简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NOK, SEK Tremble Ahead of US-China Trade War News, EU Growth Data

Abstract:The Swedish Krona and Norwegian Krone will be on their toes as US-China trade relations sour and European growth indicators may continue to show regional weakness.

NORDIC FX, NOK, SEK WEEKLY OUTLOOK

NOK watches GDP publication– SEK eyeing Riksbank, CPI reports

Nordics tremble before EU growth data – Italy and Germany in focus

Trade wars, Brexit remain headline risks as the global economy cools

See our free guide to learn how to use economic news in your trading strategy!

RECAP: LAST WEEK

Last week – much like the start of this one – markets experienced a rude awakening by the news that US-China trade relations had severely deteriorated. In Norway, the Norges Bank announced its rate decision with an eye on another “likely” hike in June. The economic docket in Sweden remained light, so SEK currency crosses found themselves being primarily driven by global fundamental themes than by Sweden-based event risk.

EUROPEAN RISK: ECONOMIC DATA

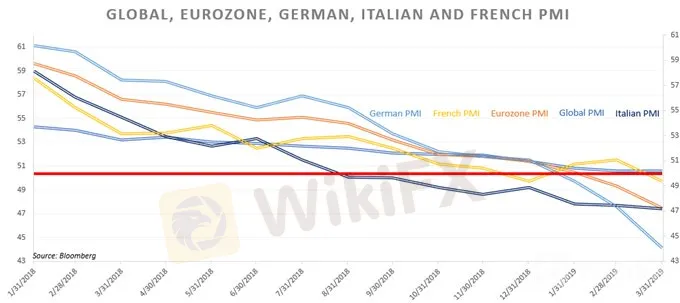

The economic docket in Europe this week is peppered with crucial growth indicators out of the aggregate Eurozone as well as key individual member states. Namely, Germany, France and Italy – the three largest economies in the Euro Area. Here are a few potentially high-risk events to keep an eye on:

May 14, Tuesday – German ZEW Surveys, CPI.

May 15, Wednesday – Eurozone GDP. German GDP, France CPI. Italy Industrial Orders, Sales

May 17, Friday – Eurozone CPI

European economies have been broadly showing weakness despite the minor improvement last week that saw better-than-expected data and Italys ascension out of its shallow recession. However, the dominant downtrend and regional weakness still persists with looming political uncertainties accompanying the upcoming – and what some might call dreaded – European parliamentary elections.

While Germany struggles to avoid a recession, France is still contending with the Yellow Vest protestors as Emmanuel Macron attempts to appease them through bold – and potentially dangerous – fiscal measures. In a similar vein, the Italian government‘s resolve on keeping its regulation-violating budget deficit is angering Brussels. This comes as Italy’s growth projection was revised for a third time down to 0.1 percent for 2019.

Krona and Krone traders will be closely watching the results of the data because of the implications European growth trends have on Nordic economies. This in large part has to do with the unique framework of EU-Nordic relations. Since the majority of Sweden‘s and Norway’s exports head to Europe, reduced demand out of the Euro area could pressure the Scandinavian economies.

US EVENT RISK: ECONOMIC DATA

In the US, a slew of key indicators will be released which could induce short bursts of volatility. Here is some data to key an eye on:

May 15, Wednesday – Empire Manufacturing, Retail Sales, Industrial Production

May 16, Thursday – Housing Starts

May 17, Friday – U. of Mich. Sentiment (May P)

According to the Citi Economic Surprise Index, US data has been tending to underperform relative to economists expectations. This might explain why the Fed pivoted from its hawkish outlook at the end of 2018 to a more neutral tone. Housing starts in particular may warrant a close eye because of the potential inflationary boost it may provide to the US economy through increased consumption that often follows from purchasing a home.

US-China trade war risks will also likely continue to dominate headlines as it remains one of the biggest fundamental themes in global markets since 2018. The recent fallout in trade relations between Beijing and Washington revived market-wide risk aversion that has resulted in equity indices, crude oil prices and other sentiment-linked assets taking a hit. To learn more, be sure to tune into my weekly webinar where I outline political risks in the week ahead.

NORDIC EVENT RISK:

In Sweden, the economic docket for the week is primarily dominated by various CPI data releases. While the latest meeting minutes and commentary from the Riksbank revealed dovish undertones, weaker price growth may further add impetus to the notion of delaying the central banks intended rate hike. A more up-to-date outlook may be provided by various Riksbank officials who will be speaking throughout the week.

In Norway, local quarter-on-quarter GDP was recently released. Apart from that, the economic docket remains relatively light. This may leave NOK at the mercy of counter currency-based event risks and fundamental themes.

Want to stay up to date on Nordic price action? Be sure follow me on Twitter @ZabelinDimitri.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

Euro May Extend Gains vs NOK and Aim to Re-Test 11-Year High

The Euro may rise vs the Norwegian Krone this week and push EURNOK to retest the 11-year high at 10.0972, a level not reached since the 2008 financial crash.

GBP/USD Downtrend Held as Yen Rose Amid Trump-China Call Dispute

The British Pound soared as “no-deal” Brexit bets cooled, but the GBP/USD dominant downtrend held on chart resistance. Disputes over the Trump-China phone call boosted the Japanese Yen.

Crude Oil Prices, NOK May Fall on Norway Sovereign Wealth Fund Data

Crude oil prices and the Norwegian Krone may fall if the world‘s largest petroleum-linked sovereign wealth fund’s earnings amplify global recession fears.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator