简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Krona, Krone Outlook: Volatility Ahead of FOMC, EU Data

Abstract:The Swedish Krona and Norwegian Krone will be in a for a potentially tumultuous week as the US and EU prepare to publish several key economic indicators along with the FOMC rate decision.

NORDIC FX, NOK, SEK WEEKLY OUTLOOK

NORDIC FX,NOK,SEK每周展望

Swedish Krona, Norwegian Krone eye EU, US data docket

瑞典克朗,挪威克朗眼欧盟,美国数据案例

FOMC and Eurozone GDP may induce volatile price swings

联邦公开市场委员会和欧元区国内生产总值可能导致价格波动剧烈

Nordic economic docket remains light – attention is abroad

北欧经济问题仍然很少 - 关注在国外

Following last weeks volatility from the Riksbank rate decision and dovish commentary, the Swedish Krona and Norwegian Krone may turn away from their economically-light docket towards external event risk. On both sides of the Atlantic, key economic data will be published in Europe and the US, with a lot of attention on the FOMC rate decision and commentary from Fed Chairman Jerome Powell.

继上周瑞典央行利率决定和温和评论的波动之后,瑞典克朗和挪威克朗可能会转向他们的经济上轻微的外部事件风险。在大西洋两岸,主要经济数据将在欧洲和美国公布,并对FOMC利率决定和美联储主席杰罗姆鲍威尔的评论给予了大量关注。

Most of the event risk will occur in the front half of the week, including trade related developments that have also pollinated the docket and may add further tension to the export-driven Nordic currencies.

大多数事件风险将发生在本周的前半部分,包括与贸易相关的发展,这些发展也为该案件授权,并可能进一步加剧出口驱动的北欧货币。

US EVENT RISK

美国事件风险

Since February, US economic data has been tending to underperform relative to economists expectations, even with the most recent GDP numbers beating forecasts. Upon closer inspection, the actual GDP report revealed weakness in consumption – the bedrock of economic activity in the US – while net exports showed a deceptive improvement.

自2月份以来,美国经济数据相对于经济学家的预期趋于低于预期,即使最近的GDP数据超出预期。经过仔细检查,实际GDP报告显示消费疲软 - 美国经济活动的基石 - 而净出口显示出欺骗性改善。

Below are some key US economic indicators and central bank-related risk that may spark volatility:

以下是一些关键的美国经济指标与央行相关的风险可能引发波动:

Tuesday, April 30 – Consumer Confidence Index (APR)

周二,4月30日 - 消费者信心指数(APR)

Wednesday, May 1 – ISM Data, FOMC Rate Decision

周三, 5月1日 - ISM数据,FOMC利率决定

Friday, May 3 – NFP, ISM Data, Unemployment Rate

5月3日星期五 - 非农就业数据,ISM数据,失业率

The FOMC rate decision on Wednesday will almost certainly garner the attention of global financial markets. Leading up to the release, volatility may be relatively tame. Market participants may be reluctant to commit amid uncertainty over what the central bank will say on the outlook for the worlds largest economy. Sign up to get live coverage of the market reaction to the FOMC rate decision here!

FOMC利率周三的决定几乎肯定会引起全球金融市场的关注。在发布之前,波动性可能相对温和。由于央行对世界最大经济体前景的看法不确定,市场参与者可能不愿承诺。注册现场报道市场对FOMC利率决定的反应!

Brussels and Washington are still in the process of negotiating their own truce with an awkward divergence in foreign policy hanging over the talks. The state of global trade affairs are a serious concern to Nordic currencies due to Norway and Swedens economy reliance on healthy external demand. Trade tensions between the US and EU is a particularly sensitive concern for NOK and SEK.

布鲁塞尔和华盛顿仍在以尴尬的方式谈判自己的休战悬而未决的外交政策出现分歧。由于挪威和瑞典经济依赖健康的外部需求,全球贸易状况是北欧货币的严重问题。美国和欧盟之间的贸易紧张局势对挪威克朗和瑞典克朗来说是一个特别敏感的问题。

EUROPEAN EVENT RISK

欧洲事件风险

Much like in the US, most of Europes economic data and major event risk is resting in the beginning of the week. Here are a few of the major – and potentially volatility-inducing – data publications this week:

很像美国,欧洲大部分经济数据和重大事件风险都在本周初休息。以下是本周一些主要的 - 可能是引发波动的 - 数据出版物:

Tuesday, April 30 – Eurozone: GDP, Unemployment Rate. France: GDP, CPI, PPI. Italy: GDP, CPI, Unemployment Rate. Germany: CPI, Unemployment Change.

周二,4月30日 - 欧元区:GDP,失业率。法国:GDP,CPI,PPI。意大利:GDP,CPI,失业率。德国:CPI,失业率变化。

Friday, May 2 – Eurozone, German, Italian, French Manufacturing PMI

5月2日星期五 - 欧元区,德国,意大利,法国制造业PMI

While having improved since February, Eurozone economic activity has been underperforming relative to forecasts. Germany, France and Italy – the three largest Eurozone economies, respectively – have been showing political and economic weakness. France is embroiled in ongoing protests with Italy contending with a recession while its government flounders and is looking to possibly have another spat with Brussels.

虽然有所改善自2月以来,欧元区经济活动相对于预期表现不佳。德国,法国和意大利 - 分别是欧元区三大经济体 - 一直表现出政治和经济疲软。法国卷入持续不断的抗议活动,意大利正在与经济衰退作斗争,而其政府陷入困境,并希望可能与布鲁塞尔再次发生争执。

{22}

SWEDEN, NORWAY EVENT RISK

{22}

In Sweden and Norway, the economic docket remains relatively light. On Thursday, Swedens parliament will host the Riksbank Board where officials – including Governor Stefan Ingves – will participate in a parliamentary hearing. Prior to this, Swedish PMI will be released, though its impact on the market may be relatively muted given that just last week, the Riksbank already laid out its monetary policy.

在瑞典和挪威,经济方面仍然相对较轻。星期四,瑞典议会将主办瑞典央行董事会,其中包括官员州长Stefan Ingves将参加议会听证会。在此之前,瑞典采购经理人指数将会公布,但由于上周瑞典央行已经制定了货币政策,其对市场的影响可能相对较小。

In Norway, manufacturing PMI will be published on Thursday, with peripheral indicators scattered throughout the week that may not elicit a strong reaction in NOK. On Friday, the countrys sovereign wealth fund will be publishing its Q1 results – following their recent decision to lightly divest from oil and emerging market assets. This is perhaps a gentle signal of a volatile future ahead in these sentiment-linked assets.

在挪威制造业采购经理人指数将于周四公布,周末分散的外围指标可能不会引发挪威克朗的强烈反应。上周五,该国主权财富基金将公布其第一季度业绩 - 此前他们最近决定放弃石油和新兴市场资产。对于这些与情绪相关的资产而言,这可能是未来波动未来的一个温和信号。

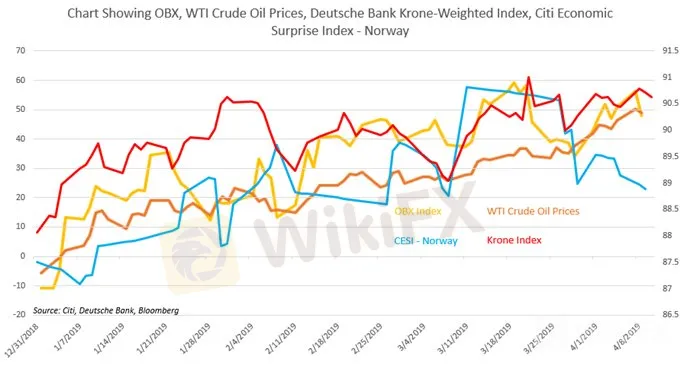

Year-to-date, the Swedish Krona has been the worst performing G10 currency against the US Dollar. Prior to the rise in crude oil prices, the Norwegian Krone was not far behind. If prevailing global growth trends continue, it is not outlandish to suggest NOK will slide ride back down and join SEK. This has to do with the trajectory of crude oil prices and the Norwegian economys reliance on it.

年初至今,瑞典克朗一直是对美国表现最差的G10货币。美元。在原油价格上涨之前,挪威克朗并不落后。如果普遍的全球增长趋势继续下去,那么建议挪威克朗将重新下滑并加入瑞典克朗并不奇怪。这与原油价格的轨迹和挪威经济对它的依赖有关。

Norways Dependence on Crude Oil

挪威对原油的依赖

See my Q2 crude oil forecast here!

在这里查看我的Q2原油预测!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

Euro May Extend Gains vs NOK and Aim to Re-Test 11-Year High

The Euro may rise vs the Norwegian Krone this week and push EURNOK to retest the 11-year high at 10.0972, a level not reached since the 2008 financial crash.

Crude Oil Prices, NOK May Fall on Norway Sovereign Wealth Fund Data

Crude oil prices and the Norwegian Krone may fall if the world‘s largest petroleum-linked sovereign wealth fund’s earnings amplify global recession fears.

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator