简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

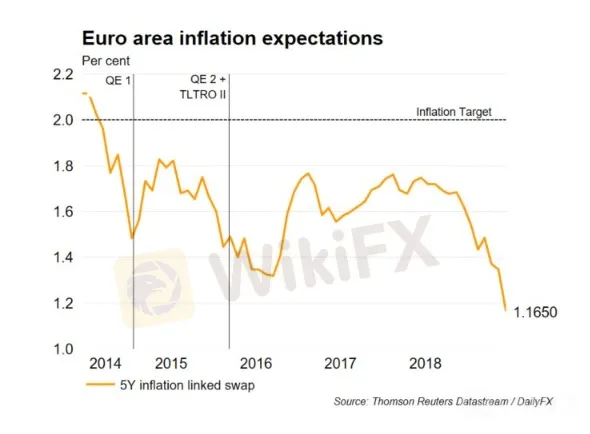

Euro (EUR) Battles Record Low Euro-Zone Inflation Expectations

Abstract:The single currency remains under downside pressure as 5-yr/5-yr Euro-Zone inflation expectations hit another record low, leaving the ECB in a precarious situation.

EURUSD Price, Chart and Analysis:

EURUSD价格,图表与分析:

Euro-Zone inflation expectations continue to make fresh lows.

欧元区通胀预期继续创下新低。

EURUSD price being kept afloat by a weak US dollar.

保持欧元兑美元价格由于美元疲软而浮出水面。

Q2 2019 EUR Forecast and USD Top Trading Opportunities

2019年第二季度欧元预测和美元最大交易机会

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

通过DailyFX经济日历了解所有关键经济数据和事件发布日期

The latest market indicator of Euro-Zone inflation expectations – the 5-yr/5-yr inflation-linked swap rate – today printed a new all-time low at 1.165%. The indicator measures inflation expectation over a five-year period starting five years from now. This will be a major headache for the ECB whose remit is to maintain inflation rates below, but close to, 2% over the medium-term.

欧元区通胀预期的最新市场指标 - 5年/ 5年通胀相关掉期利率 - 今日创下历史新低1.165%。该指标衡量了从现在起五年后的五年期间的通胀预期。对于欧洲央行来说,这将是一个令人头疼的问题,其中的职责是在中期内保持通货膨胀率低于但接近2%。

This reading is closely monitored by the ECB and the recent fall in expectations will only increase pressure on the central bank to loosen monetary conditions further – rate cuts, more quantitative easing – to boost price pressures in the single-block. The ECB halted the QE 2 at the end of 2018, apart from coupon and repayment reinvestments, and the central bank is likely in the months ahead to admit that more QE is necessary. The Euro-Zone benchmark (10-yr German Bund) currently trades at -0.265%, while the 20-year Bund offers a paltry 12.5 basis points of yield, highlighting the view that interest rates are going to stay very low for a long time.

此读数受欧洲央行密切监控,近期预期下降只会增加央行进一步放松货币政策的压力 - 降息,更多量化宽松 - 以刺激单一区块的价格压力。除了优惠券和还款再投资之外,欧洲央行在2018年底停止了QE 2,而央行可能在未来几个月承认需要更多量化宽松政策。欧元区基准(10年期德国外滩)目前的交易价格为-0.265%,而20年期外滩的收益率仅为12.5个基点,突显了利率将长期保持在低位的观点。 。

EURUSD Price Looking Shaky - Lower for Longer?

欧元兑美元价格看跌 - 持续走低?

EURUSD remains around 1.5 cents away from making a fresh two-year low if it breaks the May 23 nadir at 1.1107. The pairs upside is currently being halted by the 200-day moving average which has held firm over the last week with the level broken but not closed above. EURUSD downside is being tempered by a weak US dollar with markets fully expecting at least two 0.25% interest rate cuts this year, cutting the attractiveness of the US dollar.

欧元兑美元维持在两年新低的1.5美分左右如果它在1.1107打破5月23日的最低点。这对货币上行目前正在被200日移动平均线所阻止,该移动平均线在过去一周保持坚挺,但水平已经突破但尚未收盘。欧元兑美元由于美元疲软,市场充满期待今年至少降息0.25%,从而削弱了美元的吸引力,因此nside正在受到抑制。

EURUSD Price Outlook Cloudy – ECBs Rehn Talks Rate Cuts and More QE

欧元兑美元价格展望多云 - 欧洲央行雷恩会谈减息及更多QE

EURUSD Daily Price Chart (September 2018 – June 14, 2019)

欧元兑美元每日价格走势图(2018年9月 - 2019年6月14日)

Retail traders are 45.8% net-long EURUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. However recent daily and weekly positional changes give us a mixed trading bias.

根据最新的IG客户情绪数据,零售交易商的净多头欧元兑美元为45.8%,这是一个看涨的逆势指标。然而,最近的每日和每周位置变化给我们带来了混合交易偏见。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

Global Economic and Financial Highlights: July 18, 2024

Today's news covers significant developments in global markets and politics. President Biden's campaign faces challenges due to a COVID-19 diagnosis, while China's economic strategies and tech advancements remain in focus. Key updates include the impact of US semiconductor restrictions, rising tensions in global trade, and significant shifts in corporate strategies and financial markets. The news reflects the dynamic and interconnected nature of the global economy.

Special Article: Analysis of FOMC Minutes

The FOMC minutes highlighted financial strains on low-to-moderate-income households, the Fed's data-dependent approach, and the impact of geopolitical risks. Discussions included immigration's positive impact on the labor force and modest progress toward disinflation. Potential rate cuts were mentioned if the job market deteriorates significantly. This cautious outlook emphasizes balancing inflation control and economic support.

Today's analysis: XAUUSD Faces Potential Decline Amid Fed's Rate Uncertainty

Gold (XAU/USD) is predicted to decrease due to a mix of economic factors and technical indicators. Lower-than-expected US PPI and CPI data suggest potential Fed rate cuts, initially supporting gold, but a cautious Fed outlook has pulled prices back. Technically, a bearish Head-and-Shoulders pattern suggests a trend reversal, with a break below $2,279 confirming downside targets at $2,171 and $2,106. However, a rise above $2,345 could challenge this pattern and push prices back toward $2,450.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Dr. Sandip Ghosh, Ex-RG Kar Principal, Involved in Multi-Crore Scam

OPEC's Profound Influence on the Oil Market

Just2Trade: SAFE or SCAM?

The January Effect of 2025 in Forex Markets

New York becomes first US city with congestion charge

Currency Calculator