简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Physical branches might not be a lost cause for banks - Business Insider

Abstract:Physical bank branches are on the decline, but banks don't have to sacrifice branches if they adapt them to the digital age.

This story was delivered to Business Insider Intelligence Banking subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.In Business Insider Intelligence's recent Digital Banking Ecosystem report, we showed that physical bank branches are on the decline, in contrast to the rising popularity of digital channels like online and mobile: In the UK, one-third (3,300) of all bank branches closed in the past five years as of September 2019, while in the US there was a net decrease of 9% of branches nationwide in the past decade.

Business Insider Intelligence

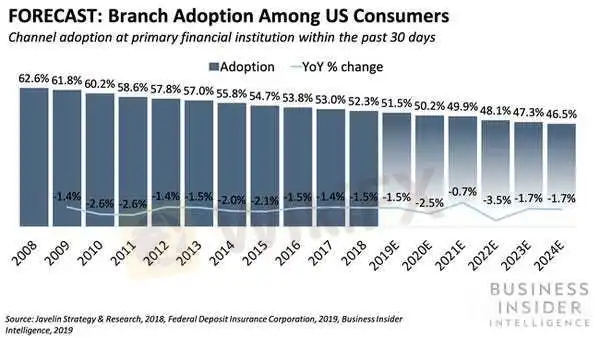

We project branch usage by US consumers will drop at a compound annual growth rate (CAGR) of -2.01% from 2019 to 2024, based on FDIC and Javelin data.Banks are slashing their branch networks to reduce costs and stay relevant — but they should proceed with caution. Factors behind the falling number of branches include shifting consumer preferences for digital banking (especially as younger generations come to the fore), as well as many incumbents' desire to cut operating costs by reducing their physical infrastructure and in-branch headcount as automated banking options proliferate.However, it's worth noting that for many incumbent banks, branches remain an invaluable source of revenue. At Chase, for instance, the vast majority (80%) of its customer transactions are completed through self-service channels, but a massive 70% of its deposit growth between 2014 and 2018 came from households that frequent branches.Banks can have their cake and eat it too, if they adapt their branches for the digital age. Some leading financial institutions are actually expanding their branch networks, indicating that they still see value in this channel. For the investment to pay off, banks should introduce digital elements to their branches.For example, they could leverage third-party solutions, such as Fiserv's Interactive Branch Kiosk, which is designed to make it easier for consumers to handle transactions within branch lobbies, drive-thrus, or other locations without a teller.They could also introduce mobile and IoT devices at branches, an approach Nationwide tested in its upgraded branch concept by adding a video calling service and iPads to access account information. Such upgrades can help banks reduce operating costs; retain loyalty among customers who prefer branches but want the same conveniences offered to digital-first customers; and make the important branch revenue stream work for them in an increasingly digital banking landscape.Want to read more stories like this one? Here's how to get access: Sign up for Banking Pro, Business Insider Intelligence's expert product suite tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator