简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD Eyeing Italy GDP, Eurozone PMI Data - Gloomy ECB Outlook

Abstract:EUR/USD may be vulnerable to Italian GDP data and Eurozone PMI as regional growth sputters. Traders are now eyeing the upcoming ECB rate decision and

EURO TALKING POINTS – UR/USD, ITALY GDP, EUROZONE PMI, EC

EUR/USD has eye on Italy GDP, Eurozone PMI

Outlook for EU growth looks gloomy, uncertai

The ECB rate decision and commentary in focu

See our free guide to learn how to use economic news in your trading strategy!

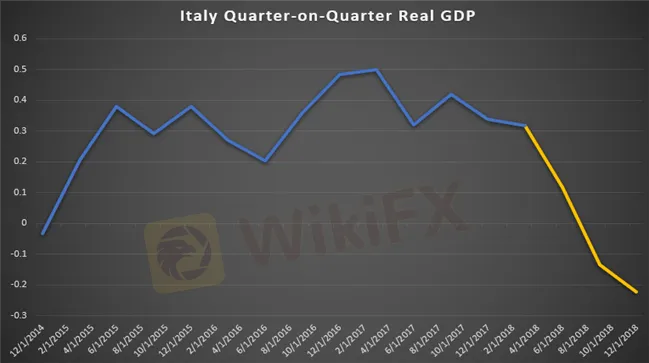

Leading up to the release of Italy‘s GDP, EUR/USD may be on its toes as traders anxiously wait to see if the third largest Eurozone economy will report a third consecutive quarter of economic contraction. Composite and services PMI data from Italy and Germany will also be in focus. This comes as preliminary estimates for the latter’s quarter-on-quarter GDP growth came in at 0.0 percent, with the previous showing a contraction.

Since April, Italys quarter-on-quarter GDP has been sharply declining with the country recently entering a technical recession – defined as two consecutive quarters of contraction. If the economy continues to shrink, policymakers in Brussels may urge Rome to revise its already-watered down controversial budget that rocked markets in 2018. The Euro took a hit from it and entered 2019 in a downtrend and has been moving sluggishly.

There is also a lingering concern that another US-EU conflict may erupt if President Trump decides to place tariffs on auto imports following the report he received from the Commerce Department. European officials have taken this potential threat seriously and announced they are ready to retaliate with similar measures against Caterpillar Inc, a US industrial giant. This would undoubtably push the already-battered Euro down.

EUR/USD – Daily Chart

Looking ahead, markets will be closely watching the upcoming ECB rate decision on Thursday. While it is expected the central bank will keep rates on hold, what markets will likely care about are the comments that will follow from ECB President Mario Draghi. If the outlook for inflation and growth are further revised downward – in addition to potentially poor Italian GDP – it may send EUR/USD down toward 1.1269.

EUR/USD – Daily Chart

Furthermore, the upcoming European Parliamentary elections will be in held in the Spring. Given the political climate of the EU, they may be particularly market-moving this year, If you are interested in learning more about the effect of political fragmentation on European assets, be sure to sign up for my webinar on trading strategies for Eurozone politics.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator