简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Follow Yen, Franc Higher as Market Mood Sours

Abstract:The US Dollar may follow the Japanese Yen and Swiss Franc higher as US GDP data amplifies fears about policy support amid global slowdown and

TALKING POINTS – YEN, TRUMP-KIM SUMMIT, US GDP, DOLLAR, FRANC

Yen, Franc rise as abrupt Trump-Kim summit end spooks financial market

Soft European data adds to global slowdown fears, helps fuel risk-off tone

US GDP data might compound investors worries while boosting the Dollar

The anti-risk Japanese Yen and Swiss Franc outperformed as the markets mood soured in Asia Pacific trade. Regional bourses accelerated lower as a summit between US President Donald Trump and North Korean leader Kim Jong-un came to an abrupt end without an agreement on the next steps forward or even a joint statement.

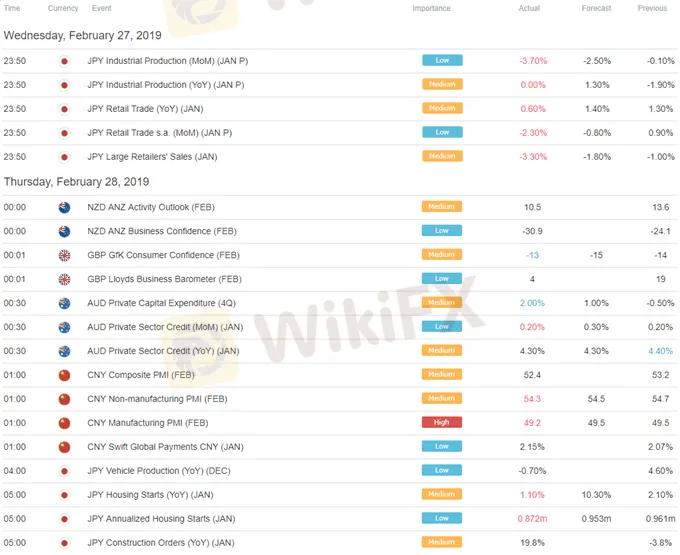

Throttling hopes for a peaceful settlement with Pyongyang comes at an inconvenient time as tensions mount between India and Pakistan, making for troubling geopolitical backdrop overall. Meanwhile, soft Japanese industrial production and Chinese PMI data are adding to growing evidence of global economic slowdown, compounding the impulse toward risk aversion.

EUROPEAN DATA STOKES GLOBAL SLOWDOWN FEAR

A soggy fourth-quarter Swiss GDP report as well as revised figures confirming that economic growth in France has slowed to the weakest in two years over the same period have done no favors for investors disposition. Bellwether S&P 500 futures are pointing convincingly lower.

German CPI data may not be much more helpful considering the trend toward underperformance relative to forecasts on regional economic news-flow in recent months. In fact, even if the expected uptick materializes, it too may be unsettling if traders reckon it might dissuade the ECB from expanding stimulus.

US GDP MAY ADD TO DOWNBEAT MOOD, BOOST DOLLAR

Later in the day, the spotlight shifts to US GDP data. The annualized growth rate is seen slowing to 2.2 percent in the final three months of 2018, down from the third quarters heady 3.4 percent but still amounting to a top-three result among major economies.

Perhaps somewhat perversely, an outcome that does not unambiguously nudge the Fed policy outlook into a more dovish direction might reinforce the risk-off atmosphere. It might help the US Dollar find renewed support against its major currency counterparts however.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

<Part 2> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

<Part 1> GTSE Global Market Dynamics: Key Developments

Global markets face significant changes. China's financial sector caps salaries under Xi Jinping's "common prosperity" policy, affecting the yuan and major financial stocks. India's entry into the JPMorgan Emerging Markets Bond Index boosts investment and strengthens the rupee. Nike's weak outlook suggests a U.S. economic slowdown. Japan's yen nears a 40-year low, prompting potential stabilization efforts. Hong Kong faces judicial concerns, impacting its financial stability.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator