简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The top 10 most active clean-energy investors in 2019 - Business Insider

Abstract:Investors bet the most money on clean energy last year since 2010. These are the 10 most active investors, according to BloombergNEF.

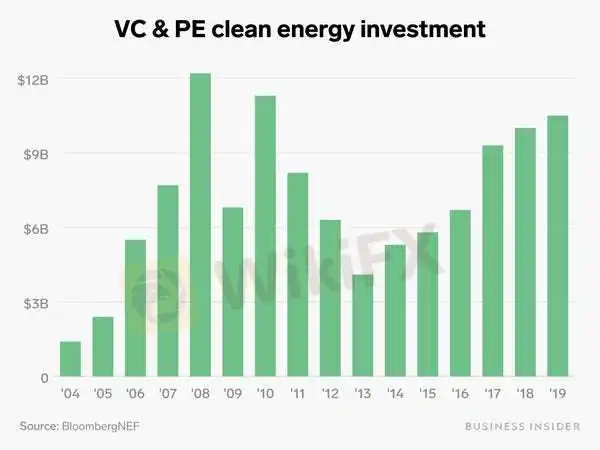

Venture capital and private equity investors flooded clean energy with $10.5 billion in 2019, according to a new report by BloombergNEF. It's the largest annual investment since 2010. Business Insider highlighted the 10 most active venture capital and private equity investors, based on the number of deals that closed in 2019, using data from BloombergNEF. The list shows that oil and gas giants are among the most active private investors, alongside the Bill Gates-led investor coalition, Breakthrough Energy Ventures. Click here to subscribe to Power Line, Business Insider's weekly clean-energy newsletter.Click here for more BI Prime stories.Private investment in clean energy is continuing to climb, with venture capital and private equity funding in the sector reaching $10.5 billion in 2019, according to a new report by the research firm BloombergNEF (BNEF). That's the largest annual investment in clean energy since 2010 and more than two times higher than the decade low of $4.1 billion in 2013.“We're seeing a resurgence in the last two years,” Tom Blum, a member of Clean Energy Venture Group, told Business Insider late last year. “Renewables, which had been plodding along steadily, are taking a huge upturn.”

Ruobing Su/Business Insider

Data from PitchBook show a similar trend: VCs flooded the clean-tech industry with nearly $10 billion in 2019, which is the second-highest investment sum in a decade.The largest clean-energy investors of 2019 include well-known giants like T. Rowe Price, Amazon, and BlackRock. They were all involved in a $1.3 billion PE deal with the electric vehicle (EV) company Rivian Automotive in December. None of the top 20 clean-energy investors, by capital, were involved in more than two deals, according to BNEF. Business Insider looked, instead, at VC and PE investors that were most active, based on the number of deals they financed or co-financed that closed in 2019.Here are the most active clean energy VC and PE investors, ranked from fewest to most deals in 2019. Note: “Clean energy” refers to “renewable energy excluding large hydro-electric projects, but including equity-raising by companies in smart grid, digital energy, energy storage, and electric vehicles,” per a BNEF spokesperson.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

12 people who seemingly predicted the coronavirus pandemic - Business Insider

Bill Gates warned Donald Trump before he took office of the dangers of a pandemic — and urged him to prioritize the US' preparedness efforts.

US jobless claims preview: Economists expect another week of decline - Business Insider

"If the current rate of decline continues, claims will dip below 1M in the second or—more likely—third week of June," said economist Ian Shepherdson.

Tough truths about starting a business, from ban.do founder Jen Gotch - Business Insider

Jen Gotch, founder of accessories and stationery brand ban.do, said sometimes the best thing you can do is just say yes and figure it out later.

Morgan Stanley: 12 energy stocks to buy now as oil markets recover - Business Insider

After a historic oil price rout, energy markets appear set to recover. Morgan Stanley says these 12 oil and gas stocks will benefit most.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator