简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

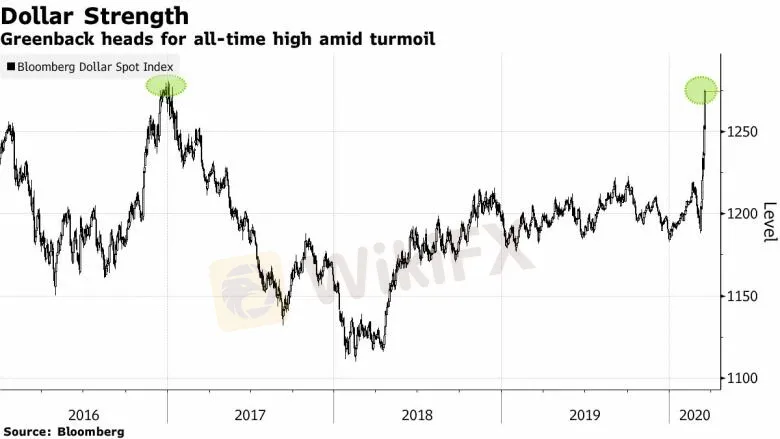

The Bloomberg Dollar Spot Index is a measure of the value of a dollar

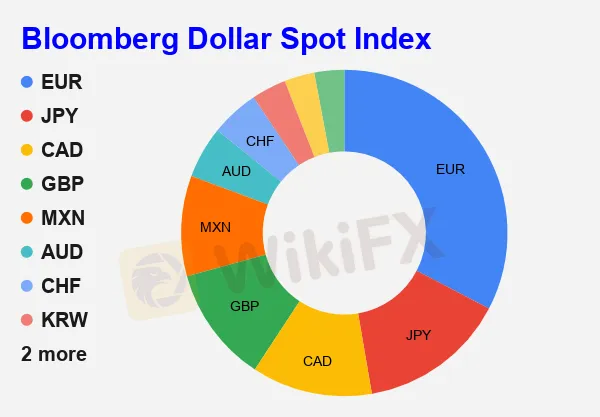

Abstract:The Bloomberg Dollar Spot Index (BBDXY) measures how a basket of ten world currencies performs versus the US dollar. Its composition is revised on an annual basis and includes a wide range of currencies that are essential in global commerce and liquidity.

The Bloomberg Dollar Spot Index (BBDXY) measures how a basket of ten world currencies performs versus the US dollar.

Its composition is revised on an annual basis and includes a wide range of currencies that are essential in global commerce and liquidity.

Bloomberg argues its index is a superior gauge of the US dollar because other dollar indices (ahem...DXY) do not change their composition and are made up of only a few currencies with concentrated weights.

The data for the BBDXY Index begins on December 31, 2004, with a base level of 1000.

The weight of each currency in the basket is determined each year depending on its share of international commerce and FX liquidity.

Is There a Better Way to Measure the Dollar in the United States?

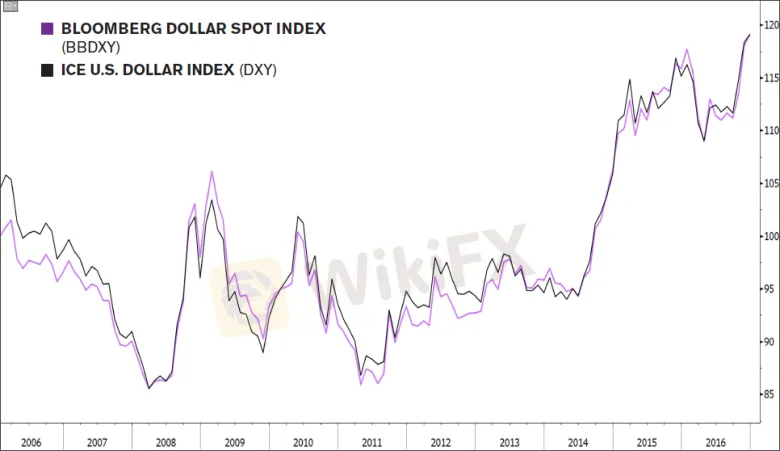

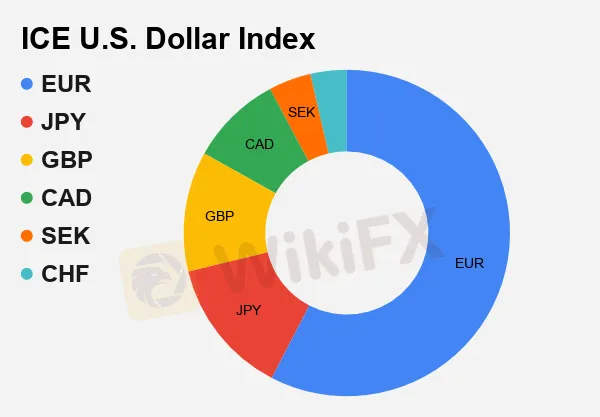

Let's compare and contrast the Bloomberg Dollar Spot Index (BBDXY) with the frequently utilized ICE Dollar Index (DXY).

BBDXY is a better representation of BBDXY.

By taking into account global currency market liquidity and the United States' trading partners, the Bloomberg Dollar Spot Index follows a more representative basket of currencies.

BBDXY has a wider range of products.

The euro does not dominate the Bloomberg Dollar Spot Index, unlike the DXY.

It also includes significant emerging market currencies including the Indian rupee, Korean won, Mexican peso, and Chinese renminbi, all of which are important trading partners for the United States.

BBDXY has a greater range of motion.

Unlike the DXY, which has a static composition, the BBDXY has a dynamic composition that is rebalanced annually to reflect the changing situation of currency markets.

As a result, the index contains key currencies (such as the Australian dollar) that outperform the Swedish krona in terms of liquidity and trade.

Why is Sweden included in USDX? Because the index is still stuck in time!The ICE US Dollar Index gauges the value of the US dollar against a basket of currencies representing the US's top six trading partners, as of 1973!The Eurozone, Japan, the United Kingdom, Canada, Sweden, and Switzerland were all included.

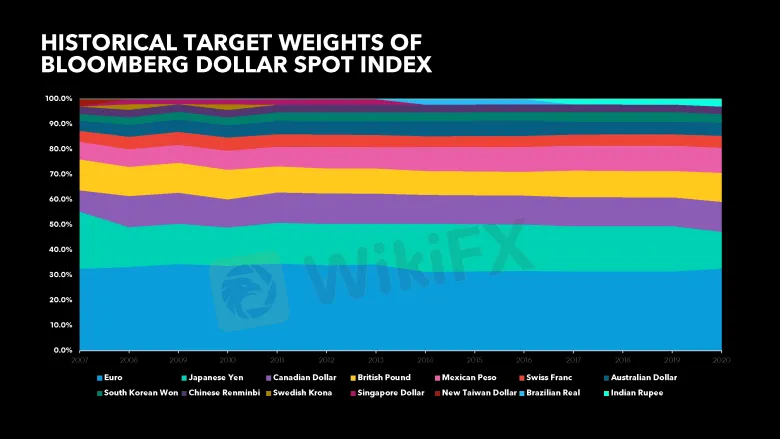

This graph depicts how the Bloomberg Dollar Index has rebalanced over time.

Take note of how currencies like the Singapore dollar (SGD) and the Brazilian real (BRL) used to be in the nice club but were finally kicked out and replaced.

BBDXY isn't a prankster. It prefers to keep things fresh!

In contrast, the currencies in the U.S. Dollar Index (USDX, DXY, DX) never change. Perhaps they should be known as the “Boring Dollar Index.”

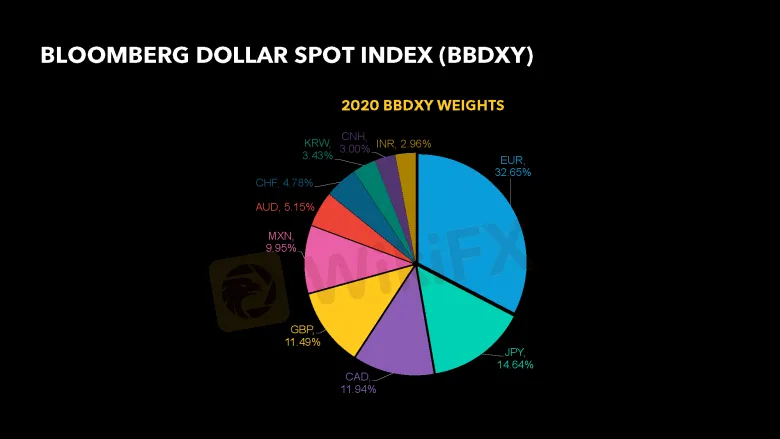

The Bloomberg Dollar Spot Index includes which currencies?

The Bloomberg Dollar Spot Index's most current composition compared to the prior year is shown below.

Which Currencies Are Included in the Bloomberg Dollar Spot Index

Once a year, the index is rebalanced to include new data from:

The Federal Reserve's yearly evaluation of key trading partners in relation to the US dollar.

The Bank of International Settlements' triennial study of the most liquid currencies (BIS).

Currency tied to the US dollar is eliminated, and heavily regulated currencies (such as the Chinese yuan) have their exposure limited.

Currency weights of less than 2% are removed in order to ensure tradability.

