简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

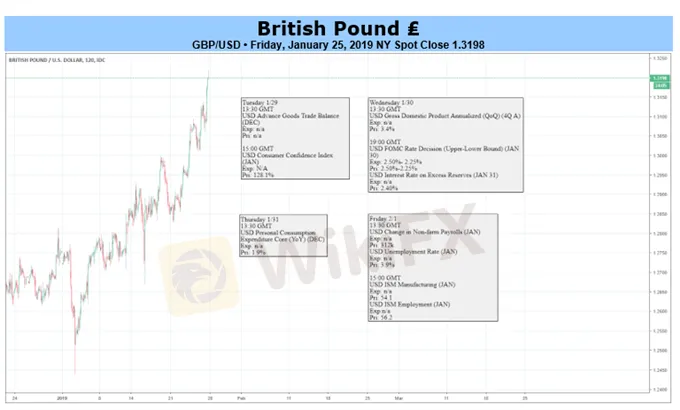

GBP Fundamental Forecast: Positive Backdrop, Bullish Outlook

Abstract:Sterling is coming off its weekly highs heading into the weekend, but the outlook for a reinvigorated British Pound remains bullish.

Sterling (GBP) Talking Points:

Brexit continues to shift towards a soft outcome as No Deal is priced-out.

Positive sentiment and supportive technical fuel the rally.

The DailyFX Q1GBP Forecasts are available to download including our short- and medium-term look at Sterling.

Fundamental Forecast for GBP: Bullish

We have changed our Sterling outlook to bullish for the near-term and would take a positive bias on sell-offs in the current climate. While Brexit retains the ability to generate an unexpected headline or two, wrecking even the best made plans, the overall sense is that a Soft Brexit is the most likely outcome and there is now a hardened opposition against the UK leaving the EU without a deal. The Irish Border question still has not been answered but it seems - according to media reports - that UK PM Theresa May has talked the DUP around to voting for her Plan B, suggesting that a solution has been found to this long-running problem.

Across the board GBP has had a good week, hitting multi-week and multi-month levels. As we write, the market has erased a small portion of these gains, but this is a natural occurrence in a strong market and provides another positive signal for Sterling. We have looked at various GBP-pairs over the week and the levels and bias remain intact despite todays book squaring. In addition to the three pairs below, GBPJPY and GBPCAD also provide opportunities going forward.

3 Sterling (GBP) Pairs Traders Should Watch as Brexit Talks Continue.

Sterling also received a small uplift this week from better-than-expected UK jobs and wages data, that suggest that BoE Governor Carney will be busy if/when the Brexit is resolved. Next week, PM Mays Plan B is put before the House and the vote will provide more information on the swing towards a soft Brexit. The economic calendar shows no high impact data releases in the UK market.

Looking for a technical perspective on the GBP? Check out the Weekly GBP Technical Forecast.

GBPUSD Daily Price Chart (May 2018 – January 25, 2019)

IG Client Sentiment data show 47.9% of traders are net-long GBPUSD. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests that GBPUSD prices may continue to rise. However, the combination of recent daily and weekly positional changes gives us a stronger bullish contrarian bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

WikiFX Broker

Latest News

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

Forex Price Trend Prediction! | Come be a New Year Price Winner!

Forex Brokers vs. Crypto Exchanges: Which Is Safer for Traders?

XTB Secures UAE and Indonesia Licenses, Expands in 2025

In Bursa Malaysia: Local Institutions Sustain Buying Streak & New Subsector Classification

Currency Calculator