简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Rate Outlook Mired by Renewed Threat of ‘Hard Brexit’

Abstract:The Brexit negotiations may continue to drag on GBP/USD as Prime Minister Theresa May struggles to secure a deal.

British Pound Rate Talking Points

英国英镑汇率谈话要点

GBP/USD trades to fresh monthly lows, with U.K. data prints doing little to influence the British Pound, and the Brexit negotiations may continue to drag on the Pound Dollar exchange rate as Prime Minister Theresa May struggles to secure a deal.

英镑/美元交易于新的月度低点,英国数据打印正在进行由于英国首相特蕾莎·梅(Theresa May)努力争取达成协议,英国脱欧谈判可能会继续拖累英镑汇率。

Fundamental Forecast for British Pound: Neutral

英镑的基本面预测:中性

The British Pound may continue to get battered even though the economic docket stands fairly light for the last full week of May amid the renewed the threat for a ‘hard Brexit.’

英镑可能会继续遭受打击,尽管经济数据显示在5月的最后一周充满活力英国脱欧的头条新闻可能会继续改变英镑兑美元的近期前景,因为总理梅可能缺乏对退出的支持,因此英国脱欧的威胁将会再次出现。

Headlines surrounding Brexit may continue to shake up the near-term outlook for GBP/USD as Prime Minister May lacks support for the Withdrawal Agreement Bill, and the ongoing rift between U.K. lawmakers may keep the Bank of England (BoE) on the sidelines even though the Consumer Price Index (CPI) show the reading for inflation climbing to 2.1% from 1.9% per annum in March.

即使消费物价指数(CPI)显示通胀数据从3月份的年均1.9%上升至2.1%,英国立法者之间的协议法案以及英国立法者之间的持续分歧也可能使英格兰银行(BoE)保持观望态度。 p>

In turn, the British Pound stands at risk of facing headwinds ahead of the next BoE meeting on June 20 as the Monetary Policy Committee (MPC) insists that ‘the economic outlook will continue to depend significantly on the nature and timing of EU withdrawal,’ but the pickup in GBP/USD volatility continues to shake up market participation, with retail sentiment still stretched going into the end of the month.

反过来,英国人由于货币政策委员会(MPC)坚称“经济前景将继续在很大程度上取决于欧盟退出的性质和时间”,英镑将面临6月20日下一次英国央行会议前面临逆风的风险,但英镑升值/美元波动继续动摇市场参与,零售情绪仍将持续到月末。

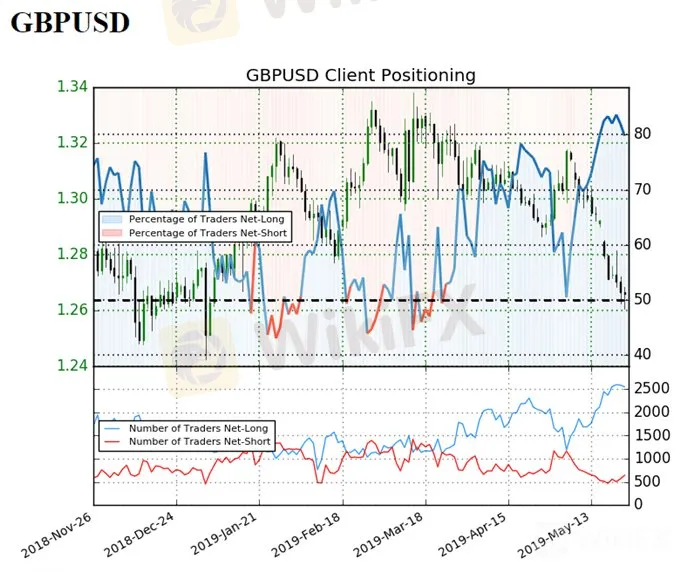

The IG Client Sentiment Report shows 79.8% of traders are net-long GBP/USD compared to 81.7% earlier this week, with the ratio of traders long to short at 3.95 to 1. Keep in mind, traders have remained net-long since March 26 when GBP/USD traded near 1.3210 region.

IG客户端情绪报告显示,79.8%的交易者是净多头英镑/美元,而本周早些时候是81.7%,交易者的多头比例为3.95比1.请记住,自3月26日以来,交易者仍然保持净多头英镑/美元在1.3210附近交易。

The number of traders net-long is 2.4% lower than yesterday and 6.3% higher from last week, while the number of traders net-short is 9.9% higher than yesterday and 16.8% higher from last week. It remains to be seen if the rise in GBP/USD interest will persist going into the final days of May, but the extreme reading in net-long position suggests the retail crowd is still attempting to fade the decline in the Pound Dollar exchange rate as it trades to a fresh monthly low (1.2605).

交易商净多头比昨天减少2.4%,比上周增加6.3%,而传单数量净空头比昨天增加9.9%,喜欢16.8%她来自上周。英镑/美元利率的上升是否会持续到5月的最后几天还有待观察,但净多头头寸的极端读数表明,零售人群仍在试图淡化英镑汇率的下跌趋势。交易价格创下月度新低(1.2605)。

Keep in mind, the tilted in retail interest offers a contrarian view to crowd sentiment especially as GBP/USD snaps the bullish trend from late-2018, with the Relative Strength Index (RSI) highlighting a similar dynamic.

请记住,零售利率的倾斜提供了一种逆势观点,尤其是当英镑兑美元突破看涨趋势时2018年末,相对强弱指数(RSI)强调了类似的动态。

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

注册并加入DailyFX货币分析师David Song LIVE,有机会讨论潜在的交易设置。

GBP/USD Rate Daily Chart

GBP / USD Rate Daily Chart

The broader outlook for GBP/USD is no longer bullish as the exchange rate snaps the upward trend from late last year after failing to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

英镑兑美元的更广阔前景不再看涨,因为汇率突破了你去年年底未能收于斐波那契收盘价上方的1.3310(100%扩张)至1.3370(扩大78.6%)之后的反弹趋势。

{14}

As a result, the advance from the 2019-low (1.2373) may continue to unravel, with a break/close below the 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion) region opens up the Fibonacci overlap around 1.2370 (50% expansion) to 1.2440 (50% expansion).

{14}{15}

Will keep a close eye on the RSI as the oscillator pushes into oversold territory, but a move back above 30 may foreshadow a rebound in GBP/USD as the bearish momentum abates.

--- Written by David Song, Currency Strategist

---由货币策略师David Song撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Global Events Shaping Financial Markets Part 2

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

Key Global Events Shaping Financial Markets Part 1

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

GBP: What To Expect From BoE

GBP: What To Expect From BoE

WikiFX Broker

Latest News

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

How Far Will the Bond Market Decline?

U.S. to Auction $6.5 Billion in Bitcoin in 2025

Standard Chartered Secures EU Crypto License in Luxembourg

Trading Lessons Inspired by Squid Game

Is Infinox a Safe Broker?

How Did the Dollar Become the "Dominant Currency"?

Currency Calculator