简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

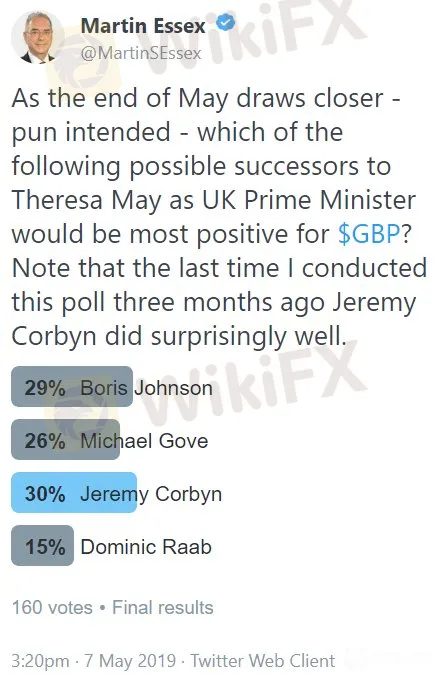

DailyFX Poll: Corbyn Could be Best Successor to PM May for GBP

Abstract:Of the four leading candidates to replace Theresa May as UK Prime Minister, Opposition leader Jeremy Corbyn would be the most positive for the British Pound, according to a DailyFX poll.

DailyFX poll analysis:

DailyFX has conducted a second poll via Twitter to find out which of the most likely successors to UK Prime Minister Theresa May would be most positive for the British Pound.

Remarkably, the winner was Opposition leader Jeremy Corbyn – suggesting once again that the financial markets, which traditionally favor Mays Conservatives, are not afraid of a Labour Government.

DailyFX poll results

Over a 24-hour period on May 7/8, I asked my Twitter followers again to choose between the bookies four leading candidates to succeed UK Prime Minister Theresa May, questioning which of them would be most positive for Sterling. May is coming under ever-increasing pressure to set a leaving date and it has been reported that Members of Parliament from her ruling Conservative Party are demanding a firm timetable for her departure. So far, she has rejected calls for her to quit.

That follows repeated delays to Brexit, large losses for the Conservatives in local elections and the prospect of the UK having to take part in European Parliament elections on May 23.

GBPUSD Price to Test Strong Support; Brexit Mayhem, Political Meltdown

Against this background, the bookies continue to take bets on her successor and these four were their favorites at the time:

Boris Johnson, formerly Foreign Secretary in Mays Cabinet and a prominent pro-Brexit campaigner,

Jeremy Corbyn, leader of the main opposition Labour Party,

Michael Gove, Environment Secretary in the current Conservative Government and formerly Co-Convenor of the Vote Leave group that led the Brexit campaign,and

Dominic Raab, a Leave campaigner who resigned as Mays Brexit Secretary in opposition to the Draft Withdrawal Agreement which he himself helped negotiate with the EU.

There were 160 votes in total, with most of the voters likely to be in the financial markets as they follow me or one of my DailyFX colleagues on Twitter, and top of the poll was Corbyn, just ahead of Johnson, who is often portrayed as a popular but controversial politician and who resigned from the government in criticism of Mays approach to Brexit.

When my last Twitter poll asking the same question was conducted almost three months ago, Johnson led the field but this time he was nudged into second place by Corbyn even though the Labour leader is regarded as being on the left-wing of his party. The full results were as follows:

You can find out here where GBP might be heading in the second quarter of the year – and how you can take advantage

In London Thursday, GBPUSD was holding close to the 1.30 level after three days of losses on reports that the Brexit talks between the Conservatives and Labour are close to collapse.

GBPUSD Price Chart, Hourly Timeframe (May 3 - 9, 2019)

Source: IG (You can click on it for a larger image)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Global Events Shaping Financial Markets Part 2

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

Key Global Events Shaping Financial Markets Part 1

Recent developments include Labour's landslide UK election victory, geopolitical tensions from Eurasian security discussions, Trump's election impact on Japanese stocks, EU's tech regulatory actions, tentative Hamas-Israel ceasefire, continuity in Mexican policies, Toronto's housing market rise, Boeing's Starliner issues, SpaceX's ISS deorbit contract, Indian IT companies' earnings, Malaysian tech stocks upgrade, Philippine inflation easing, Eli Lilly's Alzheimer's drug approval, US housing mark

GBP/USD Under Pressure as USD Outperforms - Fed, BOE and Brexit Loom

TALKING POINTS:

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator