简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Volatility: New Zealand Dollar Eyes RBNZ Rate Review

Abstract:The Reserve Bank of New Zealand's upcoming interest rate decision has potential to send spot NZDUSD swinging according to overnight implied volatility.

NZDUSD IMPLIED VOLATILITY – TALKING POINTS

NZDUSD overnight implied volatility soars to its highest level since February 12 ahead of tomorrows monetary policy update from the Reserve Bank of New Zealand

Although NZD forex traders are expecting the RBNZ to keep rates on hold, language from Governor Adrian Orr will likely provide insight on the central banks next move

Enhance your knowledge about currencies with this educational article on How Central Banks Impact the Forex Market

NZDUSD forex option traders are expecting sizable price action from the currency pair Wednesday according to overnight implied volatility. In fact, the 1-day measure jumped to 14.95 percent – the highest reading in over a month – ahead of Wednesdays Official Cash Rate announcement from the Reserve Bank of New Zealand.

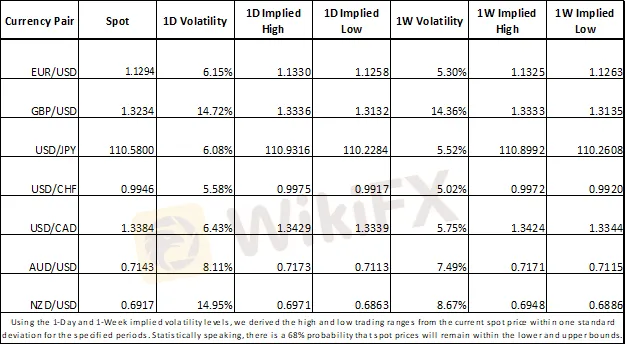

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

The RBNZ has held the OCR at 1.75 percent since November 2016 and expects to hold its interest rate steady through this year and next according to previous statements. Despite the market‘s consensus that the RBNZ will leave its OCR unchanged at 1.75 percent this March, there is still a 33 percent probability of a cut from the central bank priced in through swaps out to August. Consequently, Governor Orr’s commentary on the groups economic view and accounting of external risks could generate a market response.

Keeping an eye out for changes in language from February‘s monetary policy statement could provide insight on which direction NZDUSD moves after tomorrow’s decision. Seeing that last month‘s statement said the next OCR move could be up or down, Kiwi-Dollar forex traders will likely look for updates to the ’key judgements and risks‘ that affect the RBNZ’s interest rate decision.

NZDUSD CURRENCY PRICE CHART: DAILY TIME FRAME (SEPTEMBER 19, 2018 TO MARCH 26, 2019)

Another factor potentially fueling expectations for greater NZDUSD volatility could be the currency pair‘s technical picture. Firstly, NZDUSD’s 20-day average-true-range has taken a plunge since the indicator‘s recent high of 63 pips this past December is near its multi-month low of 52 pips. Looking at this gauge with a contrarian lens might suggest a looming reversal of this trend as it did back in October when NZDUSD’s ATR was at a similar level.

Second, the 78.6 percent and 100.0 percent Fibonacci retracement lines derived from the respective low and high in October and December are currently sandwiching NZDUSD. That leaves prices room to move before prominent technical boundaries are overrun. Nevertheless, currency market participants can project an expected range between 0.6863 and 0.6971 if overnight implied volatility measures are to be believed.

NZDUSD TRADER CLIENT SENTIMENT

Check out IGs Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

NZDUSD traders have a bearish bias headed into tomorrows RBNZ announcement according to client positioning data from IG which shows 39.0 percent of traders are net-long with the ratio of traders short to long at 1.57 to 1. Additionally, the number of traders net-short is 25.7 percent higher than yesterday and 13.7 percent higher from last week.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Week Ahead Spotlight: CPIs, Retail Sales, RBNZ Rates!

In March, Canada's consumer price index increased by 0.6% compared to the previous month, surpassing the 0.3% growth seen earlier. In April, the Reserve Bank of New Zealand opted to maintain its official cash rate at 5.5 percent for the sixth consecutive meeting, emphasizing the ongoing need to address inflation fully. In March, the UK Consumer Price Index registered a slower-than-anticipated increase, reaching 3.2% in annual terms, down from the 3.4% rise observed in February. In March, UK...

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

NZD/USD Gyrates at Support as Economic Strength Bolsters RBNZ Rate Hike Bets

APAC traders look to close the week out on a bright note following Wall Street rebound. RBNZ rate hike bets continue to strengthen as economy recovers from Covid lockdowns. And, NZD/USD clings to 100-day Simple Moving Average (SMA) after overnight drop.

RBNZ Keeps a 1% Official Cash Rate as Inflation Expectations Rally

The Reserve Bank of New Zealand (RBNZ) announced on Wednesday, September 25, 2019 its decision to maintain the current official cash rate, clearly showing a hawkish attitude in its public remarks. The short-term price of NZD to USD climbed over 40 pips to a weekly new height of 0.6347.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator