in March, as the lockdown measures cut off material golds supply channel around the globe. Price gap between New York gold futures and London spot gold hit a record high of US$70.

In general, the spread between spot gold and futures is no more than a few dollars per ounce. Banks usually sell gold futures in New York as a way to of hedging for the positions in the London market, and a significant variation of prices in the two markets will cause them heavy losses.

According to HSBC, the loss due gold‘s market value was attributed to challenges gold refinement and transportation.As spot-gold trading expanded unprecedentedly, this affected HSBC’s gold leasing and financing businesses, as well as other hedging activities, leading to a loss.

HSBC is not the only institution that suffered from gold markets unusual volatility. The long-established Bank of Nova Scotia in Canada also closed precious metal trading department in March, allegedly for the same reason.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Share Industry Insights and Discuss Forex Market Trends

Top 9 Financial Fraud Cases in Recent History

KuCoin Pay Introduces Easy Crypto Payments for Merchants

Malaysian Man Killed in Alleged Forex Dispute-Related Attack

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

What Euro Investors Can't Afford to Miss

Is OneRoyal the Right Broker for You?

Currency Calculator