简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Netflix Stock Price Slides After Earnings, S&P 500 Sentiment Dented

Abstract:FAANG member Netflix slid in after-hours trading on Tuesday after the company revealed sturdy financial results accompanied by a softer outlook than analysts had expected.

Netflix Stock Price Slides After Earnings, S&P 500 Sentiment Dented

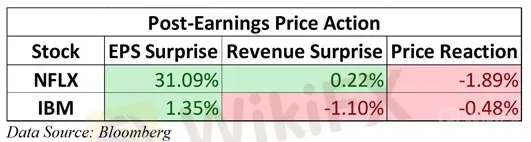

Netflix (NFLX) released first quarter earnings after the close Tuesday, beating analyst expectations on both revenue and earnings per share. As the report was digested further however, future cash flow related to subscriber growth concerned investors and the stock traded nearly 8% lower immediately after release. As the after-hours session unfolded, Netflix shares recovered – down about 1.5% at the time of this articles publication.

Netflix Stock Price After Earnings

Netflixs reported first quarter revenue was $4.52 billion, equating to $0.76 earnings per share – notably higher than the expected $0.58. Still, the strong financials were not enough to outweigh the troublesome outlook for subscriber growth. While the streaming service added an impressive 9.6 million subscribers in the most recent quarter, second quarter additions were forecasted at only 5 million – beneath Street expectations of 6.09 million. Worrisome subscriber forecasts coincide with a new entrant to the streaming space – Disney. The impact of heightened competition will likely be of headline concern in future releases.

Alongside Netflix, International Business Machines Corporation (IBM) reported first quarter earnings but failed to meet revenue guidance and subsequently slipped in after-hours trading. Like Netflix, the stock pared initial losses as the report disseminated throughout the market.

Option traders anticipated notable volatility from both Netflix and IBM – something not uncommon for the former. That said, NFLX and IBM look to trade within the expected price range heading into Wednesday‘s session. In the coming weeks however, Netflix’s implied volatility will remain heightened. As the first FAANG member to report earnings, the stock is often looked to as a bellwether for tech sentiment and a barometer for general equity sentiment. Once other tech stocks report, Netflix will likely find itself tied to the performance of the sector.

With the conclusion of bank earnings on Wednesday, tech will take the stage as the next key industry to watch as the season progresses. In the social media space, Twitter and Snapchat report next Tuesday. Following their reports, Facebook and Microsoft will report after next Wednesdays close. Follow @PeterHanksFX on Twitter for earnings season coverage. In the interim, the S&P 500 and Dow Jones will look to Chinese GDP – due to be released early Wednesday.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

S&P 500 Forecast: Stocks Threaten Breakdown as TLT ETF Soars

The S&P 500 fluctuated between losses and gains on Thursday before finishing narrowly higher. Meanwhile, investors continued to clamor for safety in bonds.

Dow Jones, DAX 30, FTSE 100 Forecasts for the Week Ahead

As trade wars and monetary policy look to maintain their position at the helm, markets will be offered insight on another major theme that could rattle fragile sentiment.

S&P 500 Forecast: Stocks Rebound, but will the Recovery Continue?

After plummeting at the open, the S&P 500 mounted a relief effort during Wednesday trading to eventually close in the green. While the rebound was encouraging, can it surmount nearby resistance?

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator