简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Further Step of U.S. Dollar's 'Weaponization', Based on Donald Trump's New Rule

Abstract:A controversial new rule being implemented by Donald Trump will pave the way for the US to impose punitive tarrifs on the goods from countries with undervalued exchange rate, said the US department of commerce.

A controversial new rule being implemented by Donald Trump will pave the way for the US to impose punitive tarrifs on the goods from countries with undervalued exchange rate, said the US department of commerce.

The action brings more complaints about exchange rate manipulation in Japan and other economies, make the US‘ global forex market with over US$6 trillion of daily trading volumes become Trump’s new battlefield of trade friction.

The rule marks the US another step toward the weaponization of the USD, following the verbal intervention to devalue the dollar and accusation that the Fed has led to a stronger dollar that has harmed US manufacturers and other exporters. This appears to be intended to send a signal to all the trading partners of the US, which is that a significant weakening of their currencies relative to the dollar may lead to the retaliation from Trump.

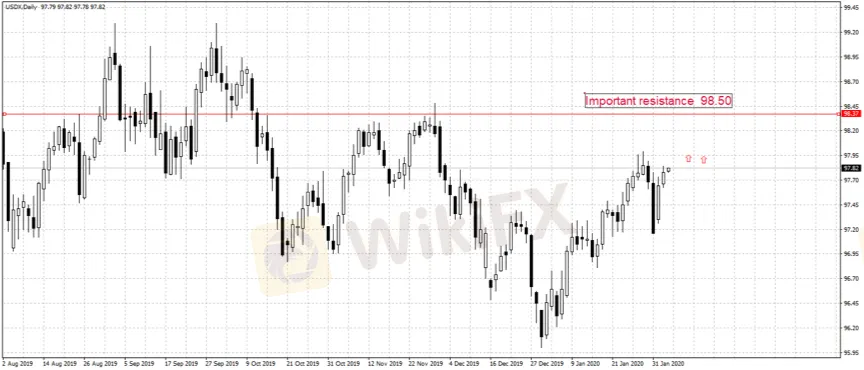

USDX Daily Pivot Points 97.89-97.93

S1: 97.81 R1: 97.81

S2: 97.68 R2: 98.14

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

5 Questions to Ask Yourself Before Taking a Trade

Quadcode Markets: Trustworthy or Risky?

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator