简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Key Yield Curve Inverted, But Should Investors Worry?

Abstract:A negative spread between the 3-month and 10-year treasury yield has investors wondering whether or not the economy will be entering a recession since the last time this happened was before the 2008 recession.

Bond Market Key Takeaways:

Yield curve inversion has investors wondering whether a recession is around the corner. However, inflation may show that their fears are unfounded.

A negative 3-month and 10-year treasury spread confirms the market is looking at a flat curve yield, the first since 2008.

A narrower high yield and investment grade bond spread may indicate that it is too soon for investors to panic as a key yield benchmark has shown a steady decline.

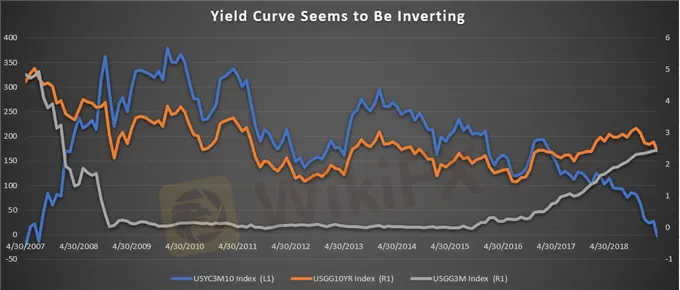

The inverted 3-month and 10-year US sovereign yield curve has many worried about whether a recession is close by since the last time this happened was in 2008.

The Economy Is Not in the Same Place as it was in 2008

A yield curve inversion tends to occur when there is an economic slowdown and lenders are willing to earn a lower interest rate due to the prediction that the Fed will cut short-term interest rates.

First Yield Curve Inversion on 3-Month and 10-Year Treasury Since 2008

Source: Bloomberg

There have been many debates about the direction of the current economy by different analysts. However, it is important to note that the situation today is different than what it was due to enhanced central bank intervention in capital markets post 2008.

Inflation Remains Close to the Feds 2% Target

The current economy does not seem to be in the same position as it was before the 2008 recession. Inflation, for the most part, is not too high and currently rests at 1.7%, not far from the forecasted rate of 1.8% and the target rate of 2%.

Actual Inflation Is 1.7%, Close to the 2% Target

Source: Bloomberg

When looking at the graph above during the 2008 recession, we notice that the inflation spiked at around 5.6%, a lot higher than the 2% target.

When evaluating whether a market is close to recession, the inflation rate is one of many factors to consider. One of the signals is uncontrollable inflation, which results from an excess supply of money circulating around. Given that the Fed has stated that they will refrain from reducing their balance sheet (i.e., allowing more bonds to remain in the market), this may indicate that a recession is not present in the near future.

High Yield and Investment Grade Bond Spread Seems to Show No Imminent Recession Threat

High yield bonds represent corporate bonds that carry higher risks due to their higher risk of default whereas investment grade bonds are lower risk investments, which tend to have a credit rating of BBB- or higher according to Standard & Poor.

Spreads Continue to Narrow

Source: Bloomberg

In the graph above, we notice the spread between high yield bonds and investment grade bonds have been trending lower.

The lower trending spread indicates that these higher risk bonds have investors feeling as though there is a lower probability of default. Hence, why the spread narrowed since the beginning to the year.

If the economy were headed towards a recession, the spread between these two investments would widen out of fear that corporations would default on their debt obligations. However, this does not seem to be the case.Therefore, this is another one of many factors that could signal that it may be too soon for investors to fear the market.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Reactions as Fed Prepares for Rate Cuts Amid Rising Geopolitical Tensions

Fed Chair Powell signals upcoming rate cuts, driving bond market speculation and influencing global markets. Asian stocks rise, while yen strengthens due to safe-haven demand. Meanwhile, Australia's central bank faces skepticism over its tightening stance.

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

Global Market Developments: Bond Market Interventions, Tech Stock Rebounds, and Rising Geopolitical Tensions

Global markets are navigating through significant shifts. China intervenes in the bond market to curb speculation, while Japan's Nikkei rebounds after historic losses. Elon Musk's increasing political involvement and General Motors' strategic shifts in China reflect broader economic and geopolitical trends. Rising tensions in the Middle East and U.S. labor market volatility add further complexity, influencing global currencies and stock movements.

Global Economic and Financial Highlights: July 18, 2024

Today's news covers significant developments in global markets and politics. President Biden's campaign faces challenges due to a COVID-19 diagnosis, while China's economic strategies and tech advancements remain in focus. Key updates include the impact of US semiconductor restrictions, rising tensions in global trade, and significant shifts in corporate strategies and financial markets. The news reflects the dynamic and interconnected nature of the global economy.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator