简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro May Drop with Stocks, Commodity Currencies on Soft GDP Data

Abstract:The Euro may fall alongside stocks and commodity bloc currencies if soft fourth-quarter GDP data cools ECB rate hike bets and stokes global slowdown fears.

TALKING POINTS – EURO, GDP, US-CHINA TRADE TALKS, YEN, AUSSIE DOLLAR

Euro may fall as soft 4Q GDP data weighs on ECB rate hike bet

Global slowdown worries may cool post-FOMC market optimism

US-China trade talks may be formative for risk sentiment trend

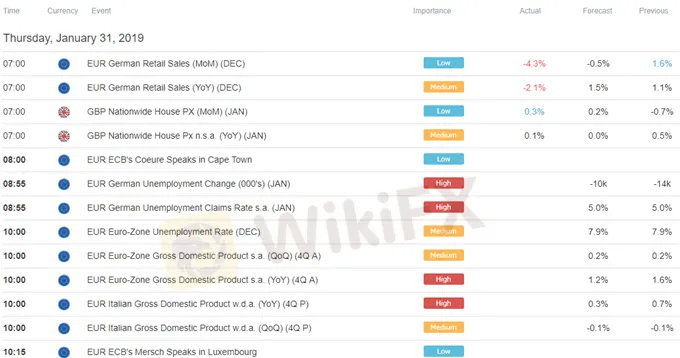

Fourth-quarter Eurozone GDP data headlines the economic calendar in European trading hours. The year-on-year trend growth rate is expected to slow to 1.2 percent, the weakest in five years. Data flow out of the currency bloc has steadily underperformed relative to forecasts since September, hinting analysts models are too rosy and opening the door for a downside surprise.

A weak result has scope to weigh on the Euro as traders mark down the probability of an ECB interest rate hike this year. As it stands, the chance of an increase is priced in at 39.6 percent. With markets thus already leaning toward the likelihood of standstillbefore the calendar turns to 2020, the impact of a disappointment may be even more pronounced in assets geared to global growth than the single currency.

Sentiment-sensitive currencies like the Australian, Canadian and New Zealand Dollars surged alongside stocks after yesterdays seemingly dovish FOMC rate decision. That makes some sense: a slower rise in credit costs can be supportive for economic growth, all else being equal. However, worries about ominous macro-level headwinds accounting for the policy shift seem to tarnish its pro-risk implications.

In fact, the probability of a global recession within one year has jumped to 19.2 percent – the highest since June 2013 – according to a survey of economists by Bloomberg. Traders may be reminded as much if the Eurozone GDP report accents global slowdown fears. That may put post-FOMC price moves into reverse, pushing commodity-bloc currencies lower while the anti-risk Japanese Yen and US Dollar rise.

CAN US-CHINA TRADE TALKS KEEP INVESTORS HAPPY?

US-China trade negotiations are another important input for establishing the level of market-wide risk appetite. Chinese Vice Premier Liu He is due for a second day of talks with US officials including President Donald Trump on a visit to Washington, DC. If the trip concludes without a clear path toward trade war de-escalation, the markets will have yet another reason to worry.

With that said, investors seem keen to give negotiators the benefit of the doubt. This means that even a modest nudge forward – like planningfurther talks before the March deadline for a deal that presidents Xi and Trump set out last year – might buoy animal spirits. The fillip is unlikely to materialize absent at least some specifics however. Furthermore, hopeful pre-positioning ahead of Mr Lius visit might dull its impact.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

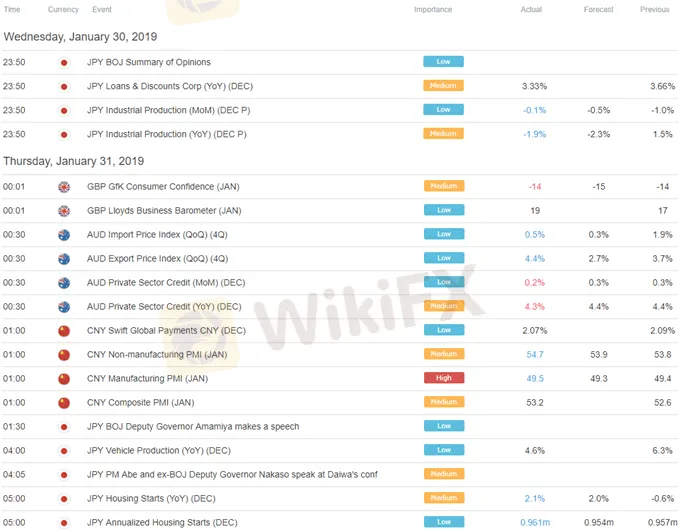

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

March 21, 2024 DAILY MARKET NEWSLETTER: Fed Hints at Rate Cuts, Stocks Surge

Consider including the date in your title for clarity.

Daily Market Newsletter - March 12, 2024: Market Recap: S&P 500 and Nasdaq Decline, Bitcoin Boosts Microstrategy to Record Highs

Insights from Trading Central's Global Research Desks

U.S. stock indexes retreated from their record-high levels. The Dow Jones Industrial Average dropped 274 points (-0.71%) to 38,380, the S&P 500 fell 15 points (-0.32%) to 4,942, the Nasdaq 100 was down 29 points (-0.17%) to 17,613.

Nvidia (NVDA) gained 4.79% to $693.32, marking a third consecutive record close. Goldman Sachs raised its price target on the stock to $800. Tesla (TSLA) fell 3.65% to $181.06, the lowest close since May 2023. ON Semiconductor (ON) jumped 9.54% as fourth-quarter results exceeded market expectations.

Financial Markets Update: Stocks Soar Amidst Tech Surge and Dollar Decline

Volatility Persists as Cryptocurrencies React to Regulatory Developments

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Singapore Blocks Polymarket Access, Following U.S. and France

OneZero Collaborates with Ladies Professional Golf Association (LPGA)

Housewives Scammed of Over RM1 Million in Gold Investment Fraud

Currency Calculator