简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

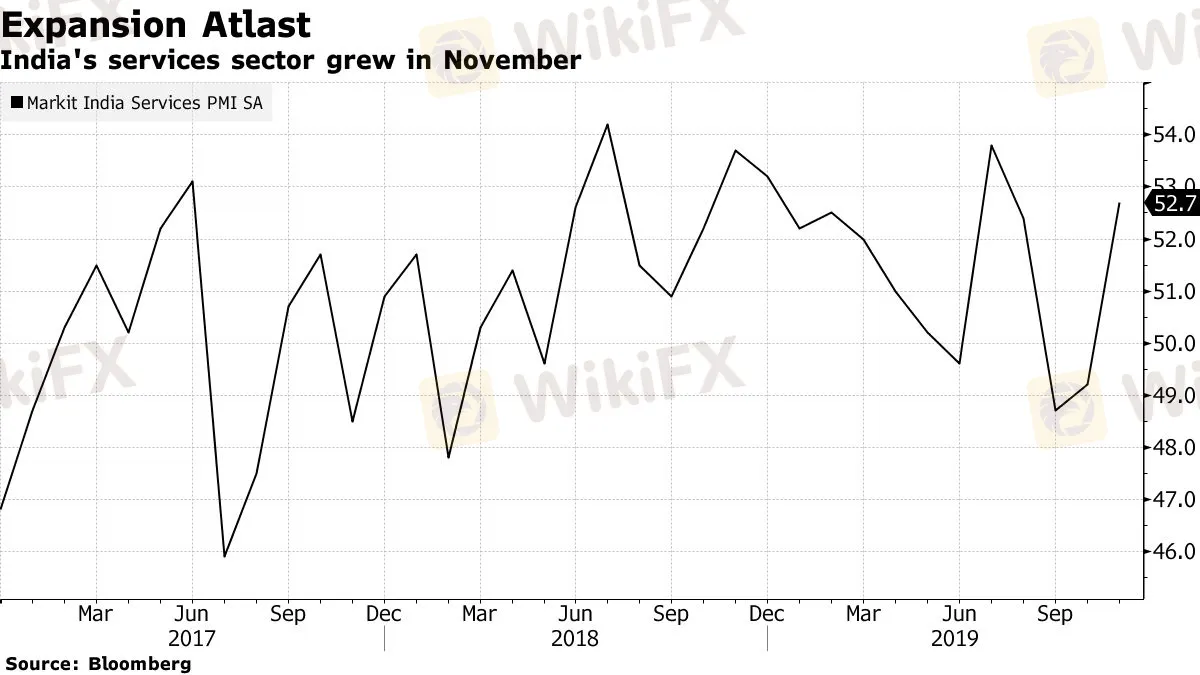

Rebound in India Services Offers Glimmer of Hope for Economy

Abstract:Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast.

Explore whats moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast.

Indias dominant services sector rebounded last month, providing some cautious optimism the economy may be turning the corner.

The IHS Markit India Services Purchasing Managers Index rose to a four-month high of 52.7 in November, the first time in three months that the reading has been above 50 to mark an expansion in output. The improvement was driven by driven by higher orders and strengthening business confidence. The index is still below its long-run average of 54.2.

“Although the services economy shrugged off some of the weakness seen in September and October, the latest PMI results continue to sound a note of caution regarding demand and the underlying state of the sector,” said Pollyanna de Lima, a principal economist at IHS Markit.

The rise in the services index followed data earlier this week showing manufacturing also improved in November, resulting in the composite PMI index jumping to 52.7 from 49.6.

What Bloombergs Economists Say

The improved PMI data for November strengthens our view that the worst might be over for the economy and a shallow recovery lies ahead. Recent efforts by the RBI and the government are beginning to now show results and economic activity should pick further momentum over the next few months.

The latest surveys offer a glimmer of hope for the economy after data last week showed growth weakening to a six-year low of 4.5% in the July to September quarter. While services growth weakened last quarter, industries like finance and real estate, and trade, transport and communication posted solid expansion of 5.8% and 4.8% respectively from a year ago.

Government officials see last quarter‘s growth as the bottom of the cycle, with the economy’s fundamentals remaining strong.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator