简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

10 Best Trend Reversal Indicators for Day Trading

Abstract:Day trading, a strategy involving the quick buying and selling of forex, stocks or other trading assets within a single trading day, can be both exhilarating and challenging. Central to navigating this fast-paced environment is the ability to predict trend reversals. This article explores the 10 best trend reversal indicators that are indispensable for day traders. These tools help traders see through the market's complexity, giving them an edge in making profitable moves. Understanding and applying these indicators can be the key to unlocking significant profit potential in the financial market.

Day trading, a strategy involving the quick buying and selling of forex, stocks or other trading assets within a single trading day, can be both exhilarating and challenging. Central to navigating this fast-paced environment is the ability to predict trend reversals. This article explores the 10 best trend reversal indicators that are indispensable for day traders. These tools help traders see through the market's complexity, giving them an edge in making profitable moves. Understanding and applying these indicators can be the key to unlocking significant profit potential in the financial market.

Moving Average Convergence Divergence (MACD)

MACD stands out as a foundational tool in a trader's arsenal, offering insights into market momentum through the relationship between two moving averages. It's the divergence or convergence of these averages that signals potential market reversals. The MACD histogram further refines these signals, providing a visual representation of the momentum's strength or weakness, thus alerting traders to impending trend changes.

Relative Strength Index (RSI)

RSI, a momentum oscillator, gauges the speed and change of price movements. By identifying overbought or oversold conditions—typically above 70 (overbought) or below 30 (oversold)—RSI alerts traders to possible reversal points. This indicator is particularly useful in volatile markets, helping traders to make decisions based on perceived market extremes.

Stochastic Oscillator

This momentum indicator compares a particular closing price of a stock to a range of its prices over a certain period. Its value oscillates between 0 and 100, with readings below 20 indicating an oversold condition and above 80 signaling an overbought condition. The crossover of the %K (fast stochastic) and %D (slow stochastic) lines can signal a trend reversal, making the stochastic oscillator a favorite among day traders.

Bollinger Bands

Bollinger Bands provide a dynamic perspective on price volatility. Comprising three lines—the moving average, an upper band, and a lower band—this indicator adjusts itself with market conditions. A price touching or breaking through the bands can signal a reversal, especially when accompanied by other indicators.

Fibonacci Retracement Levels

Fibonacci retracement levels are a tool for identifying potential support and resistance levels following a market movement. These levels, derived from the Fibonacci sequence, help traders anticipate retracements in the price. Recognizing these can be crucial for entering or exiting trades at the most opportune moments.

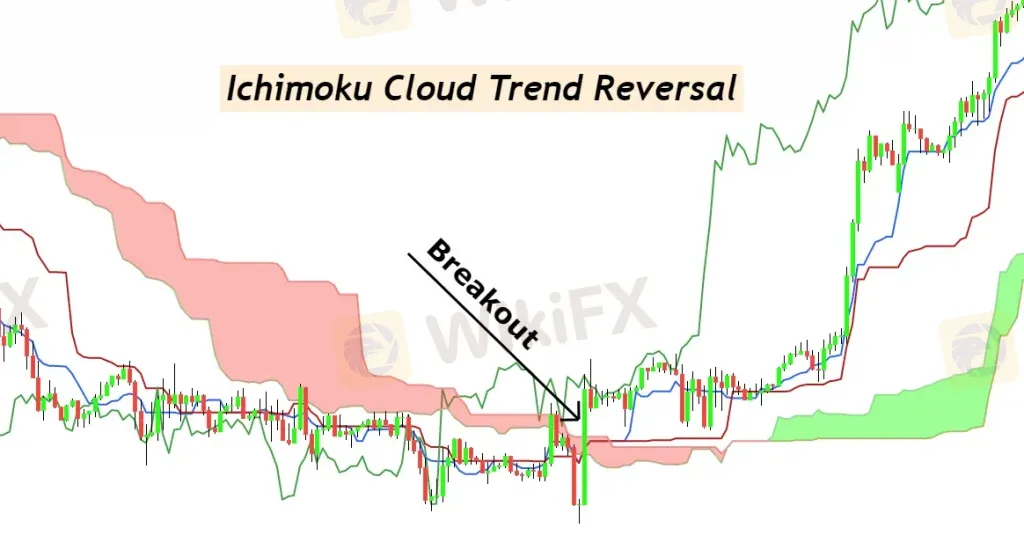

Ichimoku Cloud

The Ichimoku Cloud offers a comprehensive view of the market by integrating multiple indicators into one chart, providing insights into support and resistance levels, momentum, and trend direction. A price moving above or below the cloud can indicate a trend reversal, offering a clear signal for traders.

Average Directional Index (ADX)

ADX measures the strength of a trend, helping traders distinguish between strong trends that are likely to continue and weak trends that may reverse. A rising ADX indicates a strong trend, while a falling ADX suggests a weakening trend, potentially signaling a reversal.

Volume-Based Indicators

Volume is a key component in confirming trend reversals. Indicators like On-Balance Volume (OBV) and the Volume Oscillator provide insights into market sentiment by comparing volume to price movements. An increasing volume during a price reversal strengthens the signal's reliability.

Parabolic SAR

Designed to identify potential reversals in the market price direction, the Parabolic SAR (Stop and Reverse) places dots on a chart that indicate potential reversals. A shift in the position of the dots—from above to below the price or vice versa—signals a potential trend reversal.

Candlestick Patterns

Certain candlestick patterns, such as the hammer, engulfing patterns, and doji, are widely recognized for their ability to signal imminent trend reversals. These patterns, when observed at the end of a downtrend or uptrend, can provide early warnings of a change in the market's direction.

Combining Indicators for Effective Day Trading

Regarding day trading, relying on a single indicator to guide all your trading decisions can be likened to navigating a complex road network with just one street sign. To enhance decision-making accuracy and elevate trading strategies, savvy traders combine multiple indicators. This synthesis not only refines signal quality but also provides a more holistic view of market movements. Let's explore how combining key indicators such as MACD, RSI, and Bollinger Bands can unlock new levels of insight, featuring real-world examples for a richer understanding.

Imagine you're observing a stock that has been in a downtrend. The MACD shows a bullish divergence—where the price hits lower lows, but the MACD forms higher lows. This divergence suggests weakening downward momentum. To confirm this bullish signal, you turn to the RSI, which moves above its 30 level, indicating that the stock is moving out of the oversold territory. The concurrent bullish signals from both MACD and RSI offer a strong indication that a trend reversal is imminent, presenting a potential buying opportunity.

Psychological Aspects of Using Trend Reversal Indicators

In the high-stakes world of day trading, where fortunes can be made or lost in moments, the psychological impact of using trend reversal indicators cannot be overstated. These tools are not just mathematical formulas but are intertwined with the trader's emotions, biases, and decision-making processes. By delving into examples, we can uncover the rich psychological landscape that traders navigate when employing these indicators.

For instance, you're closely monitoring the RSI and MACD on your favorite stock. The RSI dips below 30, signaling an oversold condition, and at the same time, the MACD shows a bullish crossover. The excitement builds. This is the moment you've been waiting for - a potential trend reversal. But here lies the psychological trap: the euphoria of spotting what seems like a surefire signal can cloud judgment, leading to premature entries without adequate confirmation or risk management.

A common psychological pitfall is confirmation bias—the tendency to favor information that confirms your preconceptions or hypotheses while disregarding contradictory evidence. For instance, if you've had success with a particular pattern or indicator in the past, you might overemphasize signals that align with your expectations, ignoring signs of a false reversal. This bias underscores the importance of rigorous backtesting. By objectively reviewing historical data and outcomes, you can temper the inclination to see patterns where none exist, grounding your strategies in empirical evidence rather than wishful thinking.

Practical Tips for Implementing Indicators

In the fast-paced world of day trading, the effective implementation of trend reversal indicators can be a game-changer. These indicators not only signal potential market turns but also guide strategic entry and exit points. However, their utility hinges on the trader's ability to set up, apply, and continuously refine their use. Below are enriched and detailed strategies for leveraging these tools, ensuring you derive the most value from your trading endeavors.

Selecting the Right Indicators for Your Trading Style

Every trader has a unique style, risk tolerance, and market philosophy. Begin by assessing your trading objectives and the types of assets you trade most frequently. If you prefer fast-moving markets, indicators like the Stochastic Oscillator and RSI might suit your needs due to their ability to signal quick changes in momentum. For those who trade more volatile stocks, Bollinger Bands can provide insights into price volatility and potential reversal points.

Optimizing Indicator Settings for Market Conditions

Indicators are not one-size-fits-all tools. Their settings need to be adjusted based on prevailing market conditions and the asset being traded. For instance, adjusting the MACD's parameters to reflect a shorter timeframe can provide more responsive signals in a fast-moving market. Conversely, lengthening the periods for the ADX might filter out market noise in more stable conditions, highlighting stronger trends.

Combining Indicators for Confluence

Leveraging multiple indicators can provide a more robust framework for decision-making. For example, you might use Fibonacci retracement levels to identify potential support and resistance areas and then wait for a confirming signal from the MACD or RSI before making a trade. This multi-layered approach helps in filtering out false positives, increasing your confidence in the trade.

Backtesting and Paper Trading

Before implementing new indicators or settings in your live trading sessions, backtest them against historical data to assess their effectiveness. Paper trading, or simulated trading, offers a risk-free environment to fine-tune your strategy, allowing you to make adjustments based on real-time feedback without the financial risk.

Monitoring and Reviewing Trades

Keep a detailed log of all trades, noting the indicators used, the rationale behind each trade, and its outcome. This practice can reveal patterns in your trading, highlight which indicators work best under specific conditions, and help you identify areas for improvement.

Staying Informed and Adapting

The financial markets are constantly evolving, with new trends and trading strategies emerging regularly. Stay informed by engaging with trading communities, attending webinars, and following market analysis by experienced traders. This ongoing education will help you adapt your strategy to new market conditions and trading technologies.

Conclusion

In conclusion, these ten indicators are essential for day traders. By providing early signals of market reversals, they allow traders to position themselves advantageously, maximizing their profit potential while minimizing risks. They also offer powerful insights for day traders, allowing them to navigate the complexities of the market with greater confidence and efficiency. By understanding and applying these tools, traders can enhance their ability to predict trend reversals, optimizing their trading strategies for maximum profitability.

FAQs

What makes a good trend reversal indicator?

A good trend reversal indicator provides timely and reliable signals, has a reasonable level of accuracy, and complements other indicators and trading strategies.

How to choose the right indicators for your trading style?

Select indicators that align with your trading strategy, risk tolerance, and market understanding. It's crucial to practice with different indicators to find the combination that works best for you.

Can these indicators be used for swing trading?

Yes, while primarily designed for day trading, these indicators can also be effective for swing trading, offering insights into longer-term market movements.

How to avoid false reversal signals?

Combining multiple indicators can help filter out false signals. Additionally, implementing a solid risk management strategy can protect against the impact of incorrect predictions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator