简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Growing USD Supply Will Weaken the Currency

Abstract:In the past month, USD was in short supply at one point due to the global outbreak and the consequent aggregation of capital. Societe Generale Group commented that currently the dollar is much sought after and increasing risk on the market only drives more investors into holding USD.

In the past month, USD was in short supply at one point due to the global outbreak and the consequent aggregation of capital. Societe Generale Group commented that currently the dollar is much sought after and increasing risk on the market only drives more investors into holding USD.

But after the Feds massive fiscal stimulus recently, the market began to worry about the negative implications on USD over the long term. Even if the global outbreak alleviates before the end of this year, US may face expanding fiscal deficits, more quantitative easing and other measures to boost dollar supply, creating a context for weakening of the dollar.

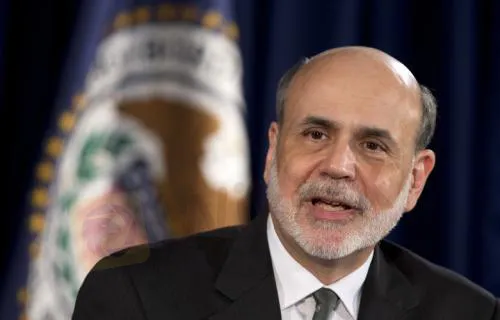

US stocks rallied over 20% lately as market sentiments slowly recover, but former Federal Chair Ben Bernanke said he believe the economy won‘t see a V-shaped recovery. The Fed’s latest meeting minutes suggest that economic outlook has quickly deteriorated in the past weeks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator