简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

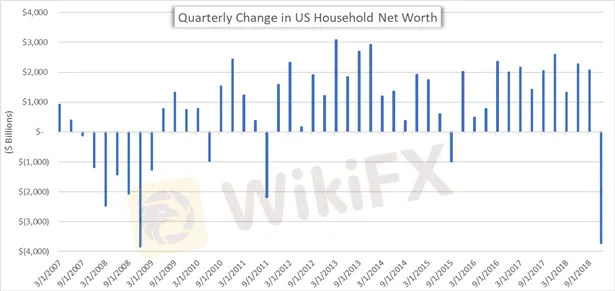

US Household Net Worth Collapses by Nearly $4 Trillion

Abstract:US Household Net Worth falls by most since the financial crisis to $104.3 Trillion at the end of 2018.

4Q 2018 US HOUSEHOLD NET WORTH – TALKING POINT

Household Net Worth in the US for 4Q fell to $104 Trillion from $108 Trillion in the period prior

A widespread selloff in risk assets at the end of 2018 sent stock prices tumbling lower and labeled as the primary contributor to the 3.5 percent decline in US household wealth

Check out the free DailyFX Building Confidence in Trading Guide for tips on how to sharpen your trading skills!

Household wealth in the United States dipped by 3.5 percent, a decline of $3.7 Trillion, over 4Q 2018 driven primarily by a cratering stock market. US Household Net Worth of $104.3 Trillion at the end of year compares to third quarters reading of $108 Trillion.The report for the current period showed the largest drop in household wealth since the Great Financial Crisis.

US HOUSEHOLD NET WORTH PRICE CHART: QUARTERLY TIME FRAME (JANUARY 2007 TO DECEMBER 2018)

Immediately following the report, the US Dollar was little changed but upward momentum looks to fade following solid gains made earlier in todays session.

DXY US DOLLAR INDEX CURRENCY PRICE CHART: 1-MINUTE TIME FRAME (MARCH 07, 2019 INTRADAY)

Unsure about the USD‘s next direction? Download the free USD Forecast for comprehensive insight from DailyFX’s analyst on the currencys outlook!

The $3.9 Trillion decline in financial assets over the months of October through December was widely attributable to the near 20 percent slide in US equity prices. Although, the decline was partially offset by a modest $300 Billion rise in the value of real estate.

DOW JONES INDUSTRIAL AVERAGE INDEX PRICE CHART: DAILY TIME FRAME (OCTOBER 01, 2018 TO DECEMBER 31, 2018)

The report also showed that domestic nonfinancial debt grew at a 2.7 percent seasonally adjusted annual rate which is lower than the 4.5 percent rate reported in 3Q 2018. However, household debt still climbed $241 Billion over the final quarter of the year. Also noteworthy from the release was the slide in the personal savings rate from 3.53 percent to 3.07 percent.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

Type of Accounts Offered by Giraffe Markets

Each type of account is tailored to meet the diverse needs and preferences of traders, ensuring that there's an option suitable for every level of expertise and trading style with Giraffe Markets.

Commodity Trading for Beginners: A Comprehensive Guide

At Giraffe Markets, we provide the tools and resources to help you confidently navigate the commodity markets. Whether you're interested in trading gold, oil, or agricultural products, our platform offers a seamless experience for new and experienced traders.

OnEquity Unveils New Website: Simplified CFD & FX Trading for Global Markets

Unlock Global Markets with Simplified CFD & FX Trading at OnEquity. Our new website offers a powerful platform, competitive spreads & commissions, and 24/7 multilingual support. Trade CFDs on currencies, stocks, indices & more. Join our thriving trading community today!

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator