简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar, Stocks Eye Fed Financial Stress Test, Iran Tension

Abstract:The US Dollar and stocks will be closely waiting for the results of the Feds annual bank stress test to see if underlying vulnerabilities are posing a systemic risk. US tensions with Iran are expected to escalate.

FED STRESS TEST, US DOLLAR FORECAST, IRAN TENSION – TALKING POINTS

Markets will be eyeing result of Fed annual bank stress test

Investors are nervously watching for signs of systemic risks

Iran is set to exceed its legally-mandated uranium stockpile

See our free guide to learn how to use economic news in your trading strategy!

CORPORATE DEBT POSING RISK TO FINANCIAL MARKETS?

Ever since market participants started pricing in – what some might call an excessive amount – of rate cut bets, the US Dollar has suffered and broken through 13-month rising support. However, the results of the Feds annual stress test may be a boon for the US Dollar if the central bank reveals that the financial system is more vulnerable than expected. Amid the prospective risk aversion, USD would likely catch a haven bid.

Conversely, if the results show strong resilience, it could push equities higher at the expense of the Greenback. However, it remains worth noting that politicians and Fed officials have expressed concern about rising corporate debt. The proliferation of collateralized loan obligations and reduced underwriting standards is becoming an ever-increasing risk that threatens the stability of the financial system.

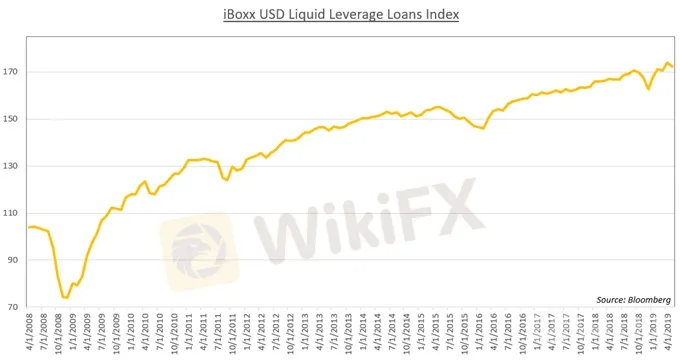

Since the Great Recession in 2008 and the subsequent implementation of a loose-credit regime via lower rates and QE, global equity markets have surged to such a degree that analysts believe it may be a bubble. Using the iBoxx USD Leveraged Loan index – composed of “approximately 100 of the most liquid, tradable leveraged loans” – shows that since 2009 the market for this kind of debt has exploded.

IRAN TENSION PROJECTED TO ESCALATE

Today, Iran is set to officially breach the legal parameters outlined in the 2015 nuclear agreement by exceeding the limit of permissible stockpiles of uranium. Tehran also threatened to increase the enrichment purity beyond the legally-stipulated 3.67 percent limit. Not only doing this increases what are already high tensions with the US, but it also hurts Europe who may endure yet another blow to their diplomatic relationships.

Washington and Brussels have been at odds with each other when it came to policy towards Iran. The former shredded the deal while the latter wanted to preserve it and even created a Special Purpose Vehicle that circumvented US sanctions. The measure was created as a way to try to mitigate the economic impact of the US embargo and thereby incentivize Tehran to hold up its end of the bargain. It appears the efforts are futile.

Europes stimulative measures are practically inconsequential when compared to the severity and economic contraction caused by US sanctions. The divergence in policy toward Iran put the US and EU at odds and even led to threats by Washington of imposing sanctions against Brussels for their cooperation with Iran. While attempting to lead with diplomacy, Europe has found itself holding the short end of the stick with both parties.

CHART OF THE DAY: IS GROWING CORPORATE DEBT, LEVERAGED LOAN MARKET THREATENING FINANCIAL STABILITY?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

GemForex - weekly analysis

The week ahead: US Dollar struggles to find demand

GemForex - Powell's policy guidance holds the key

Powell's policy guidance holds the key

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator