简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Meeting of Creditors of Halifax Held in Sydney on Dec. 5th

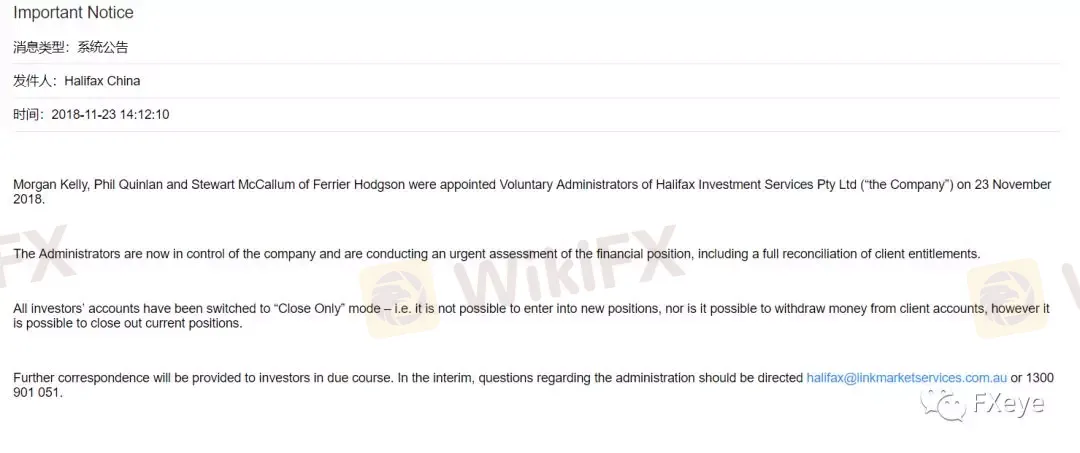

Abstract:On November 23th, Halifax suddenly announced that all investors’ account was suspended and the deposit and withdrawal was unavailable.

Case review

On November 23th, Halifax suddenly announced that all investors account was suspended and the deposit and withdrawal was unavailable.

Pursuant to the regulatory information, now Halifax has entered the bankrupt process. Faced with the sudden case, investors had no better choice but to wait for the result.

Case progress

The article, With Withdrawal Unavailable, Halifax Entered Bankrupt Process, published by FXEYE, detailedly reported the overall clearance schedule of Halifax's bankruptcy.

According to the notice of Ferrier Hodgson official website, the first meeting of creditors would be held at Wesley Conference Centre, SYDNEY on December 5th, 2018.

Today, FXEYE team in Australian came to the meeting to learn the latest progress.

Summary of meeting

Meeting stages:

- Introductio

- company overview

- administration proce

- FAQ

The vote to appoint a committee of inspection (COI), if necessary, and the result of voting will be showed on Ferrier Hodgson official website.

About FAQs

1. Reviewing Liquidator

In charge of the assets, operation and everything of Halifax, reviewing liquidator was assessing the financial situation of Halifax urgently including accounts overall review based on customer's rights and interests.

2. How is investor's transaction positions going?

Based on all assets of company and rights and interests of customers, the account overall review hasn't been finished by reviewing liquidator, and all investors'account have been suspended (though they have the choice to sell their positions).

This will be involved in the investigation based on the account owed to investors by company and that based on the company's ability to pay off its debts.

At the same time, the reviewing liquidator began to carry out the investigation, and would constantly update the progress and schedule of it.

3. Can investors get their money back?

Now, it is uncertain that if investors can get their all money back. And the liquidator will review Halifax's financial situation as soon as possible including accounts overall review based on customer's rights and interests. Meanwhile, the liquidator will constantly update the progress and schedule of the investigation.

4. Can investors sell their positions?

If you want to sell their positions, as usual, you can log in the trading system And close your account, with the trading system operating. and you don't have the permission to conduct new trade except for closing your account. With all investors' account suspended, the money involved in closing account will be froze.

5. How long will the whole clearance process last?

Unfortunately, due to this problem of complexity and the investigation of necessity, it is uncertain that if the investors can get all money back.And on the basis of the complexity of law, the process will probably last a few months, which depends on the court's instruction.

About some parts of FAQs covering Halifax staff's replies on site, if you want to learn more, please view the original article by downloading FXEYE APP.

About the matters like voting on site and that if creditors and investors agree that the company is took over by FH, the results weren't showed in the meeting.

FXEYE will pay close attention to the case and notify the investors in China as soon as possible.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Will EU Lose After Brexit?

Britain has officially left the European Union on January 31st , 2020, and will soon start negotiations with the European Union regarding bilateral relations in the future. It is believed that Brexit will cause negative impacts on the European Union in multiple aspects.

AUD’s Trend Is Affected by Macro Economy

Latest statistics show Australia’s annualized CPI from Q4, 2019 to be 1.8%, lower than the central bank’s 2%-3% long term target range, which the inflation fails to reach ever since 2017.

What Do the Economic Indicators Say About GBP

British general election at the end of 2019 was conducted against a sluggish economy. Latest statistics show that Britain’s economy growth is stagnant and the once strong labor market has weakened. In the first half of 2020, the pound will need to navigate through the domestic economy, central bank policies and the crucial March budget. In addition, the Brexit negotiation is still in its preliminary stage, whether a free trade agreement can be successfully concluded will also be critical.

CAD Will Have Less Upward Momentum in the New Year

As the G10 currency that performed the best in 2019, Canadian dollar may see a rather smooth horizontal trend this year partly because weakening domestic economy, and partly because the positive influence of easing trade tensions has been fading. CAD rose 5% against the USD in 2019, with nearly half of the increase gained in the last few weeks, benefiting as several other currencies from a reduce of risk factors at the end of 2019.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator