简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Price Analysis: Brent Crude Eyes Critical Test of $60 Support

Abstract:Crude Oil Price Analysis: Brent Crude Eyes Critical Test of $60 Support

Oil Price Analysis and News

油价分析和新闻

Brent Crude Risks Breaking Through $60

布伦特原油风险突破60美元

Hedge Funds Continue to Head for the Exit

对冲基金继续前往退出

{9} 对冲基金继续前往退出 {9}

Brent Crude Risks Breaking Through $60

布伦特原油风险突破60美元

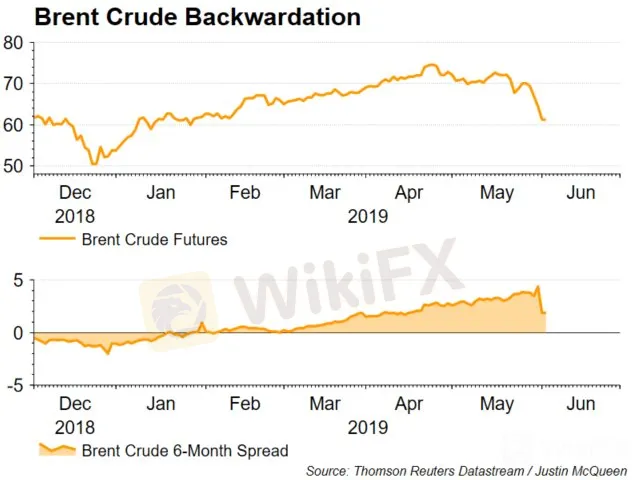

The oil market continues to remain soft as the bearish bias towards risk assets in light of rising concerns of a global slowdown weighs on the energy market. Consequently, Brent crude futures are at risk of breaking below $60 for the first time since the beginning of the year as fears mount over a potential hit to consumption growth. Coinciding with the move lower in the spot market, the Brent futures curve has also seen a pullback from its steep backwardation (6-month spreads are now at $1.80 from a prior $4.30), providing an increasing sense that trade war fears are outweighing potential supply side related risks.

由于对风险资产的担忧加剧,石油市场继续疲软全球经济放缓对能源市场构成压力。因此,布伦特原油期货自年初以来首次跌破60美元以下,因为人们担心消费增长可能受到打击。与现货市场走低相反,布伦特原油期货曲线也出现了大幅回落的逆转(6个月利差现在从先前的4.30美元上涨至1.80美元),提供了越来越多的意识,即贸易战的担忧超过了潜在的供给相关风险。

What is Brent Crude Backwardation?

什么是布伦特原油期货?

Elsewhere, reports that Norwegian oil workers have struck a wage deal with employers today had led to a strike being avoided, which would have cut production by 440kbpd. Subsequently, keeping a lid on any bounce in the energy complex. As such, focus is on the psychological $60 handle to provide a floor for oil prices.

此外,据报道挪威石油工人今天与雇主达成工资协议导致罢工被避免,这将使产量减少440kbpd。随后,关闭能量复合体中的任何反弹。因此,重点放在60美元的心理上为油价提供底线。

Hedge Funds Continue to Head for the Exit

Hedge funds have continued to exit their bullish positioning in the Brent crude oil with net longs dropping by a sizeable 40k lots amid the capitulation in oil prices throughout May. Consequently, the ratio of long/short positioning has almost halved from over 2 weeks ago to 8:1 (Prev. 15:1) with risks of a further liquidation of long Brent positioning on the horizon. (COT Commodity report)

对冲基金继续在整个5月份油价投降期间,由于净多头减少了4万手,因此退出他们对布伦特原油的看涨定位。因此,多头/空头定位的比率几乎减少了一半,从2周前变为8:1(上一个15:1),并且可能会出现长期布伦特原油定位进一步清算的风险。 (COT Commodit报告)

Brent Crude Price Chart: Daily Time Frame (Aug 2018 – Jun 2019)

布伦特原油价格走势图:每日时间表(2018年8月 - 2019年6月)

Oil Impact on FX

Oil Impact关于外汇

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

净石油进口国:当石油价格上涨时,这些国家往往会变得更糟。这包括,KRW,ZAR,INR,TRY,EUR,CNY,IDR,JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

净石油出口国:当石油价格上涨时,这些县往往会受益。这包括RUB,CAD,MXN,NOK。

--- Written by Justin McQueen, Market Analyst

---写的作者:Justin McQueen,市场分析师

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator