简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones, FTSE 100, ASX 200 Fundamental Forecast

Abstract:The Dow Jones, FTSE 100 and ASX 200 face a relatively quiet week from a data perspective, which may see overarching market themes take control.

Dow Jones, FTSE 100, ASX 200 Fundamental Forecast:

The Dow Jones will look to retail sales on Friday, but awaits a US-Mexico trade war solution in the interim

The FTSE 100 has a slew of smaller-data pieces to watch while keeping a close eye on politics

Unemployment data will influence price action for the ASX 200

Dow Jones, FTSE 100, ASX 200Fundamental Forecast

Global equities staged a considerable relief effort last week as a dovish Fed helped to buoy the decade-long bull run for US indices. Still, the DAX 30, FTSE 100 and ASX 200 all enjoyed their own rallies – recapturing key technical levels. The economic calendar for the week ahead is nearly devoid of high importance events, thus the themes we have been negotiating for months – trade wars and global growth concerns – will likely dominate the headlines.

Dow Jones Fundamental Forecast: Neutral

The Dow Jones will eagerly await a resolution to the US-Mexico tariff threat, which may quickly draw to a close. On Friday, President Trump said it was likely the two countries come to an agreement to avoid tariffs before the Monday deadline. The removal of a threat to one of the countrys largest trading partners and neighbors would inject optimism and relative calm into US stocks.

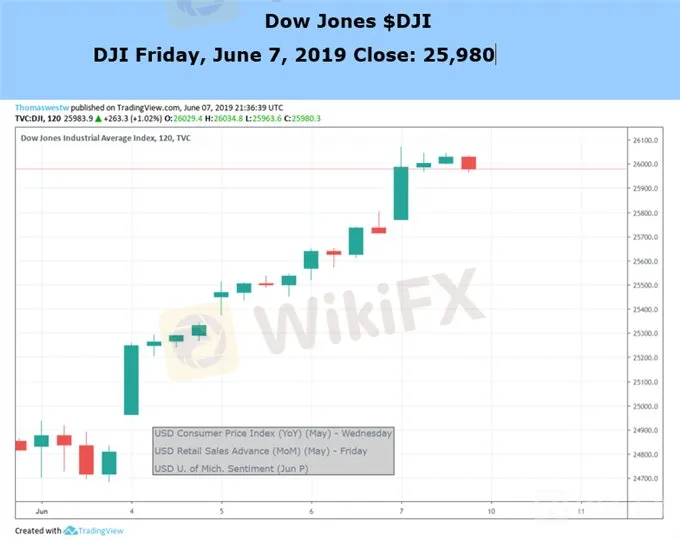

Dow Jones Price Chart: 4 – Hour Time Frame (February – June) (Chart 1)

FTSE 100 Fundamental Forecast: Bullish

The FTSE 100 is due for a slew of data – but few of them are likely to significantly influence the Indexs price. That said, the Index will look to ongoing political positioning as members of parliament determine who is next to take up the position of Prime Minister.

FTSE 100 Price Chart: 4 – Hour Time Frame (February – June) (Chart 2)

ASX 200 Fundamental Forecast: Neutral

The Australian ASX 200 is due for unemployment data on Thursday, a week after the Australian central bank sliced its interest rate to the lowest ever at 1.25%. Unlike the Dow Jones and S&P 500, the ASX 200 is unlikely to react positively to poor data – with very low chances of another near-term cut from the RBA.

ASX 200 Price Chart: 4 - Hour Time Frame (February – June) (Chart 3)

View our Economic Calendar for upcoming data and events that may shake up the trading landscape.

Finally, one event may exercise influence across global equity markets. Top finance ministers from across the G20 group are scheduled to meet in Osaka Japan this weekend and trade talks, monetary policy and global growth will undoubtedly be on the docket. This meeting presents an opportunity for trade representatives to lay the groundwork for agreements ahead of the Presidents and Prime Ministers who are due in Osaka at the end of the month. At a minimum, expect commentary on the state of trade progress between the United States, China, Japan and the European Union. For other equity updates and analysis, follow @PeterHanksFX on Twitter.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more:Gold and High Yield Debt Funds See Record Inflows on Dovish Fed

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Standard Chartered Secures EU Crypto License in Luxembourg

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator