简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

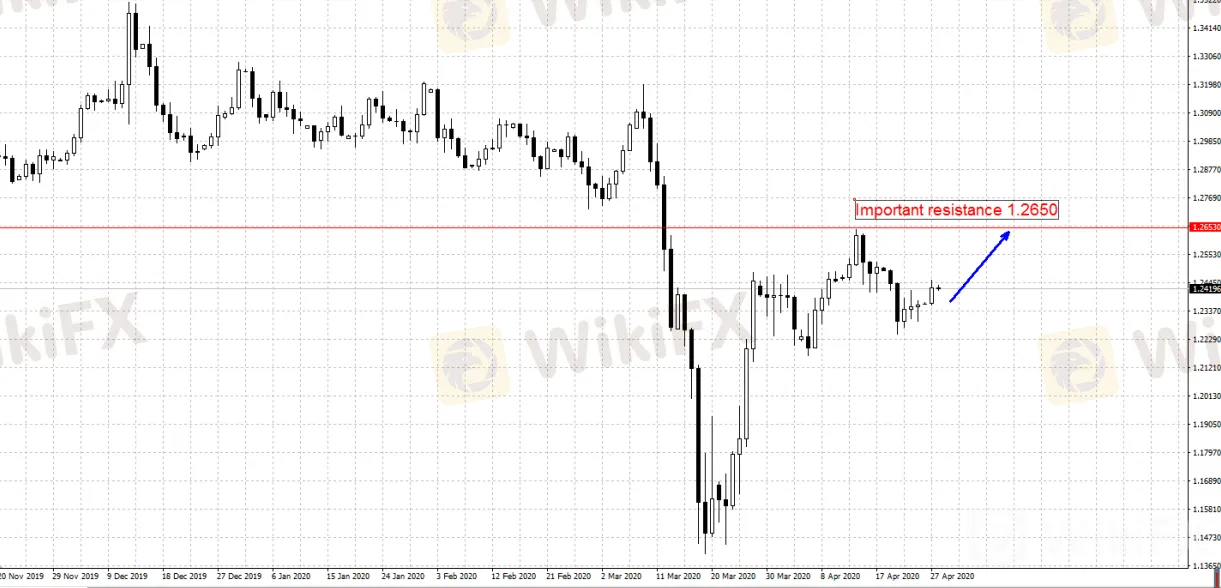

GBP's Exchange Rate Is Resistant to Decline

Abstract:The British pound has been sluggish recently, being among a group of non-US currencies that suffered general pressure due to risk aversion sentiment caused by WTI's decline into negative areas. However, the pound has now shown obvious resistance to decline.

The British pound has been sluggish recently, being among a group of non-US currencies that suffered general pressure due to risk aversion sentiment caused by WTI's decline into negative areas. However, the pound has now shown obvious resistance to decline.

Despite Markit's service industry PMI in April of 12.3, which was much lower than the expected 27.8, the pound did not show a sharp decline, indicating that the market partially digested the epidemic's shock on Britain's economy. We believe that pound s current exchange rate at an extremely low range indicates the currency has little room for further declines. As the global economy gradually recovers, the pound may rebound significantly.

The negotiators of the United Kingdom and the European Union began week-long consultations to discuss the relationship between the two countries after the Brexit, including trade issues. As the epidemic persists, the possibility of the UK applying for an extension of the Brexit transition period is also increasing. The market still needs to pay close attention to how the progress of related matters evolve.

GBP/USD daily pivot points: 1.2406-1.2418

S1 1.2371 R1 1.2465

S2 1.2506 R2 1.2318

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator