简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Panic Over the COVID19 Is Aggravating Global Economic Crisis

Abstract:A recent report released by the International Labor Organization (ILO) shows that due to the new coronavirus epidemic (COVID-2019), global unemployed population will increase by up to 25 million.

A recent report released by the International Labor Organization (ILO) shows that due to the new coronavirus epidemic (COVID-2019), global unemployed population will increase by up to 25 million. Business activities has been severely stalled around the world with more factories shutdown and stores closed, which threatens to cause more unemployment than the financial crisis during 2008-2009. There is no doubt that the continued spread of the coronavirus epidemic has become one of the biggest threats to global economy and financial market.

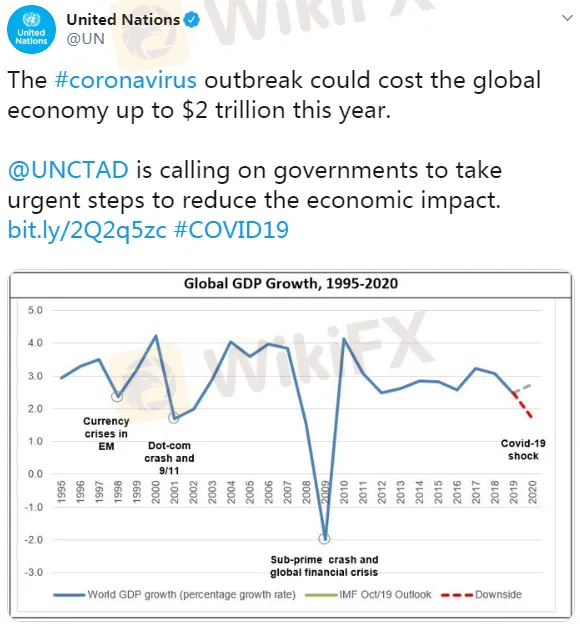

The UN predicts a US$ 200 billion global economic loss in 2020 due to the outbreak

The OECD estimates that this year's global economy may experience the slowest growth rate since 2009.

As a forex investor, how should you respond to the impact of the epidemic? If you want to avoid risks and seize opportunities during this outbreak, you must pay attention to the implications of macro events on the market besides closely following forex dynamics.

Now let's look at how the panic over COVID19 outbreak's economic impact is fueling into the global crisis.

China has been waging an all-out war against the virus ever since the outbreak started, and achieved impressive results. But just as China begin to see hope of suppressing the outbreak effectively, the virus began to spread rapidly in the rest of the world. Japan, South Korea, and Singapore were soon affected as the virus continued to rage across East Asia to Southeast Asia and South Asia. The epidemic hit Iran in the Middle East and Italy in Europe, which are now among the worst affected areas, while the situation in the United States is also grim. Currently, over 100 countries and regions have been affected by the COVID-19 epidemic, with more than 100,000 confirmed cases.

Global distribution of COVID-19 confirmed cases data from CDC

After the initial shock, the world soon fell into an economic panic. Global market, facing one heavy blow after another from the fast-evolving epidemic, is in woeful turbulent and chaos. New York stock market plummeted, while the three major European stock indices jittered down-slope; the Tokyo stock market went on a “roller coaster ride”, and stock indices of Middle East countries plunged across the board. Circuit breakers were activated in stock markets around the world, huge capital has evaporated, while panic sell-off continuously led to market clash. In fact, the global economy growth has been sluggish even before the outbreak. The Sino-US trade war and Brexit rendered a less optimistic outlook for economic growth, and the double blow from fast-spreading epidemic and the consequent market pessimism further exacerbated the economic panic. In less than two months, global financial markets turned bleak all over, with numerous economies around the world being hit.

WikiFX App News Flash

As a leading forex media, WikiFX will continue to bring you the latest forex updates round the clock, including reports on economic events that affect the market, forex economic data, live trend of currencies, and changes in forex indicators. Click here to download. www.wikifx.com/my_en/

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator