简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Most Popular FX Brokers on WikiFX | Do You Know Them?

Abstract:With forex brokers mushrooming throughout the globe at an overwhelming rate, would you like to know which are the most popular FX brokers based on WikiFX’s database? Keep reading to find out more.

It is advisable to choose an established and reputable forex broker for your trading journey. This is to greatly reduce the chances of falling into the traps of scammers or fraudsters. With that being said, when a forex broker appears to be “popular”, it does not always mean that it is guaranteed to be trustworthy.

When choosing a forex broker, WikiFX strictly advises our users to download our free mobile app or visit www.wikifx.com, and look for forex brokers with these traits:

(1) has obtained a WikiScore of at least 7 and above

(2) is established for a certain period of time, not just 1-2 years

(3) is regulated by at least 1 authority body

(4) holds at least 1 valid license

(5) preferably to have a legitimate business premise which was verified by WikiFXs field survey team

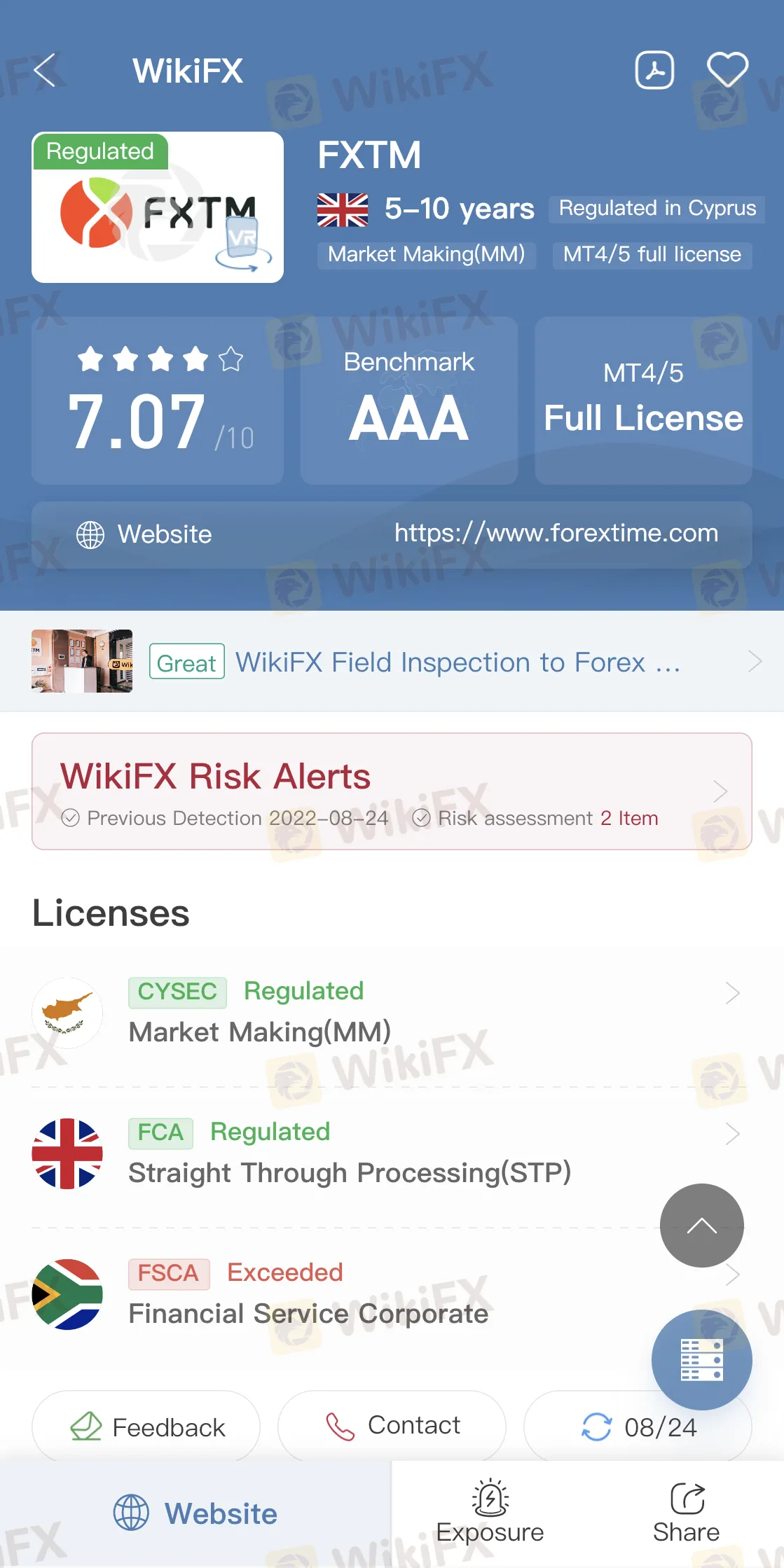

Number 1:

FXTM is one of the leaders in the industry that offers trading of foreign currencies, precious metals, commodities, futures, indices, and more.

Visit FXTMs WikiFX profile here: https://www.wikifx.com/en/dealer/3351410785.html

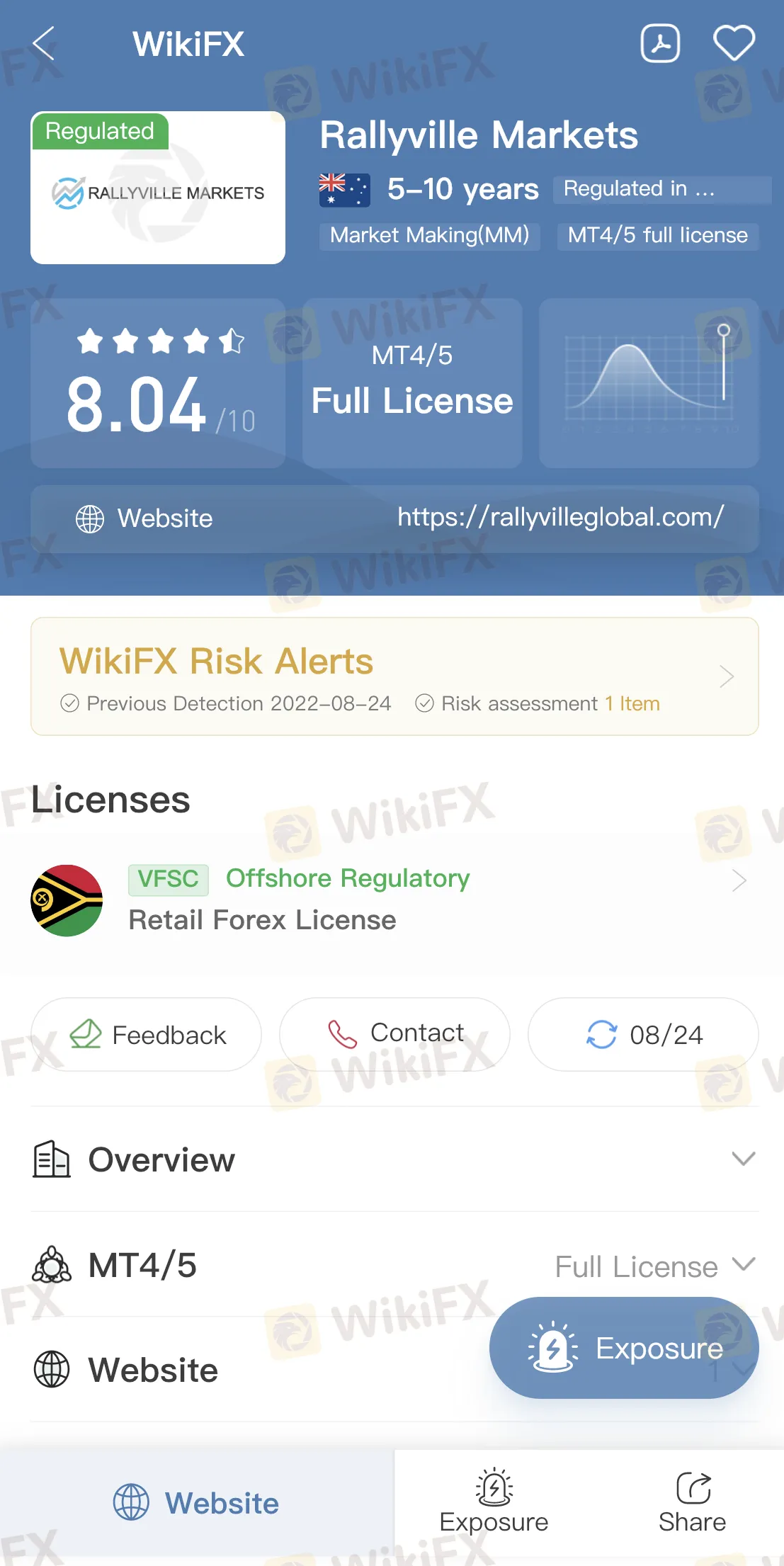

Number 2:

Rallyville Markets from Sydney (Australia) provides over 120 trading instruments on MT4.

Visit Rallyville Markets WikiFX profile here: https://www.wikifx.com/en/dealer/6560455512.html

Number 3:

TMGM is another broker from Australia that offers trading on MT4, MT5, and IRESS platforms.

Visit TMGMs WikiFX profile here: https://www.wikifx.com/en/dealer/7101709423.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

AI Triples U.S. Treasury’s Fraud Recovery to $1B in 2024

The U.S. Treasury's use of AI for fraud detection leads to a significant increase in recovery, reaching $1 billion in fiscal 2024, thanks to machine learning.

FB Investment Scam Cost Malaysian Housewife RM80K

A 50-year-old Malaysian housewife recently lost RM82,175 to a fraudulent investment scheme promoted on Facebook in July. The victim, a former secretary in a private company, was initially attracted to the enticing investment opportunity and followed a link from the advertisement that directed her to WhatsApp to connect with the scheme's operator.

The Role of Moving Averages in Trend Trading

Moving averages are essential tools in technical analysis, widely used by traders to identify trends and make informed decisions. By smoothing out price data, moving averages help traders filter out noise and determine the overall direction of a market, making them invaluable in trend trading strategies.

The Importance of Backtesting in Forex Trading

One of the most effective ways to validate trading strategies is through backtesting. This process involves testing a trading strategy using historical data to assess its effectiveness before applying it in live markets. Understanding the importance of backtesting can significantly enhance a trader's chances of success.

WikiFX Broker

Latest News

XM - Featured Broker in WikiFX SkyLine Guide

BUX and PrimaryBid Partnership Opens IPO Access for EU Retail Investors

Plus500 Users Count Surges to 121K with Average Deposits Reaching $6,150

Coinbase Launches Tool to Simplify AI Agent Creation for Crypto Tasks

Illegal Bitcoin Mining Is Draining Millions from Malaysia’s National Company

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

Currency Calculator