简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices, NOK, CAD May Rally on Saudi Aramco Drone Strike

Abstract:Crude oil prices, the Norwegian Krone and Canadian Dollar may rally after a drone struck Saudi Arabias Aramco oil processing facility and sparked supply-disruption fears.

Crude Oil Prices, Saudi Arabia Output, Aramco Drone Strike– TALKING POINTS

Crude oil prices, NOK, CAD may rally early into Mondays trading session

Drone strike against Saudi Arabia Aramco sparked supply-disruption fears

Will rising political risk help buoy crude oil prices as global demand wanes?

Learn how to use political-risk analysis in your trading strategy!

Crude oil prices and petroleum-linked currencies like the Norwegian Krone and Canadian Dollar rallied early into Monday‘s trading session after reports of drone strikes at Saudi Arabia’s Aramco oil facilities in Abqaiq. The attack has disrupted their production of about 5.7 million barrels of crude oil per day, about half of the Kingdom‘s daily production of 9.8 million; to put another way: 5 percent of the world’s supply.

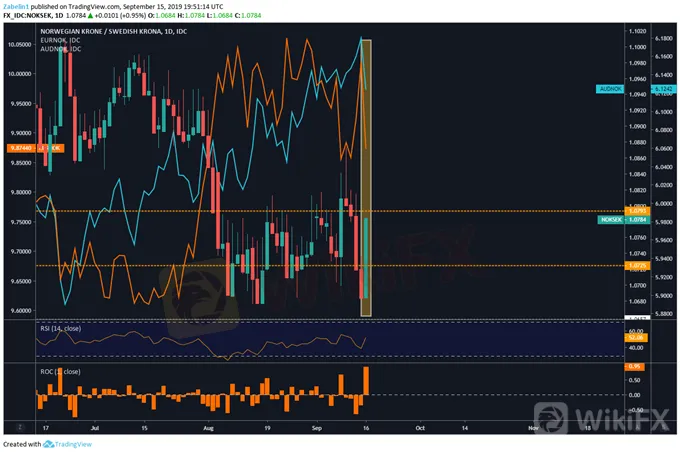

Oil-Linked Norwegian Krone Rallies Early into Mondays Trading Session Over Supply-Disruption Concerns

NOK chart created using TradingView

Yemen‘s Houthi rebels – which are widely considered to be backed by Iran – claimed responsibility for the attack. US Secretary of State Mike Pompeo condemned Tehran’s alleged involvement in the strike. This will likely amplify politically-induced supply disruption fears in the region as the prospect of reconciliation between Iran and the US is now much less likely.

According to people familiar with the matter, it could take a few weeks for Saudi Arabia to repair its facilities and resume its regular production schedule. While crude oil prices may initially spike, their upside momentum may quickly fade if Saudi Arabia draws on its reserves and if US President Donald Trump follows up on his offer to draw on the Strategic Petroleum Reserve to stabilize the energy market.

While regional political risk has helped to boost crude oil prices, it may fail to significantly alter the commoditys longer-term trajectory. Eroding fundamentals and weaker global demand have overwhelmed supply disruptions fears and political risks in Iran. Eroding fundamentals and the US-China trade war have dominating headlines and have been the primary catalyst behind the ongoing decline in crude oil prices.

Crude Oil Prices Continue to Fall Despite Rising Politically-Induced Supply Disruption Fears

Crude oil prices chart created using TradingView

CRUDE OIL TRADING RESOURCES

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 5 August: Gold Declines in Early Asian Session Amid Profit-Taking and Market Uncertainty

Gold declined in the early Asian session due to profit-taking after hitting a record high on Friday. The US NFP report showed only 117K new jobs in July, below the expected 175K, signaling a potential increase for XAU/USD. Annual wage growth slowed to 3.7%, easing inflation fears and boosting Fed rate-cut prospects. Rising tensions between Iran and Israel have also increased gold’s safe-haven appeal.

Yen May Sink as US-China Restart Trade Talks, Can Crude Oil Rise?

The Japanese Yen may weaken as markets digest US-China restarting trade talks after the G20 Summit. Will this offset crude oil price declines as EU cooled Iran supply disruption fears?

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator