简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

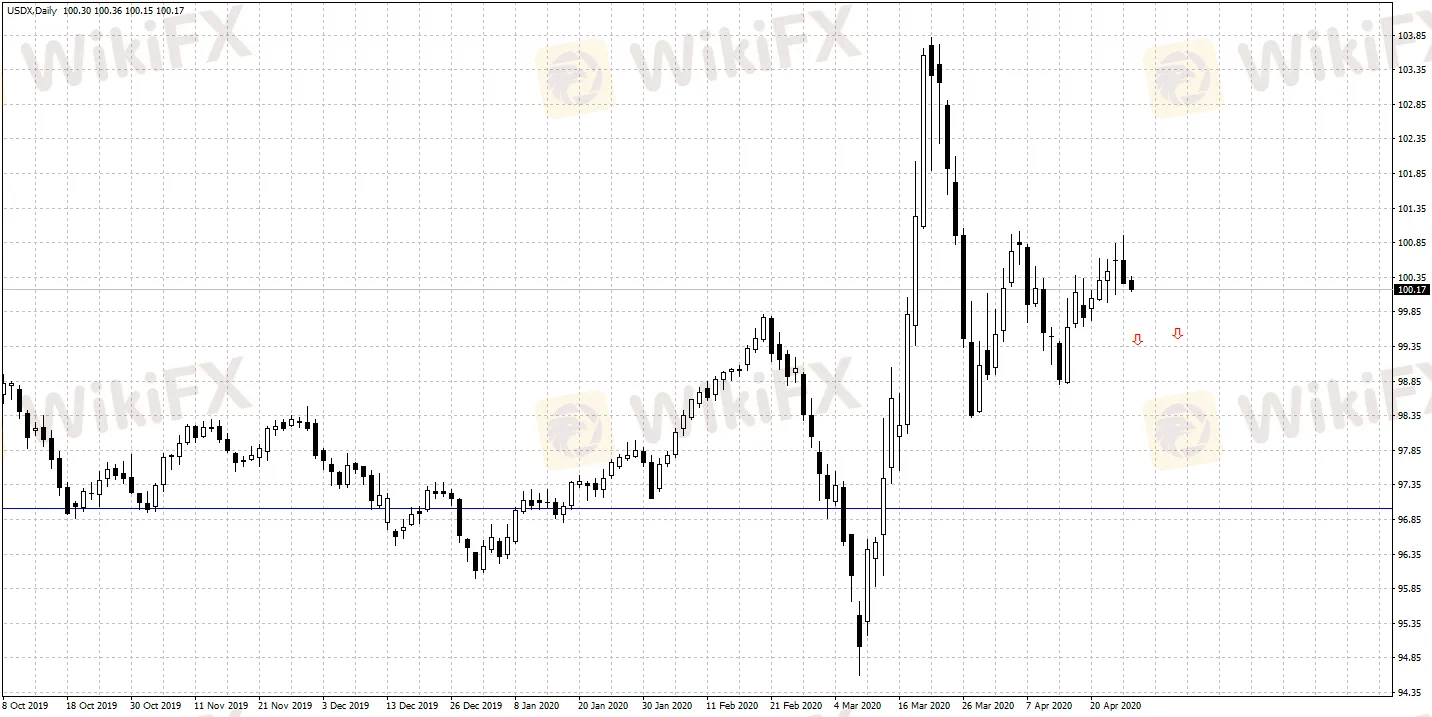

USD Net Shorts Rose to the Highest in Past 2 Years

Abstract:According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week

According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week; as of the week ending April 21st, USD net short positions totaled US$11.51 billion. Net short positions of the previous week reached US$ 11.39 billion. Reuters calculation of total USD net position in the Chicago International Monetary Market is based on the net positions of six major currencies: Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar, and Australian Dollar.

Under the impact of the epidemic, the Fed has continuously launched several rounds of quantitative easing that exceeded market expectations, almost exhausting all conventional and unconventional policy ammunition available. As of now, the Fed has reduced interest rates to zero to inject liquidity into various markets. Investors will still pay close attention to the Fed s outlook on the current economy and whether it will give hints on the introduction of negative interest rates in the future.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator