简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Markets Cheer US Budget Deal Hopes But Headwinds Loom Ahead

Abstract:The anti-risk Yen fell while the Aussie Dollar rose with stocks on hopes for a US budget deal avoiding another government shutdown. Potent headwinds loom

TALKING POINTS – YEN, AUSSIE DOLLAR, US SHUTDOWN, EUROGROUP, CARNEY

Yen down, Aussie Dollar up on hopes US to avoid second government shutdow

European, US stock index futures hint market sentiment may strengthen further

Comments from Eurogroup meeting, BOEs Carney might dampen risk appetite

The sentiment-geared Australian Dollar outperformed while the anti-risk Japanese Yen traded broadly lower as risk appetite firmed in Asia Pacific trade. Regional bourses appeared to be bolstered by hopeful headlines hinting that US policymakers may have reached a deal to avoid another government shutdown.

Bellwether European and US stock index futures are pointing higher, signaling more of the same is likely ahead. The upbeat tone may be upset if US President Donald Trump withholds support for the bipartisan effort however, snuffing it out much as he did when the government shuttered in late 2018.

Soundbites from a gathering of Eurozone finance ministers might be another spoiler. The gathering will almost certainly discuss the ominous slowdown in regional economic growth and the potential for political instability therein as member states struggle to stay within budgetary thresholds.

A speech from BOE Governor Mark Carney might have a similarly chilling effect. He will almost certainly sound the alarm on growth, trade wars and the growing threat of a “no-deal” Brexit. Fed Chair Jerome Powell is also due to speak, but a focus on rural US development might imply limited policy guidance.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

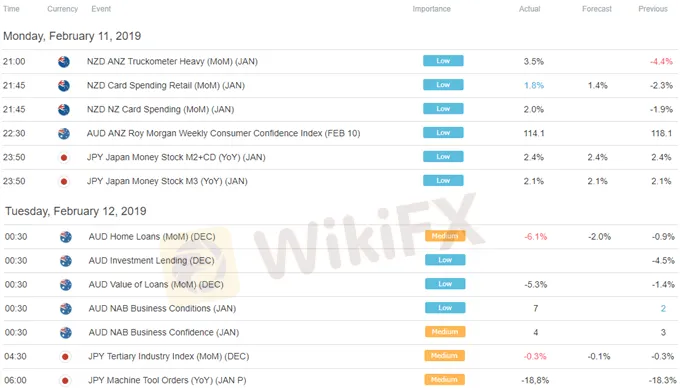

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: The Dollar keeps dictating the markets

USD/JPY reverses lower as risk appetite weighs on US yields, bounces at key 112.50 support

USD/JPY fell back to weekly lows in the 112.50 region on Friday though has since bounced as volumes fade. The pair reversed from as high as the 113.50s as risk appetite deteriorated and drove long-term US yields lower.

Australian Dollar Technical Outlook Ahead: AUD/USD, AUD/CAD, EUR/AUD

Australian Dollar facing mixed signals vs. USD, CAD and EUR. AUD/USD may reverse higher on support, AUD/CAD ranging. EUR/AUD downtrend remains despite recent consolidation.

Japanese Yen Technical Analysis: USD/JPY False Break, or is Momentum Still There?

USD/JPY made a new peak as USD gained traction across the board. Bollinger Bands and a candlestick might indicate exhausted price action. Momentum signals remain on the radar. Where to next for USD/JPY?

WikiFX Broker

Latest News

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

Currency Calculator