简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones, S&P 500, DAX 30 and FTSE 100 Price Outlook

Abstract:After a loaded week for US equities, event risk looks to subside as the S&P 500 and Dow Jones look for the path of least resistance.

Dow Jones, S&P 500, DAX 30 and FTSE 100 Price Outlook:

-

With FAANG earnings in the rearview, earnings season will lose some of its sway

With a quiet week ahead, the DAX will await trade war news

The FTSE 100 looks to Fridays UK GDP release

Dow Jones Price Outlook: Neutral

Compared to last week, the week ahead should provide relative calm for US equities. The Dow Jones remains beneath record highs unlike its S&P 500 and Nasdaq counterparts. With a lack of domestic data, commentary from the central banks of Australia and New Zealand early in the week may offer some slight influence over the index as they offer their monetary policy outlooks and offer insight on the state of global growth.

View our Economic Calendar for live data releases and event times in the week ahead.

Outside of broader macroeconomic concerns, earnings season remains a factor. Although most of the big players have already reported, Wednesday will see Disney (DIS) offer their financial findings to the market. As roughly 3.5% of the Industrial Average, the stock will have some sway – but sentiment could play a larger role.

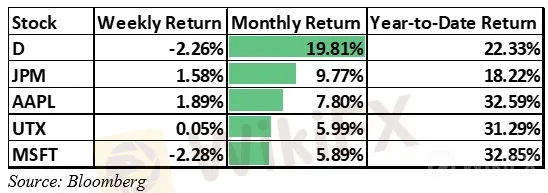

Dow Jones Top Performers

Disney has rallied nearly 20% over the last month, doubling the performance of second place JP Morgan. An unexpected miss out of Disney could spoil the stocks recent run and weigh on the Average. Follow @PeterHanksFX on Twitter for an earnings preview and implied volatility of Disney next week.

Looking for a technical perspective on equity? Check out theWeekly Equity Technical Forecast.

Dow Jones Price Chart: 4 – Hour Time Frame (February – May) (Chart 1)

How to Day Trade the Dow Jones

S&P 500 Price Outlook: Neutral

The S&P 500 finds itself in a similar fundamental standing, but with arguably more to lose. The Index was able to print record highs last week, before slipping on a Federal Reserve that was not as dovish as many market participants would have hoped. The Index will look to the same themes as the Dow Jones, but with price at loftier levels and more earnings to come, the group of 500 should experience higher volatility than its blue-chip counterpart.

S&P 500 Price Chart: 4 – Hour Time Frame (February – May) (Chart 2)

How to Trade the S&P 500

DAX 30 Price Outlook: Bullish

Similarly, the German DAX 30 has little to go by from a domestic data perspective. Given the sparse data calendar, any trade war progress or breakdowns could carry greater weight than usual. President Trump has yet to decide on auto tariffs toward the bloc, which leaves a key uncertainty on the horizon that will eventually have to be resolved. Until then, it would seem imprudent to fight the recent price trend.

DAX 30 Price Chart: 4 – Hour Time Frame (February – May) (Chart 3)

FTSE 100 Price Outlook: Neutral

Unlike the DAX, the FTSE 100 has an important data print to look forward to. First quarter GDP is due Friday and is expected at 1.4%. Last week the Bank of England raised some concern regarding their commentary on future rate moves, so GDP will play an important role in the monetary policy path of the economy.

FTSE 100 Price Chart: 4 – Hour Time Frame (January – May) (Chart 4)

Finally, one theme may impact equities across the globe in the week ahead. After months of negotiations, the US and China are apparently approaching a resolution to their trade war. The deal was first scheduled at the end of May, but rumors have surfaced that Friday may be the date. With that in mind, trade wars will be an important theme to watch.

As the saying goes, a rising tide floats all boats, and a US-China trade deal would amount to such a tide. One caveat is the particulars of the deal. Some market participants have criticized the USMCA agreement for its lack of change from NAFTA. If few changes are inked in the US-China deal, jubilation could be limited.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Stock Market Update: Retailers Warn of Impact from Strong US Dollar

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Other Weekly Fundamental Forecast:

Australian Forecast: Australian Dollar Could Face First RBA Rate Cut Since August 2016

GBP Forecast: Sterling (GBP) Price Outlook: Brexit Anger May Dampen Sterling Strength

Gold Forecast: Prices May Fall as Dollar Gains on Fed Policy Bets, Risk Trends

Euro Forecast: EURUSD at Risk to Bearish Euro Sentiment and EU-US Trade War Fears

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Dutch Law Student Arrested for €4.5 Million Crypto Scam

Currency Calculator