简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Buoyed by Declining Crude Inventories - US Market Open

Abstract:Crude Oil Prices Buoyed by Declining Crude Inventories - US Market Open

MARKET DEVELOPMENT – Crude Oil Prices Buoyed by Declining Crude Inventories

DailyFX 2019 FX Trading Forecasts

Oil: Crude oil futures are notably firmer this morning with Brent crude up over 1% following yesterday‘s API crude oil inventory data. The report showed a larger than expected crude drawdown of 6.02mln barrels over the last week (Exp. 2.6mln barrels). Alongside this, reports of supply disruptions at Libya’s El-Sharara oilfield has also underpinned the complex. Eyes will be on the DoE crude report for confirmation of the API data.

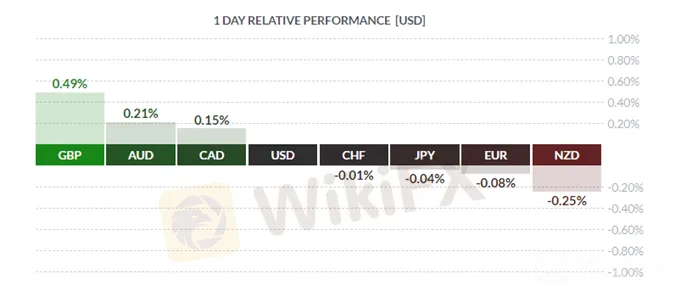

GBP / EUR: After 2-days of heavy selling for GBP, the currency is showing modest gains this morning, reclaiming the 1.22 handle amid a bout of profit taking ahead of the FOMC and BoE rate decisions. Elsewhere, EURUSD trades within a tight range as todays mixed inflation and growth data unlikely to change the near-term outlook for the ECB with the central bank scheduled to announce a fresh stimulus package at the September meeting.

AUD / CAD: Across commodity currencies both the Aussie and Loonie are firmer vs the US Dollar with the latter benefitting from better than expected GDP figures, while the Q2 inflation report from Australia has largely done enough to keep the RBA from lowering interest rates at next weeks meeting.

Source: DailyFX, Thomson Reuters

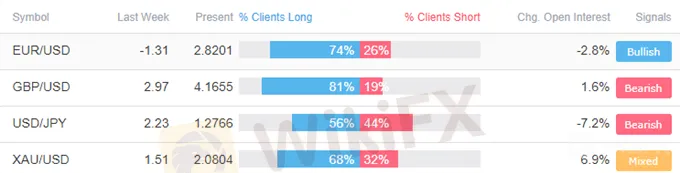

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“FTSE 100 Technical Outlook – Monday Rally Coming Under Fire” by Paul Robinson, Currency Strategist

“Gold Price, Crude Oil Price: Breakouts Ahead of Fed Rate Decision” by Nick Cawley, Market Analyst

“US Dollar Outlook: GBPUSD, USDJPY FOMC Set-Ups” byJustin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator