简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Breaking: FTX Hacked: $1bn Drained from FTX and FTX US Accounts So Far

Abstract:The hack came just hours after Sam Bankman-Fried resigned as CEO Speculation is rife of an 'inside job'

The FTX drama continues.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.Just hours after FTX crypto exchange filed for Chapter 11 bankruptcy and Sam Bankman-Fried resigned as CEO, over $600 million disappeared from FTX wallets within a matter of hours with no explanation as to why.

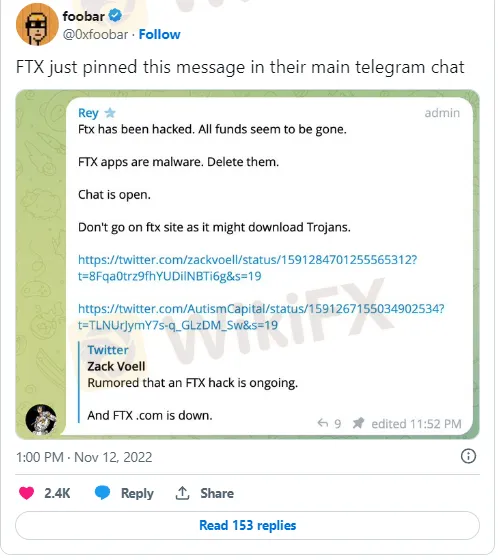

Amid the Friday night confusion, there was speculation that the draining of wallets into a single account was the action of a liquidator or even a regulator. However, shortly after, it was confirmed on the FTX official Telegram channel (now pinned by FTX General Counsel Ryne Miller) that the hundreds of millions of dollars being siphoned off was indeed the action of a hack, as the FTX.com website came offline.

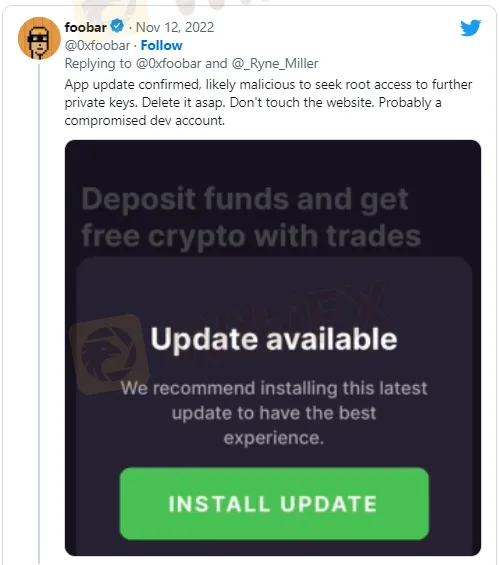

Both FTX and FTX US appear to be affected by what is speculated to be the result of a Trojan, with users of both exchanges reporting balances of $0 in their accounts. Reports are emerging of SMS messages and emails being sent by FTX to customers to log into the app and website, which are infected with a trojan and enabled the hack.

Hack or Rug Pull?

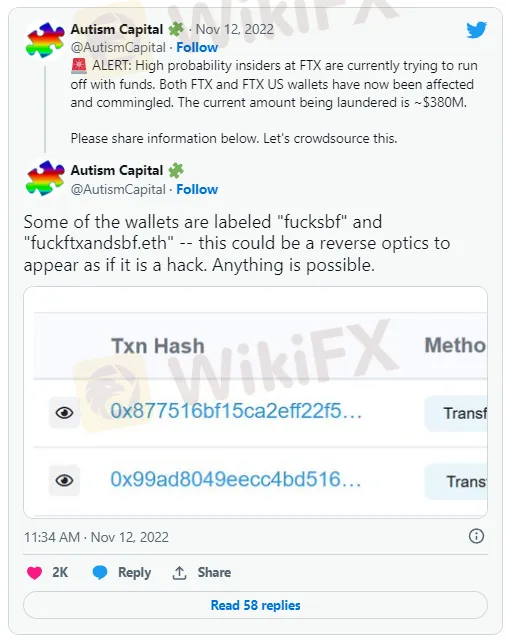

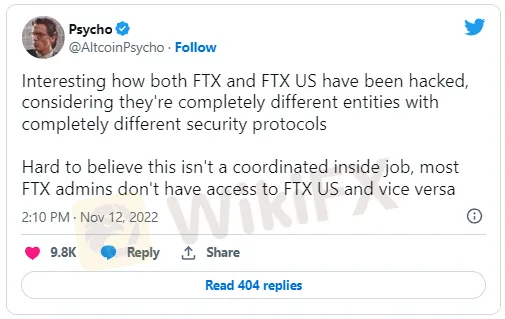

With the attack and account draining appearing to be ongoing at the time of writing, speculation is rife on what is happening and where the money is going. Accusations of an 'inside job' quickly gathered steam on social media.

It does not take Sherlock Holmes to link the draining of accounts to the recently resigned CEO, Sam Bankman-Fried who took to Twitter on Thursday to explain and apologize for his actions. Twitter sleuths were quick to point out why they thought it “hard to believe this isn't a coordinated inside job.”

With the attack understood to be ongoing and details emerging all the time, approximately $1 billion is believed to be drained so far. All FTX and FTX US users are being advised NOT to visit the app or website and delete the app altogether.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM5.9M Lost to "Davidson Kempner Capital Management" Facebook Scam

A private contractor in Malaysia faced a devastating loss of over RM5.9 million after falling victim to a fraudulent investment scheme promoted on Facebook. Tempted by the scheme’s impressive claims and credentials, the victim began investing in September 2024. The investment process required him to download an application called A-Trade, which was readily available on the Apple Store.

Is There Still Opportunity as Gold Reaches 4-Week High?

Gold Continues to Rise, can the Bulls Keep Going? Recently, gold prices have been on the rise, especially following the release of the non-farm payrolls data, as demand for gold as a safe-haven asset continues to increase.

Bitcoin in 2025: The Opportunities and Challenges Ahead

Bitcoin experienced a transformative year in 2024, with its value surpassing $100,000 and attracting attention from institutional investors, retail traders, and governments alike. This growth was driven by milestones such as the approval of spot bitcoin ETFs and increasing adoption by major financial institutions. As 2025 begins, bitcoin’s position as a cornerstone of the digital financial ecosystem is stronger than ever.

BI Apprehends Japanese Scam Leader in Manila

The Bureau of Immigration apprehended a Japanese scam leader in Manila for targeting elderly victims in Japan, with plans to investigate possible local operations.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator