简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is Axia Investments a safe broker?

Abstract:In this review, WikiFX will discuss all aspects of Axia Investments, in order to figure out whether it’s safe to invest with them.

Axia Investments (www.axiainvestments.com) says that its goal is to provide the ultimate trading experience – a superior educational framework, robust technology, outstanding support, and a safe environment. We should admit that at first glance their website looks pretty neat -there is all the relevant information about account types, spreads, leverage, and minimum investment amounts.

When one takes a closer look, however, things aren‘t as good as it seems. In this review, WikiFX will discuss all aspects of Axia Investments, in order to figure out whether it’s safe to invest with them.

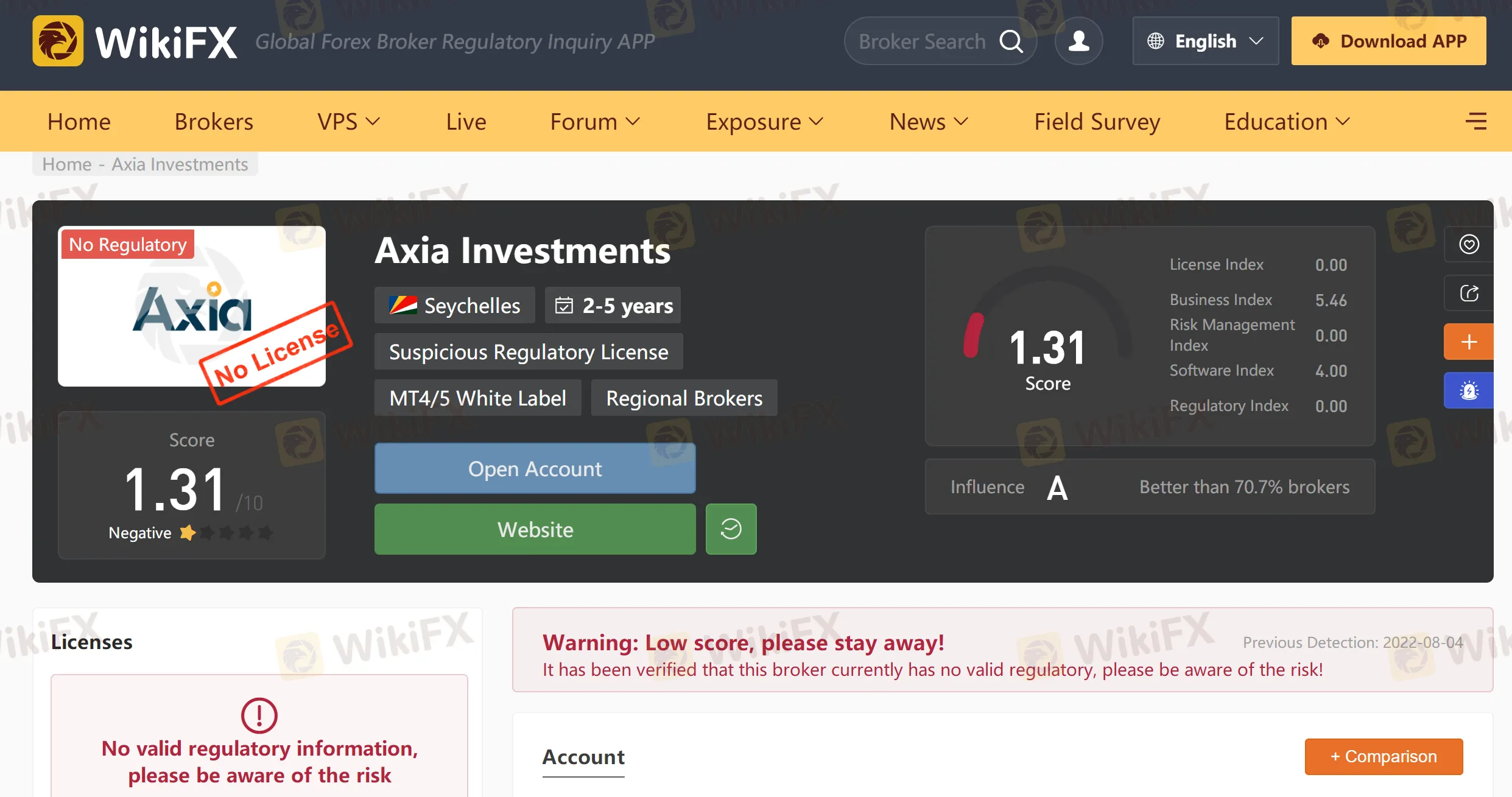

First let's search “Axia Investments” on WikiFX to take a look at the details page. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/3480260937.html), Axia Investments currently has no valid regulatory license and the score is rather negative - only 1.31/10.

Although Axia Investments claims to be formally licensed according to its website, their authorization is issued by an offshore institution, so it doesnt really count. Better stick with legit brokers, authorized by trustworthy financial regulators such as the CySEC in Cyprus for example.

WikiFX did check, and the company operating Axia Investments, SMARTTOOL TRADING SC LIMITED, is indeed licensed by the Seychelles Financial Services Authority (FSA). Such a license, however, doesn‘t mean much in the forex industry, because FSA-registered brokers don’t have to abide by any strict rules, nor are subjected to real oversight. The only requirement for a broker licensed in the Seychelles is to have a company registered on the Islands with a share capital of at least $50 000.

In comparison, forex brokers licensed in Cyprus and the EU in general, are required to hold a minimum capital of EUR 730 000, to keep all clients‘ funds in segregated accounts, to conduct external audits, and report to the financial authorities on a regular basis, and more. Besides, they should also be members of compensation funds that cover victimized clients’ losses in case a licensed entity becomes insolvent.

That is why WikiFX generally advises investors to stay away from offshore brokers like Axia Investments and instead deal with companies licensed by trustworthy regulators such as the Cyprus Securities and Exchange Commission (CySEC), or another EU financial regulator like BaFin in Germany, CONSOB in Italy, or the Spanish CNMV.

According to the official website, Axia Investments claims to be a forex broker trading in CFD, forex, commodities, stocks and indices. The trading platform offered to the traders is a web trader.

Looking at the bid/ask price for EUR/USD, WikiFX calculated the spread to be 2.1 pips which is higher than the industry average. High spread increases the cost of transactions and is not favourable for the traders. The leverage for this pair is 1:400. This leverage is very high and signifies only two things – a big win or a big loss for the traders. However tempting it may seem, high leverage increases the exposure to the risk of losing funds given the statistics that around 70% of traders lose. So, we advise you to refrain from trading with such high leverage. Please note that licensed brokers in the EU have a leverage cap of 1:30 and in the US, 1:50 to prevent traders from entering recklessly in risky transactions.

And let's take a closer look at the trading accounts that Axia Investments offers to its clients. They are 5 – Bronze, Silver, Gold, Platinum and Diamond. The minimum initial deposit is $500 for the Bronze account. The other accounts start at $2,500, $10,000, $50,000 and $250,000 respectively.

WikiFX found the fees this company charges rather ‘interesting’. For example, if an account stays inactive, there are different fees applying depending on the period of inactivity. It starts with 80 EUR for inactivity up to 2 months and can reach $1,000 for the inactivity of over 12 months. If the trader decides to reactivate the account, then the fee is 2,000 EUR!

Also, you must be aware that should you decide to break up with this broker and file for a chargeback, then youll be charged $150 research fee by the company.

In addition, the broker hasnt updated its social media (Facebook, Twitter and Instagram) for almost nine months. The last time it posted anything was in November last year, and it did not have much popularity on those sites.

Nevertheless, investors who have traded with Axia Investments seem to think highly of the broker:

There are negative comments regarding the broker though:

Source: https://www.forexpeacearmy.com/forex-reviews/18559/axiainvestments-forex-brokers

In conclusion, Axia Investments does not qualify as a safe broker generally speaking. Investors are advised to think carefully before deciding to invest in this broker. For your money safety, please do more research and make yourself comfortable before making a decision. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM5.9M Lost to "Davidson Kempner Capital Management" Facebook Scam

A private contractor in Malaysia faced a devastating loss of over RM5.9 million after falling victim to a fraudulent investment scheme promoted on Facebook. Tempted by the scheme’s impressive claims and credentials, the victim began investing in September 2024. The investment process required him to download an application called A-Trade, which was readily available on the Apple Store.

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

The latest data shows that Japan’s base wages in November rose by 2.7% year-on-year, marking the largest increase in 32 years, fueling speculation about a potential BOJ rate hike, but Governor Kazuo Ueda’s dovish remarks in December have shifted market expectations toward a potential delay in policy adjustments.

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

Following the successful auction of 30-year government bonds by the UK, the yield on 30-year bonds surged, reaching its highest level in 25 years. This increase reflects growing concerns in the market over the government's fiscal policies and large-scale debt issuance.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator