简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How Bond Spreads Between Two Countries Affect Their Exchange Rate

Abstract:The bond spread represents the difference between two countries’ bond yields. Investors often include foreign or international bonds in their portfolios for a few basics reasons – to take advantage of higher interest rates or yields and to diversify their holdings.

The bond spread represents the difference between two countries bond yields. Investors often include foreign or international bonds in their portfolios for a few basics reasons – to take advantage of higher interest rates or yields and to diversify their holdings. However, the higher return expected from investing in foreign bonds is accompanied by increased risk arising from adverse currency fluctuations

These differences give birth to carry trade, which we have explained in the lesson before this.

By monitoring bond spreads and assumptions for the change in the interest amount, you will have an idea of where currency pairs are headed.

Heres what we mean in details:

While the bond spread between two economies widens, the currency of the country with the higher bond yield do appreciate against the other currency of the country with the lower bond yield.

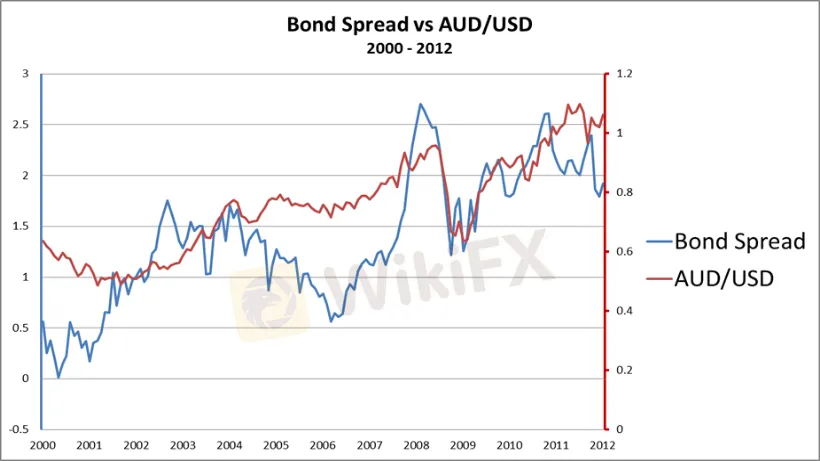

You can easily notice this phenomenon by looking at the graph of AUD/USD price action and the bond spread between Australian and U.S. 10-year government bonds from January 2000 to January 2012. Observe carefully that when the bond spread rise from 0.50% to 1.00% from 2002 to 2004, AUD/USD rise almost 50%, rising from 0.5000 to 0.7000. And The same thing happened in 2007, when the bond differential rise higher from 1.00% to 2.50%, AUD/USD rose from .7000 to just above .9000. All at the same time. Which Is almost 2,000 pips!

The moment the 2008 recession continues to expand all the major central banks started to cut their interest rates, AUD/USD jumped back from the 0.9000 handle down to 0.7000. So what possibly happened here?

Well.. one point we can likely say in control here is that traders are taking advantage of carry trades.

When bond spreads were increasing in between the Aussie bonds and U.S. Treasuries, traders take advantage and load up on their long AUD/USD positions.

But Why?Could it means To take advantage of carry trade!

Although, the moment the Reserve Bank of Australia set up a cheaper rate of bond spreads began to tighten, traders tends to react by loosen up their long AUD/USD positions, because they were no longer as profitable.

Below is one more example to consider:

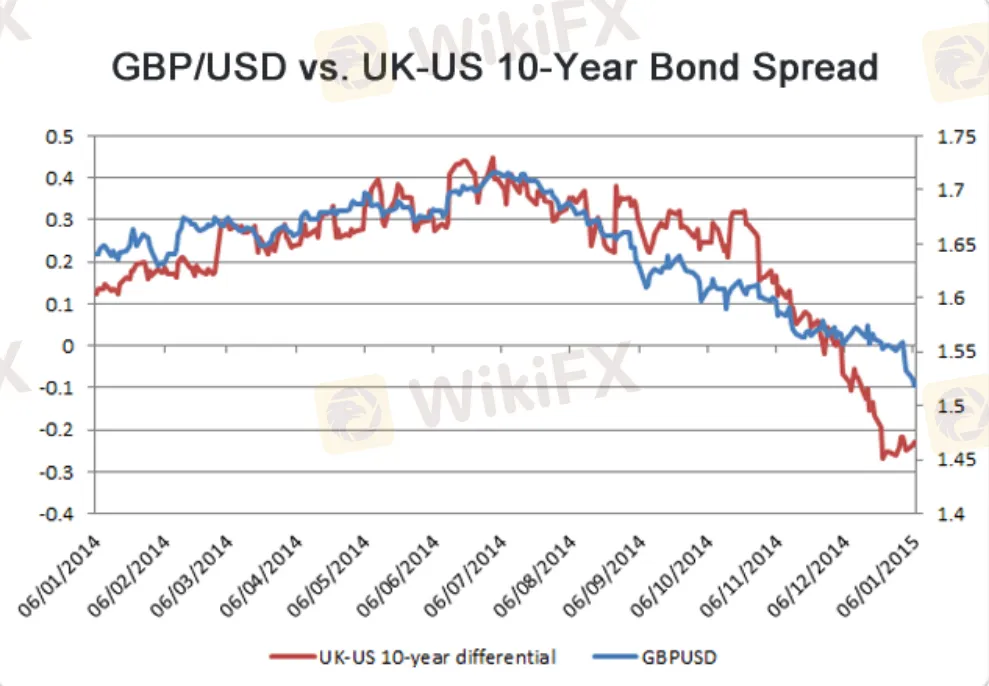

As the bond spread between the UK bond and the US bond decreased, the GBP/USD also loosen.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator