简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: April US Nonfarm Payrolls & EURUSD Price Forecast

Abstract:The April US Change in Nonfarm Payrolls report is due on Friday at 12:30 GMT.

Talking Points:

谈话要点:

- The April US Change in Nonfarm Payrolls report is due on Friday at 12:30 GMT.

- 4月美国非农就业人数变动报告将于周五格林尼治标准时间12:30公布。

{2}

- Markets are expecting the weak February print of 20K to be a one-off; consensus calls for 170K.

{2}

- Retail traders are selling the US Dollar, despite price breaking to a fresh 2019 high last week.

- 零售交易商正在抛售美元,尽管上周价格突破2019新高。

{4}

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

{4}

05/03 FRIDAY | 12:30 GMT | USD Change in Nonfarm Payrolls & Unemployment Rate (APR)

05/03星期五| 12:30 GMT |美元非农就业人数和失业率(APR)的变化

The US labor market remains a pillar of strength for the US economy, and all signs pointed to another solid jobs expansion in April. Following the print of 196K in March, Bloomberg News consensus forecast is looking for 185K jobs to have been added in the fourth month of the year. As a result, forecasts point to the unemployment rate staying on hold at 3.8%, a multi-decade and cycle low.

美国劳动力市场仍然是美国经济实力的支柱,所有迹象都表明4月份就业增长强劲。继三月196K的印刷之后,彭博新闻的共识预测是在今年第四个月增加185,000个就业岗位。因此,预测指出失业率维持在3.8%,数十年和周期低点。

Another solid US jobs report could be another piece of evidence to suggest that rates markets are priced far-too-dovish. Even after the Q119 US GDP report showed growth at 3.2% annualized, Fed funds futures are pricing in nearly a two-in-three chance that a 25-bps rate cut comes by December 2019. As it were, a strong April US NFP report could give reason for rates markets to push back against a rate cut, in turn, helping lift the US Dollar.

另一份稳固的美国就业报告可能是另一项证据。表明利率市场定价过于温和。即使在第11季度美国国内生产总值报告显示年化增长率为3.2%之后,联邦基金期货的价格仍有近三分之二的可能性,即到2019年12月降息25个基点。尽管如此,4月美国非农就业报告强劲可能会让利率市场反对降息,反过来帮助提振美元。

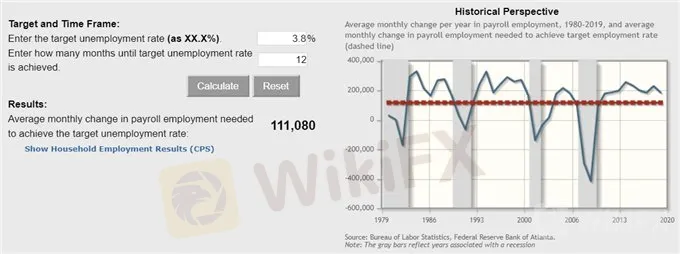

According to the Atlanta Fed Jobs Growth Calculator, the economy only needs +111K jobs growth per month over the next 12-months to sustain said unemployment rate at its current 3.8% level.

根据亚特兰大联邦就业增长计算器,经济在未来12个月内仅需要每月增加111,000个就业岗位,以使失业率保持在目前的3.8%水平。

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

值得关注:DXY指数,欧元兑美元, USDJPY,黄金

{10}

EURUSD Technical Analysis: Daily Price Chart (May 2018 to April 2019) (Chart 1)

{10}

After falling to its lowest level since June 2017, EURUSD prices have started to rebound following their break down to fresh 2019 lows last week. Mirroring the pullback in the DXY Index breakout, now the question is whether or not US Dollar strength – and in turn, Euro weakness – will remain in vogue. To this end, the near-term technical forecast for EURUSD remains bearish so long as price remains below the daily 8-EMA, currently at 1.1191 – which would also represent a return back above the former 2019 low and March swing low at 1.1176.

在跌至2017年6月以来的最低水平后,欧元兑美元价格在上周突破2019新低之后开始反弹。反映DXY指数突破的回调,现在的问题是美元强势 - 以及欧元疲软 - 是否会继续流行。为此,只要价格仍然低于每日8-EMA,目前为1.1191,欧元兑美元的近期技术预测依然看跌 - 这也将回升至2019年前低点和3月低点1.1176之上。 / p>

IG Client Sentiment Index: EURUSD (April 29, 2019) (Chart 2)

IG客户情绪指数:EURUSD(2019年4月29日)(图2)

Retail trader data shows 72.2% of traders are net-long with the ratio of traders long to short at 2.59 to 1. In fact, traders have remained net-long since Mar 26 when EURUSD traded near 1.12738; price has moved 0.5% lower since then. The number of traders net-long is 1.7% lower than yesterday and 26.1% higher from last week, while the number of traders net-short is 10.5% higher than yesterday and 16.3% lower from last week.

零售交易者数据显示72.2%的交易者是净多头,交易者多头做空比率为2.59比1.事实上,自3月26日欧元兑美元交易于1.12738附近以来,交易者仍然保持净多头;此后价格已下跌0.5%。交易商净多头比昨天减少1.7%,比上周增加26.1%,而交易商净空头数比昨天增加10.5%,比上周减少16.3%。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

Euro (EUR) Price Outlook: No End Yet in Sight for EUR/USD Weakness

EUR/USD continues to tumble, with no sign yet of a rally or even a near-term bounce.. The pair has dropped already beneath the support line of a downward-sloping channel in place since late May this year to its lowest level since July 2020 and there is now little support between here and 1.1170. From a fundamental perspective, the Euro is suffering from a continued insistence by the European Central Bank that much higher Eurozone interest rates are not needed.

Dollar Index (DXY) Soars on Data and Hawkish Fed Lifting Yields. Can USD Fly Higher?

The US Dollar continues to break new ground as momentum gathers. Encouraging economic data and hawkish comments boost yields and USD. Commodities and currencies weaken against the Dollar. Will USD keep going?

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator