简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

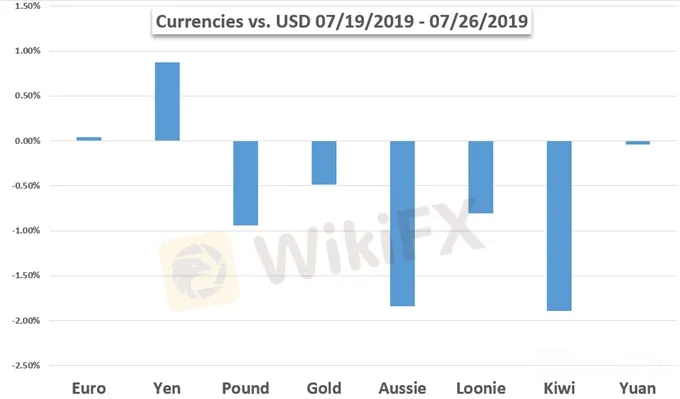

Weekly Trading Forecast: Dollar and Dow Dialed in to Fed, NFPs and Trade Wars

Abstract:After a week of dovish ECB, a US GDP beat and unexpected headlines from President Trump; we now move into a second week of heavy scheduled and unscheduled event risk. The FOMC rate decision is an event that will stretch to all corners of the financial system and the focus

Gold Prices May Suffer if FOMC Undermines Dovish Expectations

Gold prices may look increasingly overpriced if the FOMC rate decision and commentary fall short of the markets comparatively more dovish expectations, opening the door to weakness.

Australian Dollar Could Struggle as Crucial Inflation Data Loom

Australian Dollar market focus has returned with a vengeance to domestic monetary policy prospects. Its likely to stay there this week, which is bad news for resurgent bulls.

Euro Weekly Forecast: ECB Stimulus Primed and Ready as Outlook Sours

The outlook for the Euro-Zone economy remains gloomy and with fresh central bank stimulus on the way, the path of least resistance for the Euro remains lower.

Dow Jones, Nasdaq 100, S&P 500, DAX 30, FTSE 100 Forecast

Earnings season continues next week, but a series of central bank decisions will look to wrestle the markets focus back to monetary policy.

US Dollar Seems to be Biased Upward on FOMC Rate Decision

The US Dollar seems more likely to rise than fall after the FOMC monetary policy announcement even as an interest rate cut is overwhelmingly expected.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FED meeting minutes strongly hint at a rate cut in September; US dollar index falls to new low this year!

The U.S. Bureau of Labor Statistics revised down the employment growth in the year ending in March by 818,000, an average monthly decrease of about 68,000, the largest downward revision since 2009. The substantial downward revision of employment data re-emphasized the severity and necessity of the U.S. employment problem, paving the way for a rate hike in September. Bearish for the U.S. dollar.

What new signals does the Federal Reserve have? FED Governor Michelle Bowman reiterates the risk of inflation!

Fed Governor Bowman: There are upside risks to inflation, the labor market continues to strengthen, and a cautious attitude will be maintained at the September meeting. Boston Fed President Collins: If the data is as expected, it would be appropriate to start easing policy "soon". Inflationary pressure will slow down the pace of U.S. interest rate cuts, which will be bullish for the dollar.

Wall Street Dip on AI Jitters

The U.S. equity market experienced one of its worst trading days this year, with the Nasdaq leading the decline, plunging more than 700 points in the last session. Investor concerns over the AI sector surged following Tesla's earnings miss and Google's higher-than-expected spending, both of which saw sharp declines.

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

The ECB's consumer expectations survey shows mixed economic signals with slight improvements in unemployment expectations but unchanged growth forecasts. The euro faces pressure from a strong USD, while the GBP shows resilience, contributing to the strength of GBP/USD and the decline of EUR/GBP.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator