简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUD/USD Flash-Crash Rebound Eyes December-High Ahead of RBA

Abstract:The AUD/USD flash-crash rebound appears to be on track to test the December-high (0.7394) as the Relative Strength Index (RSI) breaks out of the bearish

Australian Dollar Talking Point

AUD/USD climbs to fresh monthly highs as the Federal Reserves drops the hawkish forward-guidance for monetary policy, and recent price action raises the risk for a larger flash-crash rebound as the Relative Strength Index (RSI) breaks out of the bearish formation from late-2018.

AUD/USD appears to be on track to test the December-high (0.7394) ahead of the Reserve Bank of Australias (RBA) first meeting for 2019 as the Federal Open Market Committee (FOMC) interest rate decision triggers a selloff in the U.S. dollar.

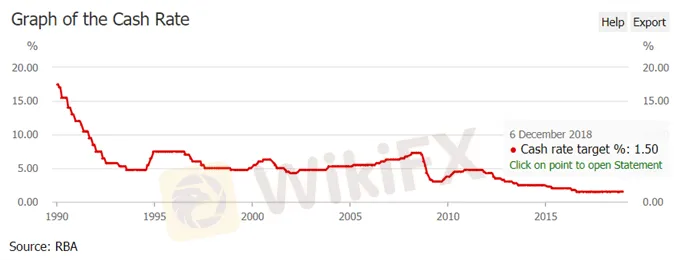

Like the Fed, the RBA is widely expected to retain the current policy on February 5 amid the uncertainty surrounding the global economy, and more of the same from Governor Philip Lowe & Co. may rattle the aussie-dollar exchange rate as the central bank appears to in no rush to lift the official cash rate (OCR) off of the record-low.

In fact, the stickiness in Australia‘s Consumer Price Index (CPI) may do little to move the RBA amid the weaken outlook for global growth, and the central bank may ultimately show a greater willingness to retain the record-low interest rate throughout 2019 as ’the low level of interest rates is continuing to support the Australian economy. With that said, comments from the RBA may produce headwinds for the Australian dollar as the central bank tames bets for an imminent rate-hike, but the flash-cash rebound appears to be spurring a shift in retail interest as the crowd flips net-short for the first time since November.

The IG Client Sentiment Report shows 47.4% of traders a now net-long AUD/USD compared to 52.6% on Janary 14, with the ratio of traders short to long at 1.11 to 1. The percentage of traders net-long is now its lowest since November 26 when AUD/USD traded near the 0.7220 area. The number of traders net-long is 12.5% lower than yesterday and 26.8% lower from last week, while the number of traders net-short is 4.8% lower than yesterday and 25.0% higher from last week.

The decline in net-long interest persists appears to be a culprit of profit-taking behavior, but the ongoing accumulation in net-short position warns of a broader shift in retail sentiment as the crowd fades the flash-crash rebound in AUD/USD. Keep in mind, the break of the monthly range instills a constructive outlook, with the recent series of higher highs & lows raising the risk for a larger correction especially as the Relative Strength Index (RSI) breaks out of the bearish formation carried over from November. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

Topside targets are still on the radar for AUD/USD as the RSI flashes a bullish signal, with a break/close above the 0.7320 (50% expansion) to 0.7340 (61.8% retracement) region raising the risk for a run at the December-high (0.7394), which lines up with the 0.7400 (38.2% expansion) hurdle.

Next region of interest comes in around 0.7460 (23.6% retracement) followed by the Fibonacci overlap around 0.7500 (50% retracement) to 0.7510 (23.6% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

How Long Can the Dollar Remain Strong?

Currency Calculator