简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead Top 5 Events: Q2 Eurozone GDP, July Eurozone Inflation & EUR/JPY Rate Forecast

Abstract:Euro currency traders will likely turn to upcoming Eurozone economic data next Wednesday which highlights EU GDP and CPI numbers following last week's July ECB meeting.

EURO PRICE TURNS TO EUROZONE GDP & INFLATION DATA AFTER JULY ECB MEETING

7月欧洲央行会议后欧元区国内生产总值和通货膨胀数据出现欧元价格

EUR currency pairs look to high-impact Eurozone GDP and inflation data slated for release next week

欧元货币对期待下周发布的欧元区国内生产总值和通胀数据将受到高影响

The Euro could fall if Eurozone economic data continues to disappoint after the July ECB meeting primed markets for future monetary stimulus

如果欧元区经济数据在7月欧洲央行之后继续令人失望,欧元可能会下跌为未来货币刺激计划做好准备

Spot EUR/JPY may provide the cleanest look at the forex markets reaction to upcoming Eurozone economic data

现货欧元兑日元可能会对外汇市场对即将到来的欧元区经济数据的反应提供最清晰的看法

07/31 THURSDAY | 09:00 GMT | EUR Eurozone GDP (2Q A) & Eurozone CPI (JUL A)

07/31周四| 09:00 GMT | EUR欧元区GDP(第二季度)和欧元区CPI(JUL A)

Next week‘s economic calendar is jam-packed with event risk and Wednesday’s release of Eurozone GDP and CPI data at 9:00 GMT is certainly among the top 5 forex trading events. The closely watched economic indicators will follow last weeks July ECB meeting where central bank President Mario Draghi paved the road to ease monetary policy in the near future.

下周的经济日历充满了事件风险以及周三公布的欧元区GDP和CPI数据格林尼治标准时间9点肯定是前5大外汇交易活动之一。密切关注的经济指标将跟随欧洲央行7月份的会议,中央银行行长马里奥·德拉吉在不久的将来为宽松的货币政策铺平道路。

Although Draghi mentioned that a rate cut was not discussed among the ECB Governing Councils most recent meeting, he did state that “a significant degree of monetary stimulus continues to be necessary for financial conditions to remain very favorable and support the euro area expansion, the ongoing build-up of domestic price pressures and headline inflation developments over the medium term.”

尽管德拉吉提到降息在欧洲央行管理委员会最近的会议上没有讨论过,他确实表示“为了保持非常有利的金融条件并支持欧元区扩张,国内价格压力不断增加,仍需要进行大量货币刺激措施中期内的通胀发展。”

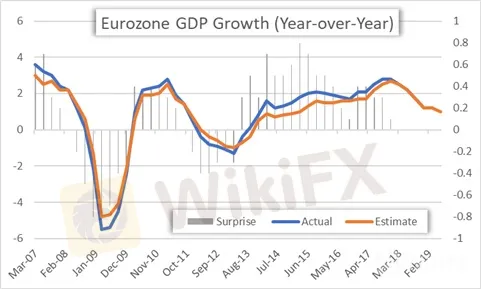

EUROZONE GDP GROWTH CHART (QUARTERLY, YEAR-OVER-YEAR)

欧元区国内生产总值增长图表(季度,年 - 年)

EUROZONE CPI CHART (MONTHLY, YEAR-OVER-YEAR)

EUROZONE CPI图表(每年,每年 - ){/ p>

{11}

Stubbornly-sluggish economic activity across the Euro area is likely to be reiterated in the Q2 Eurozone GDP and CPI report, which stands to follow weaker-than-expected Eurozone PMI data just released. ECB President Drahi expressed concern on inflation and conveyed that the Governing Council “will act with same determination whether inflation is above or below the inflation aim” of around 2%. Moreover, Draghi also said that outlook is getting worse and worse in manufacturing.

{11}

As such, the Euro could face significant downside if the headline EU economic data disappoints. Eurozone Q2 GDP (YoY) is estimated to be reported 0.2% lower than Q1 at 1.0% whereas Eurozone CPI for July (YoY) is expected to come in 0.1% lower than the prior month‘s reading of 1.1% according to Bloomberg’s survey of economists.

因此,如果欧盟的总体经济数据令人失望,欧元可能面临重大下滑。根据彭博社的调查,欧元区第二季度GDP(同比)预计比第一季度下降0.2%,为1.0%,而欧元区7月份的同比(同比)预计比前一个月的1.1%低0.1%。经济学家。

Pairs to Watch: EURUSD, EURGBP, EURJPY

值得关注:EURUSD,EURGBP,EURJPY

SPOT EUR/JPY TECHNICAL ANALYSIS: DAILY PRICE CHART (SEPTEMBER 2018 TO JULY 2019)

SPOT EUR / JPY技术分析:每日价格表(2018年9月)至2019年7月)

EUR/JPY looks towards the end of July on shaky footing, continuing to hold below the rising trendline from the 2012 and 2016 yearly swing lows. Bearish momentum has eased off in recent days, as both daily MACD and Slow Stochastics have turned higher (albeit still in bearish territory). Price is still holding below the daily 21-EMA.

欧元/日元在7月底看起来不稳定,继续保持在2012年以来的上升趋势线之下和2016年每年的低谷。最近几天看跌势头有所缓解,因为日线MACD和慢速随机指标均走高(尽管仍处于看跌区域)。价格仍然低于每日21-EMA。

Now that EUR/JPY has broken through the June swing low at 120.78, there may be an easier pathway for a return towards the 2019 low established during the Yen flash crash in January at 118.62. Otherwise, if bulls are going to retake control, a return above the descending trendline from the October 2017 and March 2019 highs is required; that could come above the 23.6% retracement of the 2018 high/2019 low range at 122.20.

现在欧元/日元突破了6月的低点120.78,可能会有一条更容易回归的路径。在1月份的日元急剧下跌期间,2019年低点确定为118.62。否则,如果多头将重新获得控制权,则需要从2017年10月和2019年3月的高点回落至下降趋势线之上;这可能会超过2018年高点/ 2019年低点区间的23.6%回撤位122.20。

IG CLIENT SENTIMENT INDEX: EUR/JPY DAILY PRICE CHART (JANUARY 28, 2019 TO JULY 26, 2019)

IG客户风险指数:欧元/日元每日价格表(2019年1月28日至7月) 26,2019)

EUR/JPY retail trader data shows 70.4% of traders are net-long with the ratio of traders long to short at 2.38 to 1. In fact, traders have remained net-long since Apr 25 when spot EUR/JPY traded near 125.662; price has moved 3.8% lower since then. The number of traders net-long is 8.0% higher than yesterday and 8.7% lower from last week, while the number of traders net-short is 8.1% lower than yesterday and 1.5% lower from last week.

EUR / JPY零售交易商数据显示70.4%的交易者净额 - 交易者长期与卖空的比率为2.38比1.事实上,自4月25日欧洲/日元现货交易于125.662附近以来,交易商一直保持净多头;此后价格已经下跌3.8%。多头较昨日上涨8.0%,较上周下跌8.7%,而交易商净空头数较昨日下跌8.1%,较上周下跌1.5%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests spot EUR/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURJPY-bearish contrarian trading bias.

我们通常采取逆向观点来看待人群情绪,而交易商净多头意味着现货欧元/日元价格可能会继续下跌。交易商的净持续时间比昨天和上周更长,以及当前情绪和近期变化的结合给我们一个更强的欧元兑日元看跌逆势交易偏见。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator