简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

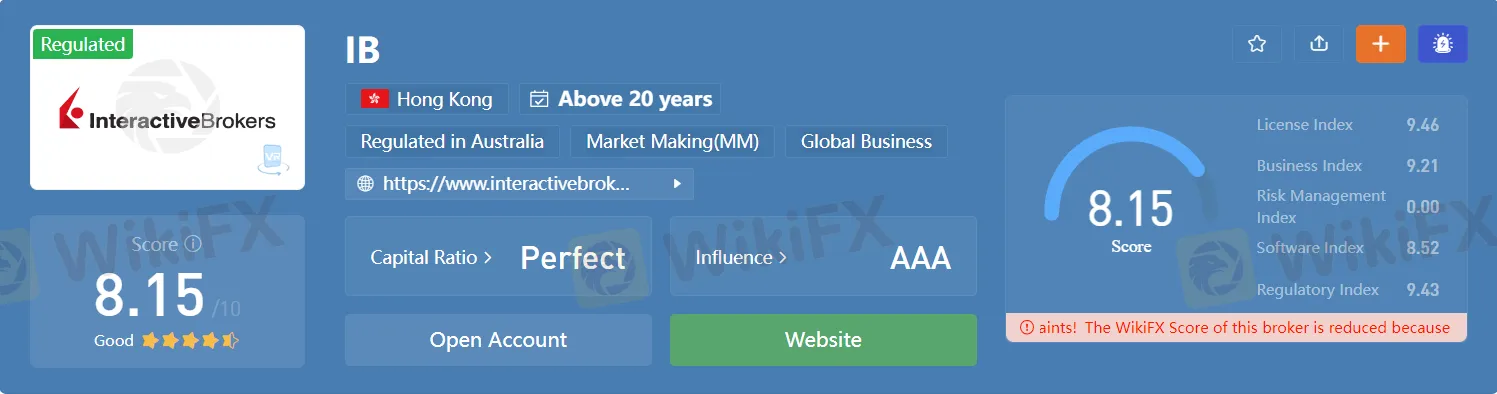

ASIC Issues Two Temporary Halt Orders Against Interactive Brokers Australia Proprietary Ltd.

Abstract:ASIC has granted two temporary restraining orders to halt Interactive Brokers Australia Pty Ltd (Interactive Brokers) from marketing Stock Yield Enhancement Program (SYEP) derivatives to individual buyers. Defects in the product's target market determination (TMD) and product transparency statement led to the issuance of the directives (PDS).

ASIC has granted two temporary restraining orders to halt Interactive Brokers Australia Pty Ltd (Interactive Brokers) from marketing Stock Yield Enhancement Program (SYEP) derivatives to individual buyers. Defects in the product's target market determination (TMD) and product transparency statement led to the issuance of the directives (PDS).

A PDS for SYEP Derivatives or general guidance on SYEP Derivatives cannot be given to individual buyers by Interactive Brokers, according to the temporary directives. Unless they are canceled early, these directives are valid for 21 days.

Retail buyers are protected by temporary directives from purchasing SYEP Futures that might not be appropriate for their wants, circumstances, or financial goals. The PDS's flaws are a worry for ASIC as well.

SYEP Derivatives are contracts that allow small-scale buyers to loan qualified equities to Interactive Brokers, who may then lease the securities to additional parties for reasons such as short selling or other uses. In return, Interactive Brokers gives the retail trader consideration (less its fees and charges) and offers cash as security to ensure that it will fulfill its promise to return the stocks. Retail investors in SYEP Derivatives are subject to risks associated with securities lending, such as the effect of short selling on the value of their securities, counterparty risk in the event that Interactive Brokers defaults, the loss of voting rights, and tax repercussions related to substituted dividend payments and corporate actions.

ASIC has issues with the TMD for SYEP Derivatives, including the inclusion of participants whose stated investment goals are the protection of capital and the production of income, or hedging, which are likely at odds with the characteristics and risks of the product. Additionally, the TMD specified an unreasonable amount of time for distributors to report complaints and other issues to Interactive Brokers, as well as insufficient and ill-defined triggers for determining whether the TMD remains appropriate. The TMD also included knowledge and experience criteria that are not described with objective, concrete parameters.

The PDS was also deemed to be flawed by ASIC for a number of reasons, including the omission of crucial details regarding the advantages, costs, and commissions of the SYEP Derivatives, the inclusion of a false claim regarding forfeiture of voting rights, and the use of ambiguous and ineffective wording and presentation.

Interactive Brokers are expected by ASIC to resolve these issues and maintain conformance. If the issues are not resolved quickly, ASIC might think about issuing a definitive ruling. Before any definitive stop-order decisions are made, Interactive Brokers will have a chance to submit any comments.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TICKMILL FREE WEBINAR ON US ELECTION 2024

The 2024 US election is expected to have a significant impact on the Forex market. Therefore, on November 3, 2024, the well-known broker Tickmill will host a free webinar on US Election 2024. There are only a few seats available.

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

With extensive experience in the financial market, STARTRADER PRIME is highly knowledgeable about the needs of institutional businesses. The brand has gained trust from clients in over 200 regions by providing tailored liquidity solutions. Institutional clients require solutions designed according to their unique business needs, and STARTRADER PRIME offers such solutions, giving clients a real competitive edge in the market.

FX Guys Aims to Ride Solana's Surge: A New DeFi Project Tracking SOL's Growth

FX Guys, a new decentralised finance (DeFi) project, aims to track Solana's price trajectory, presenting a unique option for investors interested in decentralised asset trading. Solana (SOL) has gained significant momentum over the past year, with a 480% increase in value, establishing it as a strong presence in the altcoin market. FX Guys seeks to mirror Solana’s growth, offering a platform that combines community-driven trading with DeFi’s decentralised infrastructure.

Fear, Greed, and Decision-Making in Forex Trading

This article explores how fear and greed manifest in forex trading, how they impact decision-making, and the strategies traders can adopt to mitigate their effects.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Can Blockchain Technology Protect Your Money from Risk?

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Hong Kong Court Rules in Favor of Investors in JPEX Case

Currency Calculator