简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | CA Markets: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of CA Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2015 and headquartered in Sydney, CA Markets Limited, operating as CA Markets Global (also known as CA Markets), is an online brokerage specializing in the trading of exchange CFDs.

CA Markets offers a diverse range of over 1000 tradable assets, including currency pairs, agricultural contracts, cryptocurrencies, commodities, government bonds, interest-rate instruments, and global indices.

In addition, CA Markets provides a social trading service called CA Markets Copy Trading, which enables money managers and traders to enhance efficiency, increase profitability, and generate passive income through copy trading.

CA Markets also supports Algo Trading via the renowned MetaTrader 5 trading platform.

CA Markets offers several partnership programs, including an Introducing Broker (IB) program with a competitive rebate structure and high trading standards, an affiliate program with scheduled and attractive payouts for driving traffic, and a white label program designed for individuals or companies aiming to establish their own Forex brokerage. Additionally, CA Markets provides advanced technology to seamlessly connect businesses with a wide range of liquidity providers, offering tailored solutions to meet specific business needs.

It is important to note that, at present, CA Markets does not offer its services to residents of Vanuatu, the USA, or countries listed as NCCT by the FATF (as of 2024, these include Iran, North Korea, and Myanmar).

Types of Accounts:

CA Markets offers three account options: the Standard Account, the Pro Account and the Ace Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

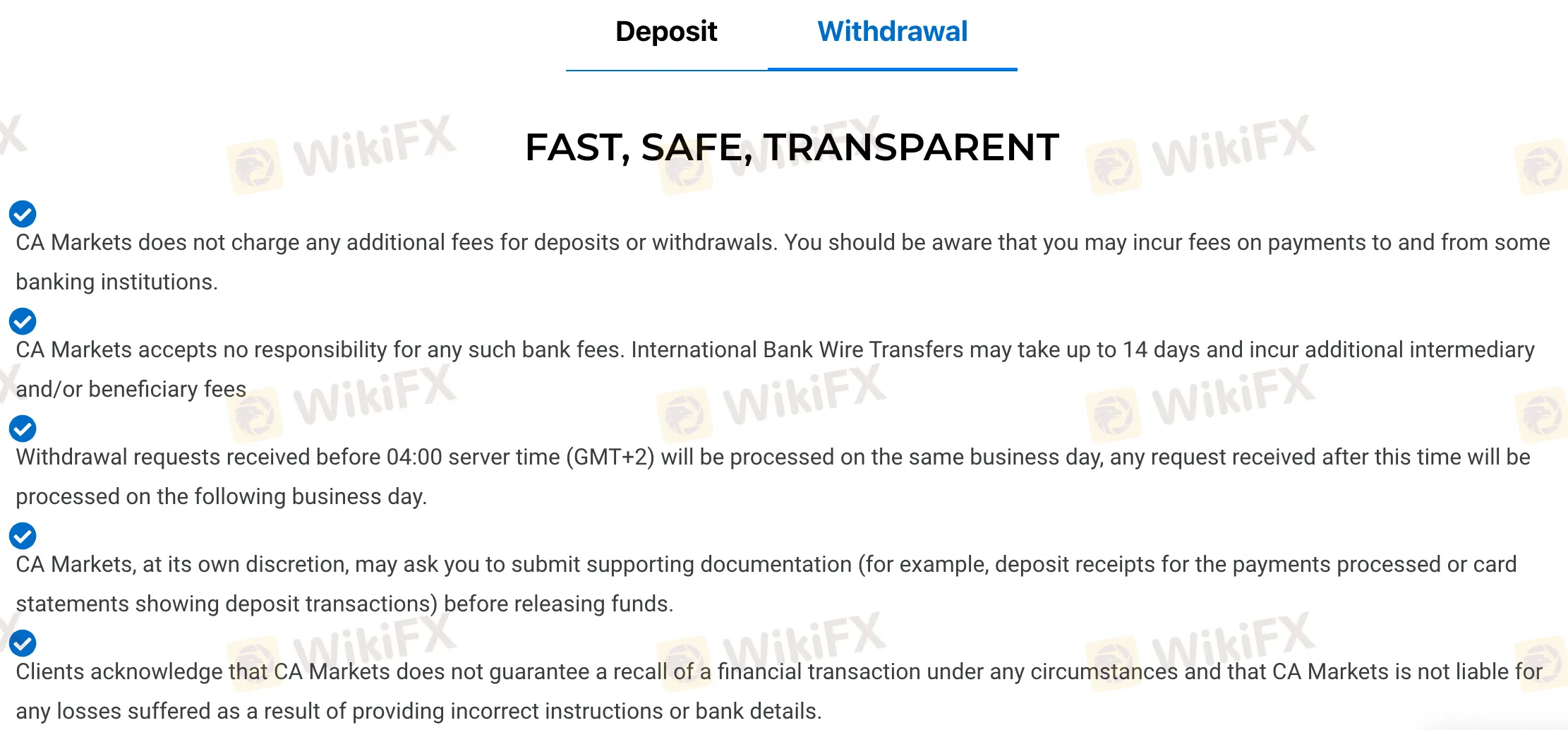

CA Markets offers a range of deposit methods, including UnionPay, ChipPay, 9Pay, Help2Pay, Crypto Wallet, bank transfers, and additional methods. While CA Markets asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client. In conjunction with this, CA Markets claims that it will waive fees charged by the merchant service provider if clients meet the minimum trading requirement of 0.2% of the deposit amount in round lots. Otherwise, a funding fee of 3% will be charged during client withdrawals.

Trading Platforms:

CA Markets only offers the MetaTrader 5 (MT5) as its trading platform. The MT5 platform, available on PC, mobile, and web, is known for its technological sophistication, providing access to a depth of market and various advanced solutions.

MT5 features technical analysis tools, customizable charts, automated trading through Expert Advisors (EAs), and a wide array of indicators to assist traders in making decisions. Its multi-asset capabilities and execution speed make it suitable for both novice and experienced traders. MT5s versatility, user-friendly interface, and access to real-time market data provide a platform for engaging in online trading across multiple financial instruments.

Research and Education:

No research or educational resources could be found on CA Markets official website. Compared to its industry peers, CA Markets is lacking in this department, as it is common for brokers to provide an extensive array of free resources for the benefit of their trading clients.

Customer Service:

CA Markets has four offices located in Sydney (Australia), Melbourne (Australia), Toronto (Canada), and Auckland (New Zealand). Clients can contact the broker at any of these offices using the contact information provided below.

Additionally, trading clients can contact the broker through its live chat service on its official website or via email at info@camarkets.com. Notably, CA Markets' website is currently available only in English, suggesting that its customer service support may be limited to English-savvy clients.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned CA Markets a WikiScore of 5.23 out of 10.

Upon examining CA Markets' licenses, WikiFX found that the broker is regulated by the Vanuatu Financial Services Commission (VFSC) with license number 700714, classifying it as an offshore-regulated broker.

However, the broker exceeds the business scope regulated by New Zealand's Financial Service Providers Register (FSPR) with the non-Forex license number 1002179, rendering this license invalid.

Additionally, CA Markets' license number 523351, which is purported to be issued by the Australian Securities and Investments Commission (ASIC), is suspected to be a clone.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator