简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Canadian Dollar Outlook: USD/CAD Turns to Canada Jobs Data

Abstract:The Canadian Dollar is ripe for heightened forex price action surrounding the July Canada jobs report due for release during Friday's trading session - here's what you should know.

CANADIAN DOLLAR, JULY CANADA JOBS REPORT & LABOUR FORCE SURVEY

USDCAD upward momentum is beginning to show signs of waning headed into the July Canada jobs report due Friday at 12:30 GMT

Canadian Dollar overnight implied volatility measures jump as currency traders prepare for high-impact event risk surrounding Canadas change in employment data release

Sharpen your forex trading skills with this free educational guide covering the Traits of Successful Traders

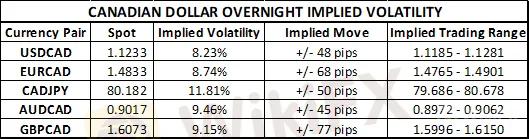

As uncertainty rises, typically so does implied volatility. Canadian Dollar currency pairs are reflecting this phenomenon which is to be expected around closely watched economic data releases that tend to move markets – like tomorrows labour force survey. In fact, overnight implied volatility measures for USDCAD, EURCAD, CADJPY, AUDCAD and GBPCAD are all well above their 12-month averages headed into the July Canada jobs report.

CANADIAN DOLLAR IMPLIED CURRENCY VOLATILITY & TRADING RANGES – USDCAD, EURCAD, CADJPY, AUDCAD, GBPCAD

Canadian Dollar currency traders are likely placing heavy weight on the headline change in employment figure seeing that it will provide the latest anecdote for the Bank of Canada (BOC) to consider when communicating its next monetary policy update. BOC Senior Deputy Governor Wilkins most recently communicated how the central bank is “paying particular attention to Canadian household spending and the oil sector. Consumption has rebounded and should continue to be supported by a solid labour market.”

That said, another robust Canadian jobs report could reinforce the relatively hawkish posturing of the BOC whereas a worse-than-expected data print may send the loonie tumbling – particularly if markets reassess BOC rate cut bets higher.

FOREX ECONOMIC CALENDAR – CAD

Learn more about Forex News Trading

While the net change in employment will likely take the spotlight, there are several other economic indicators that have potential to weigh in on the markets reaction in addition to the underlying components of the labour force survey which should not be overlooked.

CANADA CHANGE IN EMPLOYMENT – MONTHLY CHART

It was stated in the June Canada jobs report that “employment gains have been relatively broad-based across sectors and regions,” adding that job additions were “particularly strong in service industries and outside oil-producing regions.” Also noteworthy is how the prior 2 employment change readings have drifted lower from the blockbuster report in April. Although, net job additions will look to continue its overarching trend higher.

BANK OF CANADA INTEREST RATE CHANGE PROBABILITIES

According to overnight swaps, rate traders are currently pricing in a 59.3% probability that the Bank of Canada cuts its policy interest rate by the end of the year. This is down slightly from yesterdays reading of 66.9% but higher than the low on July 31 low of a 24.7% probability of a rate cut priced in.

USDCAD PRICE CHART: DAILY TIME FRAME (MAY 26, 2019 TO AUGUST 08, 2019)

Judging by USDCAD overnight implied volatility of 8.23%, spot prices are estimated to trade between 1.3181-1.3295 with a 68% statistical probability. The 1.33 handle, which aligns closely with the upper bound of the 1-standard deviation trading range and the midpoint of spot USDCADs leg lower from the end of May to mid-July, could serve as a strong area of technical resistance if the July Canada jobs report disappoints. On the other hand, USDCAD bears will have to push below technical support posed by the 38.2% Fibonacci retracement if the data print is strong before targeting the month-to-date low and lower bound of the options implied trading range around the 1.32 handle.

FOREX TRADING RESOURCES

Download the Q3 DailyFX Forecasts for comprehensive fundamental and technical analysis on major currencies like the US Dollar and Euro in addition to equities, gold and oil

Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real-time

Find out how IG Client Sentiment data can be used to identify potential forex trading opportunities

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Canadian Dollar Price Chart: Loonie Rips as USD/CAD Tests Resistance

The Canadian Dollar is up nearly 0.5% against the US Dollar after reversing off a key technical confluence zone. Here are the levels that matter on the USD/CAD weekly chart.

USDCAD Forecast: RSI Snaps Bullish Formation Following BoC Meeting

Recent developments in the Relative Strength Index (RSI) foreshadow a further decline in USDCAD as the indicator snaps the bullish formation carried over from July.

US Dollar Price Volatility Outlook: Data & Fed Cuts in Focus

US Dollar currency volatility eyes the barrage of high-impact economic data releases slated for Thursday and how it might sway Fed rate cut expectations.

EUR/USD Recovers, GBP/USD Rallies, USD/CAD Eyes BoC Risk - US Market Open

EUR/USD Recovers, GBP/USD Rallies, USD/CAD Eyes BoC Risk - US Market Open

WikiFX Broker

Latest News

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

SEC Warns on Advance Fee Loan Scams in the Philippines

Currency Calculator