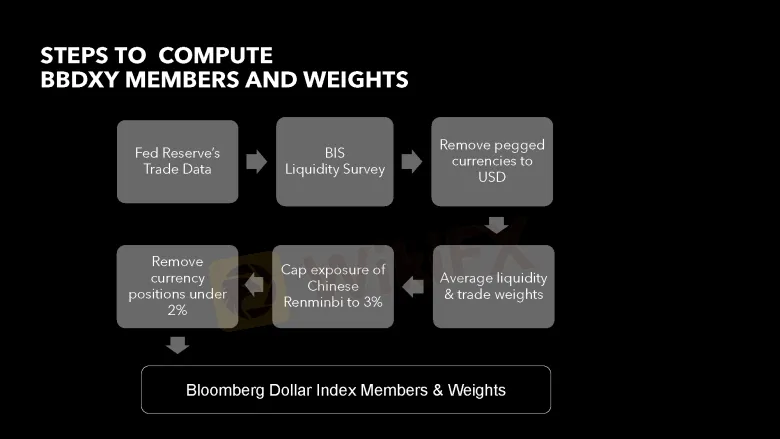

The following methods are followed to decide which currencies to include and their weights at each annual rebalance:

· Determine the top 20 currencies in terms of trading volume against the base currency.

This is how the Federal Reserve defines the US dollar in its Broad Index of the Foreign Exchange Value of the Dollar.

Using the Triennial Central Bank Survey on Foreign Exchange and Derivatives Market Activity, identify the top 20 currencies.

Here you will find detailed information on foreign exchange turnover.

Choose the top ten currencies from both lists, but leave out any currencies that are pegged. The Bloomberg Dollar Spot Index, for example, excludes currencies tied to the US dollar (such as the Hong Kong dollar or the Saudi riyal).

Assign each currency a preliminary weight based on its trade weight and liquidity weight.

Chinese yuan exposure will be limited, and smaller currency investments, defined as those with a weight of less than 2%, will be eliminated.

Voila! The BBDXY computation is finished!

Every year, at the close of the last U.S. trading day in December, the rebalanced target weights are applied.

Here's a diagram that depicts the above procedure:

The Bloomberg Dollar Spot Index: How to Read It

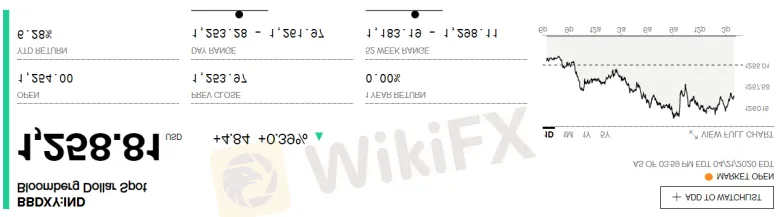

The Bloomberg Dollar Spot Index can be viewed by running BDXY on the Bloomberg Terminal® for Bloomberg subscribers.

If you can't afford the $20,000 annual charge for a Bloomberg Terminal subscription, you may still view the live BBDXY quote on Bloomberg's website for free.

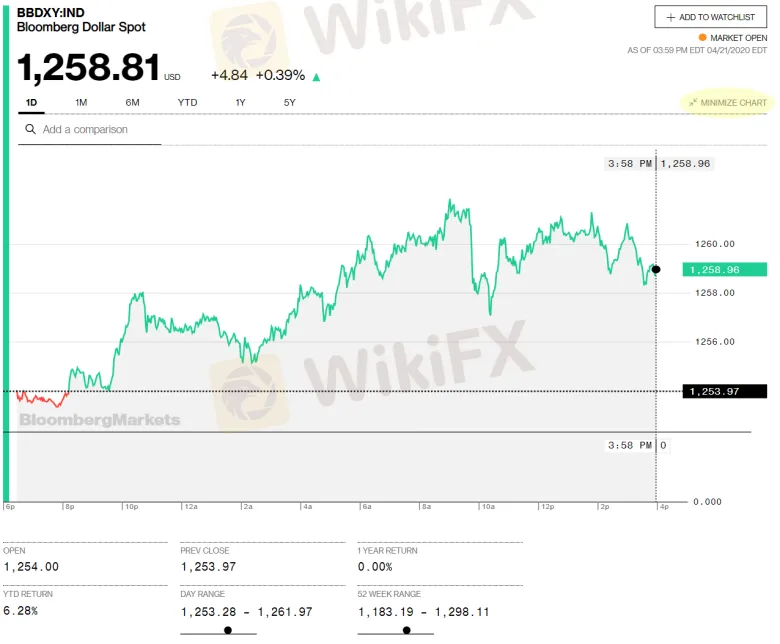

On the BBDXY page of Bloomberg, you'll notice a live quote that looks like this:

By clicking towards the top right corner, you may see the entire chart.

On Bloomberg's website, you can also find the DXY quote.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator