简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Eye Chart Barrier as Markets Weigh Fed, ECB Policy

Abstract:Crude oil prices have run into four-month chart resistance as markets await cues from Julys FOMC and ECB meeting minutes as well as the Jackson Hole symposium.

CRUDE OIL & GOLD TALKING POINTS:

Crude oil prices edge up in risk-on trade, but key resistance held

API inventory flow data rounds out barebones economic calendar

Gold prices retreat as markets eye FOMC minutes, Jackson Hole

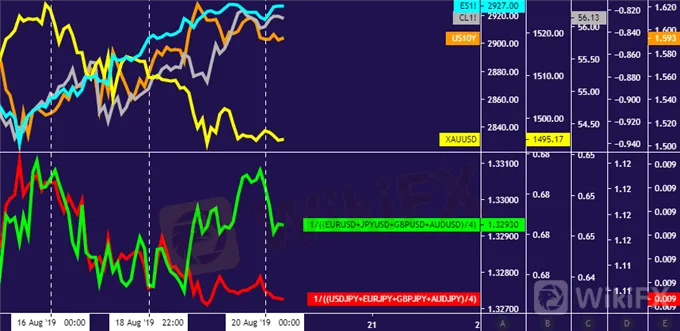

Friday‘s risk-on sentiment tilt carried through Monday’s session, with crude oil prices rising alongside stocks. A parallel rise in bond yields undermined the appeal of non-interest-bearing assets and weighed on gold. Impressively, the US Dollar recovered some lost ground despite its recently anti-risk profile.

All the same, the benchmark commodities made little progress from near-term ranges, as expected. That seems to reflect traders withholding conviction ahead of critical event risk: minutes from Julys FOMC and ECB meetings as well as the Fed-hosted economic symposium in Jackson Hole, Wyoming.

The weekly API inventory flow report rounds out the barebones data docket. It will be sized up against expectations of a 1.22-million-barrel drawdown in US stockpiles expected to be reported in official EIA statistics due Wednesday. Absent dramatic deviation, a strong response from prices seems unlikely.

GOLD TECHNICAL ANALYSIS

Gold prices edged lower toward swing low support at 1480.00. A daily close below that would bolster topping cues hinted in negative RSI divergence, exposing a more substantive barrier in the 1437.70-52.95 zone next. Swing high resistance is at 1535.03, with a weekly chart inflection level at 1563.00 lining up thereafter.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned below resistance capping gains since late April, now at 58.30. A daily close above that targets the 60.04-84 zone. Alternatively, a move below the congestion area running down through 53.95 sets the stage to challenge support near the $50/bbl figure once again.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

KVB Today's Analysis: USD/JPY Eyes Volatility Ahead of BoJ Policy Meeting and US Data

The USD/JPY pair rises to 154.35 during the Asian session as the Yen strengthens against the Dollar for the fourth consecutive session, nearing a 12-week high. This is due to traders unwinding carry trades ahead of the Bank of Japan's expected rate hike and bond purchase tapering. Recent strong US PMI data supports the Federal Reserve's restrictive policy. Investors await US GDP and PCE inflation data, indicating potential volatility ahead of key central bank events.

Today's analysis: USDJPY Poised for Increase Amid Bank of Japan's Strategy

The USD/JPY is expected to rise. The Bank of Japan will keep interest rates between 0 and 0.1% and continue its bond purchase plan but may reduce purchases and raise rates in July based on economic data. Technically, the pair is trending upward with resistance at $158.25 and $158.44, and support at $157.00, $156.16, and $155.93.

USDJPY Predicted to Rise on Yen Depreciation

The USD/JPY pair is predicted to increase based on both fundamental and technical analyses. Fundamental factors include a potential easing of aggressive bond buying by the Bank of Japan (BoJ), which could lead to yen depreciation. Technical indicators suggest a continuing uptrend, with the possibility of a correction once the price reaches the 157.7 to 160 range.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator