简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: April ECB Meeting & EURJPY Price Outlook

Abstract:The April European Central Bank rate decision is on Wednesday, April 10 at 12:45 GMT.

Talking Points:

- The April European Central Bank rate decision is on Wednesday, April 10 at 12:45 GMT.

{2}

- No rate move is anticipated at the April ECB meeting, but a greater discussion about the new TLTRO program and the effects of negative interest rates could be prominent.

{2}

- Retail traders are net-long both EURJPY and EURUSD.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/10 WEDNESDAY | 11:45 GMT | EUR European Central Bank Rate Decision

{6}

Eurozone economic data momentum has disappointed in recent weeks, particularly following the March European Central Bank rate decision. Since its high on March 21, the Citi Economic Surprise Index for the Eurozone has fallen from -25.1 to -59.1. ECB President Mario Draghis preferred gauge of inflation, the 5y5y inflation swap forwards, have been falling all month long, hitting a high on March 5 at 1.510% before settling at 1.365% the week before the April ECB meeting.

{6}

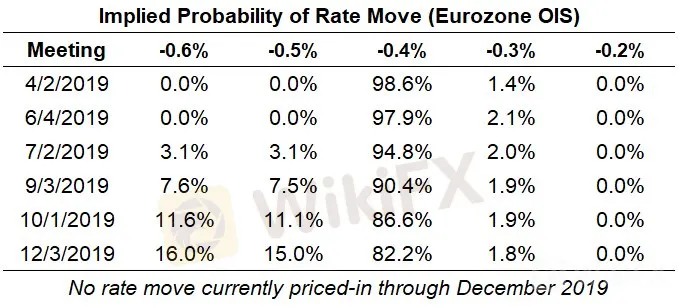

There‘s little reason to think that the conditions in front of the Governing Council will warrant a change in tone beyond their dovish shift seen last month. They’ve already eliminated their previous forecast of a rate hike sometime around “summer 2019,” and rates markets are leaning more into a rate cut (15%) than a rate hike (1.8%) by the end of the year. Being pragmatic, it seems unlikely that the new ECB president makes a policy change at their first meeting with new Staff Economic Projections; Draghi steps down in October 2019.

Given the discussion by ECB President Draghi about negative interest rates and their impact on the banking sector during the interim period since the last meeting, traders should be mindful of a potential discussion in this area.

Pairs to Watch: EURGBP, EURJPY, EURUSD

EURJPY Price Chart: Daily Timeframe (July 2018 to April 2019) (Chart 1)

EURJPY has made more progress in recent days, finding itself back above the daily 8-, 13-, and 21-EMA envelope. But the EMAs are not in sequential order, reflective of the countervailing nature of the move higher. Indeed, price remains in the downtrend from the September 2018 and March 2019 highs. Both daily MACD and Slow Stochastics remain in bearish territory, even as EURJPY price rebounded.This may mean that EURJPY is due for another test of the descending trendline near 126.000 before bears take another attempt at pushing price lower.

IG Client Sentiment Index: EURJPY (April 5, 2019) (Chart 2)

Retail trader data shows 52.3% of traders are net-long with the ratio of traders long to short at 1.09 to 1. In fact, traders have remained net-long since Mar 22 when EURJPY traded near 126.035; price has moved 0.6% lower since then. The percentage of traders net-long is now its lowest since Mar 21 when EURJPY traded near 126.035. The number of traders net-long is 18.6% lower than yesterday and 19.7% lower from last week, while the number of traders net-short is 4.3% higher than yesterday and 22.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURJPY price trend may soon reverse higher despite the fact traders remain net-long.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

“Predict and Win” Big Rewards! Join the Contest Now

"Jumped Deposit Scam": New Wave of Financial Fraud in India

South Korean President Yoon Suk Yeol's Arrest Shakes Markets

Titanium Capital LLC Ponzi Scheme: Henry Abdo Admits Fraud, Impacting Over 200 Investors

Currency Calculator